- Meaning

- Type of Account

- Sundry Debtors in Trial Balance

- Sundry Debtors and Creditors

- Is Sundry Debtor an Asset or Liability?

- Quiz

- Conclusion

Meaning

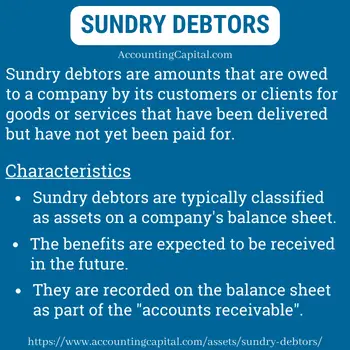

The term ‘Debtor’ refers to a person or entity that owes money to your business for goods or services sold on credit. A group of such individuals or entities is called Sundry Debtors. They may also be referred to as accounts receivable or trade receivables.

Sundry means “various” or “several”. In the world of business, it refers to many similar items combined under one head.

Typically, sundry debtors arise from core business activities, such as sales of goods or services. The business treats them as an asset.

Example: Satya purchases some daily items from a grocery store on credit. Thus, Satya will be recorded as a Debtor in the store’s books (current asset). Similarly, a collection of such debtors is viewed as sundry debtors from the point of view of the grocery store.

Related Topic – Journal Entry for Sale of Services on Credit

In Simple Terms – Sundry debtors is when a person or a business owes money to a company for things they have bought. Let’s say you run a small fruit shop in your neighbourhood and one of your neighbors buys a kilogram of apples from you but doesn’t pay you right away, the amount they owe you can be seen as a sundry debtor. In this case, the fruit shop is the company, and the neighbor who hasn’t yet paid for the apples is the sundry debtor.

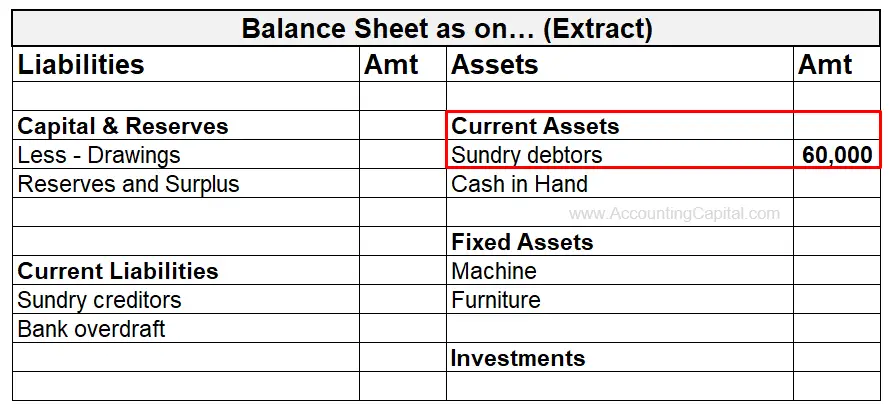

Example & Treatment in the Balance Sheet

Suppose “Daniel Constructions” sold building material worth 60,000 to “Axis Housing” on credit, and Axis Housing (buyer) agrees to pay the related invoices in the future accounting period.

In the above case, Axis Housing is a debtor for Daniel Constructions and the same is recorded in the books of Daniel Constructions (seller) for 60,000 due to credit sales. Many such debtors combined together are known as “Sundry Debtors”.

Sundry Debtors in Balance Sheet

In the books of Daniel Constructions Note: Creditors in the books of Axis Housing will also increase by 60,000 on account of credit purchases done for 60K construction material.

Note: Creditors in the books of Axis Housing will also increase by 60,000 on account of credit purchases done for 60K construction material.

Related Topic – Sundry Expenses

Type of Account

When accounting for such receivables, it is vital to know what type of account it is because the accounting rule to be applied is based on it.

As per the golden rules of debit and credit

| Type of Account | Personal Account |

| Rule Applied | Debit the Receiver & Credit the Giver |

Similarly, the modern rules.

| Type of Account | Asset account |

| Rule Applied | Debit the increase in assets and Credit the decrease |

Related Topic – Difference Between Bad Debts and Doubtful Debts

Journal Entry

Such trade receivables arise as a result of credit sales which is revenue in nature. However, when the money is due to be received, it becomes an asset for the organization. Following is the journal entry for sundry debtors that should be recorded to show credit sale of goods/services;

In the Books of Seller

| Sundry Debtors A/C | Debit |

| To Sales A/C | Credit |

(Being goods or services sold on credit)

Rules – Debit the increase in assets (S. Debtors) & Credit the increase in revenue (Sales).

Entry at the time when payment is received

At the time when payment is received from the debtor below entry is recorded.

| Cash (or) Bank (or) B/R | Debit |

| To Sundry Debtors A/C | Credit |

(Payment made in cash (or) by cheque (or) issue of a bill receivable by the buyer)

Rules – Debit the increase in assets (Cash/Bank) & Credit the decrease in assets (S. Debtors).

Related Topic – Are Accounts Receivable Assets or Revenue?

