Table of Contents

Meaning & Explanation

In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. Rather than recording it as a one-time expense on the income statement in the same year as it occurred. It is depreciated (expensed) over time.

Why is capitalization done?

The logic behind this approach is the matching principle of accounting which says that the expense should be recorded in the same accounting period in which the corresponding revenue is earned.

Some long-term assets like plant & machinery, land & building, office equipment, etc., provide their benefits in more than one accounting period. The cost should also be allocated over the period of their useful life.

This is done by capitalizing the cost of such expenses by recording them as assets and later depreciating them over their estimated useful life.

Example

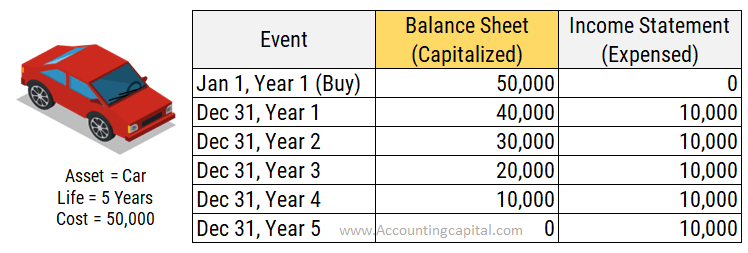

ABC Ltd. purchased a car worth 50,000. The life of the car is estimated to be 5 years.

Since the life of the car is 5 years, the cash outflow should be recorded as an asset in the balance sheet and depreciated over 5 years of its life. This is called capitalization of an asset. Treating an expense as an investment and recording it on the firm’s financial statements over time.

You could say, “We bought this expensive vehicle for the business, and we’ll keep track of its value.” This helps the firm show a more accurate picture of its long-term assets and account for the benefits derived over time.

The cost incurred to purchase the car = 50,000

This cash outflow of 50,000 will be capitalized and recorded on the Asset side of the balance sheet. The scrap value is assumed to be Nil.

Capitalization shown inside the balance sheet

Calculation of depreciation expense for year 1

Depreciation = (Total Cost of Asset – Scrap Value) / Estimated Useful Life

= (50,000 – 0) / 5

= 10,000 per annum

Hence, only 10,000 will be recorded in the profit and loss account as an expense.

Related Topic – What is capitalized expenditure?

Journal Entry for Capitalization

Continuing the above example, the following journal entries will be recorded in the books of ABC Ltd.,

At the time of incurring the expenditure (Capitalized)

| Car A/C | 50,000 |

| To Bank A/C | 50,000 |

(Being car purchased for cash)

Depreciation expense for 1st year

The capitalized amount is distributed each year as depreciation.

| Depreciation A/C | 10,000 |

| To Car A/C | 10,000 |

(Being Depreciation charged on machinery)

| Profit & Loss A/C | 10,000 |

| To Depreciation A/C | 10,000 |

(Being depreciation expense transferred to Profit & Loss Account)

Note: The above two entries will be repeated in the next four years in order to record the depreciation expense each year.

Related Topic – Journal Entry for Bought Goods in Cash

The benefit of Capitalization

Since costs incurred on these long-term assets are generally very high, recording them as a one-time expense in profit and loss can show a distorted image of the financial performance of the company.

Recording the cost as an expense will result in huge losses in the year in which the assets are purchased and an incorrect amount of profits in the subsequent years during which the assets are used.

Conditions for capitalization

- The cash outflow incurred must have some future economic benefits associated with it.

- The estimated useful life of the recognized asset should be more than 1 year.

Capitalized Vs Expensed

| Basis | Capitalized | Expensed |

| Meaning | It involves capitalizing the cash outflow and expensing the cost of Long term assets over their estimated useful life | Recording the cash outflows as an expense in the statement of profit and loss all at once |

| Effect on Profit and Loss | Indirect through depreciation or amortization. | Direct since the cost is directly debited to the income statement |

| Example | Purchase of Machinery | Payment of monthly salaries to employees |

Related Topic – Difference Between Revenue and Profit

Practice (Capitalize or Not?)

- Paid 8,000 to purchase stock for trade – Not Capitalized

- Paid 90,000 for installing solar panels with a life of 10 years – Capitalized

- Paid 15,000 for regular service and maintenance of the machinery – Not Capitalized

- Paid 40,000 for acquiring a patent with a life of 10 years – Capitalized

Note – Once an asset is capitalized, any subsequent expenditure that increases its capacity, thereby increasing its future economic benefit, should also be capitalized.

Any other expenditures on assets that are day-to-day maintenance shouldn’t be capitalized but instead should go into the profit & loss account.

Related Topic – Accounting Quiz on Capital Expense

Amortization Vs Capitalization

Capitalization

- It’s when you record some costs as assets on the balance sheet instead of expenses.

- Depreciation or amortization is applied over time as the asset’s value is used up or benefits are realized.

Amortization

- Amortization is the process of spreading the cost of an intangible asset, such as patents, copyrights, or trademarks, over its useful life.

- Intangible assets are amortized to match when they generate revenue and provide benefits to the company.

>Read Format of a Balance Sheet