Definition

To understand Accruals we need to understand the meaning of the word accrual, which is “The act of accumulating something”. Accruals are mainly related to prepayments and arrears.

In accrual-based accounting, accruals refer to expenses and revenues that have been incurred or earned but have not been recorded in the books of accounts. Adjustment entries are incorporated in the financial statements to report these at the end of an accounting period.

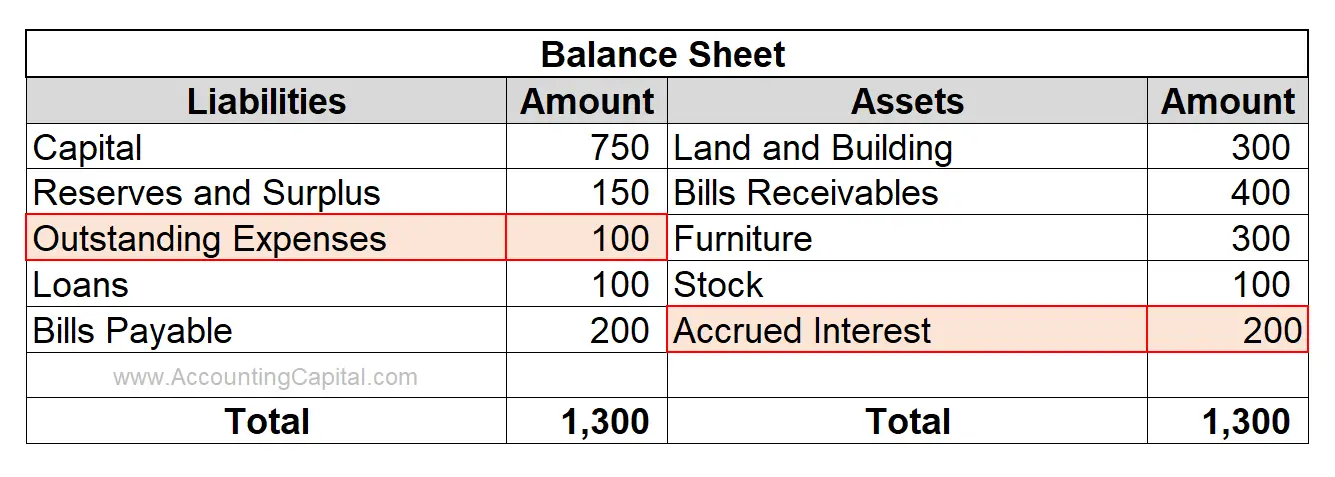

In other words, they consist of balance sheet accounts that are a liability or non-cash based assets. A few examples of accruals may include accounts receivables, accounts payable, accrued rent, etc.

Accrued Expense is an expense which has been incurred, but has not been recorded in the books of accounts presently. It will require an adjustment entry in the books of accounts to reflect this in the financial statements.

Accrued Income is an income which has been earned, but has not been recorded in the books of accounts presently. Similar to accrued expenses, an adjustment entry will be required in this case too.

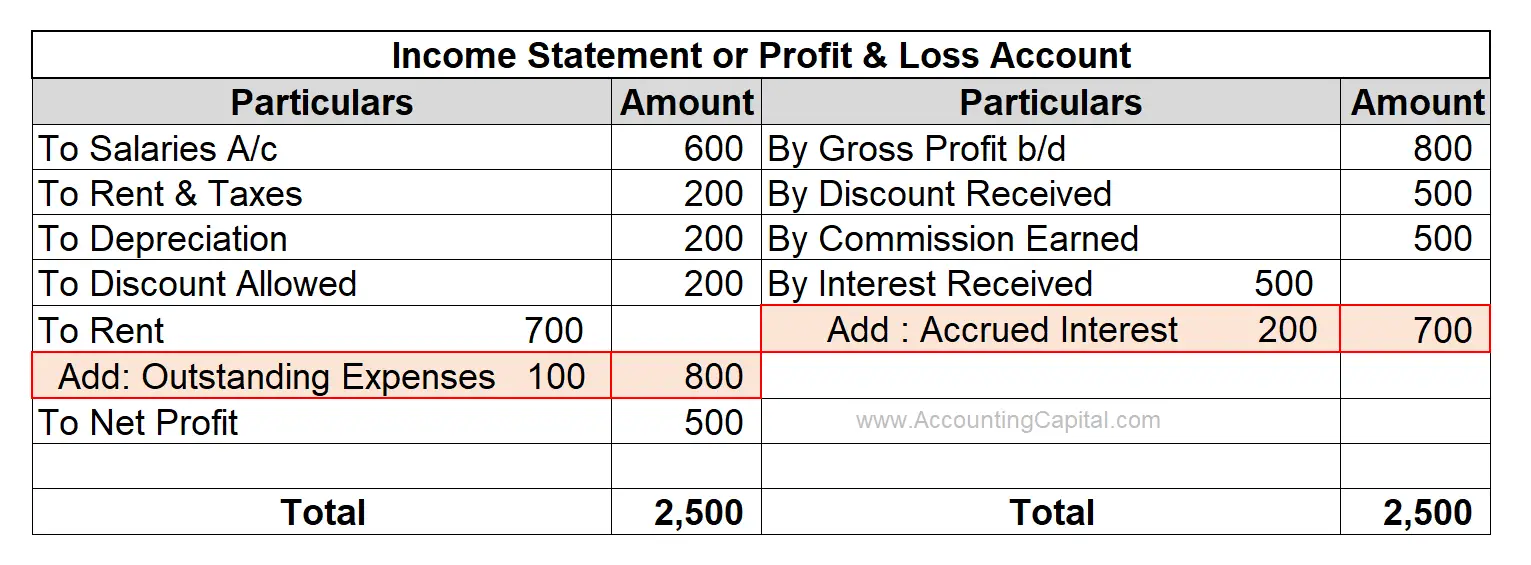

Money owed by a business in the current accounting period is to be accrued and should be added to the expenses in the profit and loss account.

Money that is owed to a business in the current accounting period is to be accrued and should be added to the income in the profit and loss account.

Examples of Accruals

Illustration 1

A company pays 25,000 to rent every month. On January, 1 it decides to pay 1,00,000 advance towards rent.

Accruals related treatment – The company will not record the payment as an expense immediately because the building has not been used yet. So when they report their quarterly results after March, 31, they will report expenses for 3 months i.e. 25,000 x 3 months = 75,000 because the building will only be used for 3 months till that time.

Illustration 2

Another example is when a company is supposed to receive 25,000 per month as rent but the tenant pays 1,00,000 on January, 1 in advance.

Accruals related treatment – The company will not record the received amount as income till the building has been used. So, again during the quarterly results after March, 31, they will report income for 3 months i.e. 25,000 x 3 months = 75,000 because the building will only be used for 3 months until that time.

Where Should Accruals be Recorded?

Short Quiz for Self-Evaluation

>Read Journal Entry for Director’s Salary