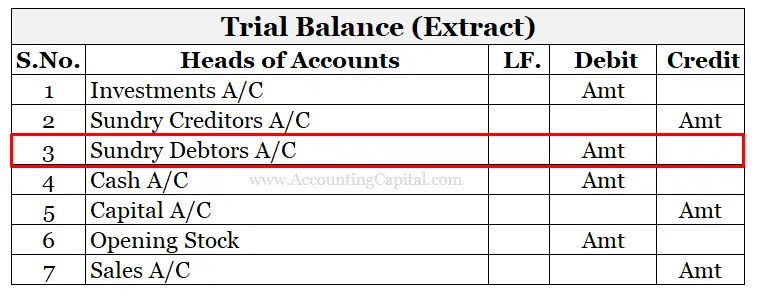

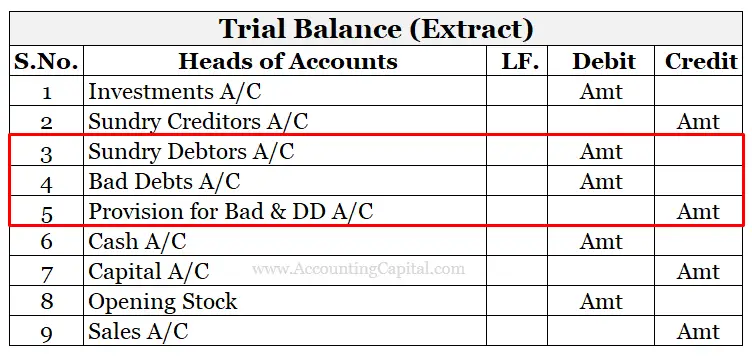

Sundry Debtors in Trial Balance

Treatment of Sundry Debtors in the Trial Balance

Case 1: In case of no bad debts & no provision for bad/doubtful debts exist. It is simply shown as it is with a debit balance.

Case 2: When Sundry Debtors are recorded at the gross value in the trial balance, that is, before making adjustments for bad debts and provision for bad/doubtful debts.

Case 3: When they are recorded at the net value in the trial balance, that is, after making adjustments for bad debts and provision for bad & doubtful debts.

Net Sundry Debtors = Gross Sundry Debtors – Bad Debts – Provision for Bad & Doubtful Debts

The trial balance will appear to be similar to in case 1.

Note: Debtors’ gross or net value may be recorded in the Trial Balance.

Related Topic – Provision for doubtful debts in the trial balance

Sundry Debtors and Creditors

Example demonstrating the relationship between the two terms

Suppose a furniture-making company, Wood Ltd. sells furniture worth 30,000 to QRT Ltd. on credit. Therefore, QRT Ltd. will become a debtor for Wood Ltd., whereas Wood Ltd. will become a creditor for QRT Ltd.

As a result, such transactions usually lead to the addition of a debtor & a creditor in the books of the seller and buyer, respectively.

Differences between Sundry Debtors & Sundry Creditors

- It refers to a group of people who owe money to an enterprise, but Sundry Creditors are those to whom the enterprise owes money.

- Unlike Debtors, who are assets, creditors are liabilities.

- As per the modern rules, an increase in Debtors (asset) is to be debited, whereas an increase in Creditors (liability) is to be credited.

- Similarly, credit a decrease in Debtors and debit a decrease in Creditors.

Related Topic – Accounts Receivable (Quiz-10)

Is Sundry Debtor an Asset or Liability?

As covered in the previous heading, sundry debtors are shown in the company’s balance sheet as “assets”; therefore, they are an asset for the business. These amounts are recorded as assets because they represent a future economic benefit that is expected to be received by the company.

It cannot be a liability because in order for it to be a liability, there must be a pending outflow of money that is supposed to happen in the future.

Note: Although a balance sheet records sundry debtors as assets, they are not risk-free, and there is always the possibility that some of the amounts owed may not be collected. If the collection of the full amount is doubtful, sundry debtors may be recorded on the balance sheet at a lower amount than the amount due in order to reflect the risk of doubtful debts.

Related Topic – Accounting FAQs

Short Quiz for Self-Evaluation

Related Topic – Provision for Doubtful Debts in the Balance Sheet

Conclusion

- The recording of sundry debtors helps a company manage its cash flow, forecast future revenues, and clearly present its financial position to investors and other stakeholders.

- Sometimes, the amounts owed by sundry debtors may not be collected on the balance sheet, so they may be recorded at a lower amount than the actual amount due (if it is considered unlikely that the full amount will be paid).

- In addition, recording sundry debtors is important for financial reporting purposes. The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a particular point in time.

- Managing and reporting sundry debtors is an important part of a company’s financial management.

Keeping track of debtors is essential for companies because if too many people or businesses fail to pay, the company may be unable to pay its bills on time.

Accurately recording such debtors allows a company to manage its cash flow more effectively, as it can use the amounts owed to it to pay for its own expenses or investments. It also helps the company forecast future revenues and better plan its operations.

>Read Sundry Creditors