Asset Disposal Account

When an asset is being sold, a new account in the name of “Asset Disposal Account” is created in the ledger. This account is primarily created to ascertain profit on sale of fixed assets or loss on the sale of fixed assets. The difference between the amount received from sale proceeds and the net current value of the fixed asset being disposed of determines profit or loss. This amount is shown on the income statement.

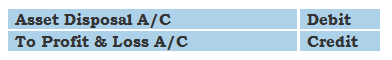

The account is termed as “Profit (or) Loss on Sale of Asset”. If an asset is sold at a price higher than its written down value it is said to have produced a profit. Similarly, if an asset is sold at a price lower than its written down value it is said to have incurred a loss.

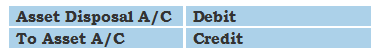

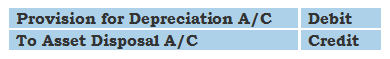

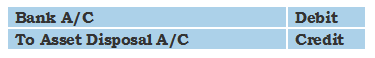

Journal Entries for Disposal of Fixed Assets – With Provision for Depreciation

- Gross amount of asset being sold is transferred to Asset Disposal Account (at original cost)

- Amount of accumulated depreciation is transferred to the Asset Disposal Account.

- To record the value of proceeds received from the sale of asset.

- In the case of Profit.

- In the case of Loss.

If an “Asset Disposal” account shows debit balance it means loss has been incurred on the disposal of the fixed asset whereas credit balance in the account shows profit earned on disposal.

Related Article – Journal entry of loss on sale of fixed assets

Journal Entries for Disposal of Fixed Assets – Without Provision for Depreciation

- Gross amount of asset being sold is transferred to Asset Disposal Account (at written down value calculated at the beginning of the year of sale)

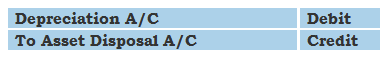

- Depreciation is charged from the beginning of the year till the date of sale (shown in below journal entry

- To record the value of proceeds received from the sale of the asset.

- In the case of Profit.

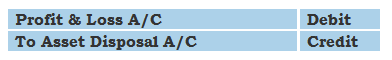

- In the case of Loss.

Short Quiz for Self-Evaluation

>Read Fictitious Assets