Subledger

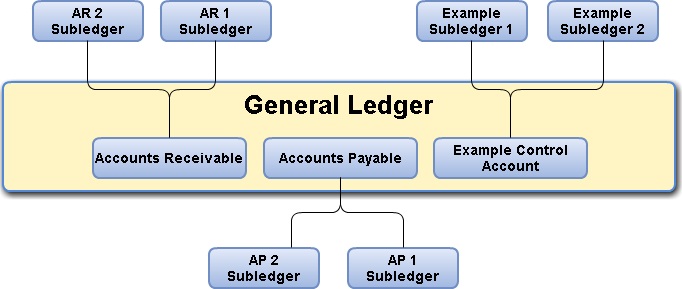

When a business is small there is only one general ledger that is maintained. As the size of the business increases, the number of accounts also grow along with that. New subledgers are created under the general ledger accounts, these subsets of the general ledger are called subledger.

Similar types of accounts are grouped together and their representative account is shown in the general ledger. Few examples include accounts receivable, accounts payable, property, etc.

Example

Let’s take an example of the general ledger control account “Accounts Receivable”, which is made up of the following individual debtors of the business:

A’s Receivable A/C = Subledger AR1

B’s Receivable A/C = Subledger AR2

A’s Balance + B’s Balance = Accounts Receivables (Control Account)

(AR1) + (AR2) = Accounts Receivable A/C (To be shown in GL)

So, one can imagine a big multinational corporation where hundreds and thousands of debtors, creditors, etc. are not uncommon. It becomes almost impossible to maintain one single ledger.

Hence, creating such subsets is the best possible option to not only maintain the data efficiently but also for calculations and quick access to information on an individual level.

>Read What is a Control Account?