Net Profit and Net Loss

A business may earn from various different operating and non-operating sources. Furthermore, it may pay for several different continuous and one-time events. The difference between indirect expenses and indirect incomes of business gives rise to net profit and net loss.

In its adjective form, the word “Net” means the amount remaining after all deductions. In the accounting world, net profit and net loss refer to the remaining difference between indirect expenses and indirect revenues.

After all the relevant indirect items are recorded in the income statement in their respective debit and credit columns the difference is calculated to ascertain the net profit or net loss. It is then transferred to the company’s capital account.

Net Profit

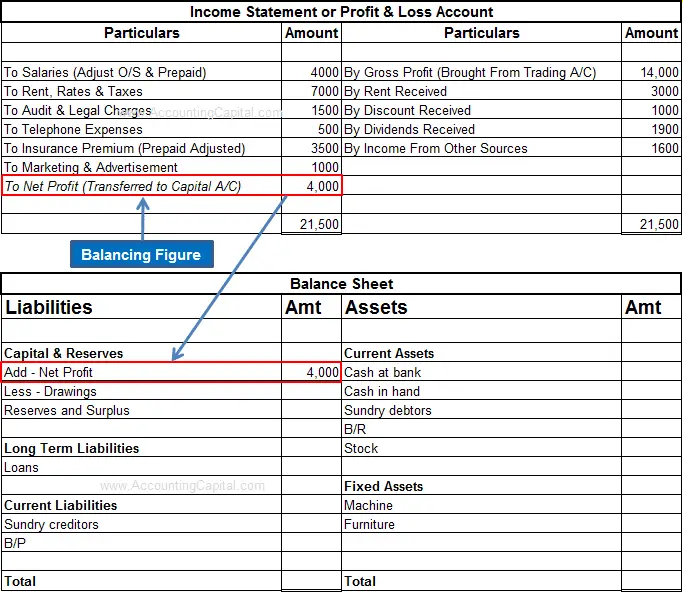

In a company’s income statement if the credit side i.e. the income side is in excess of the debit side i.e. the expense side it is said to have earned a net profit. The amount calculated is the balancing figure to be put on the debit side as a part of balancing the account. (Refer to the image below)

Debit Side (Indirect Expenses) < Credit Side (Indirect Incomes)

Net Profit is transferred to the Capital Account and shown on the Liability side of a balance sheet. (Shown in the image)

Related Topic – What is are Liquid Assets?

Net Loss

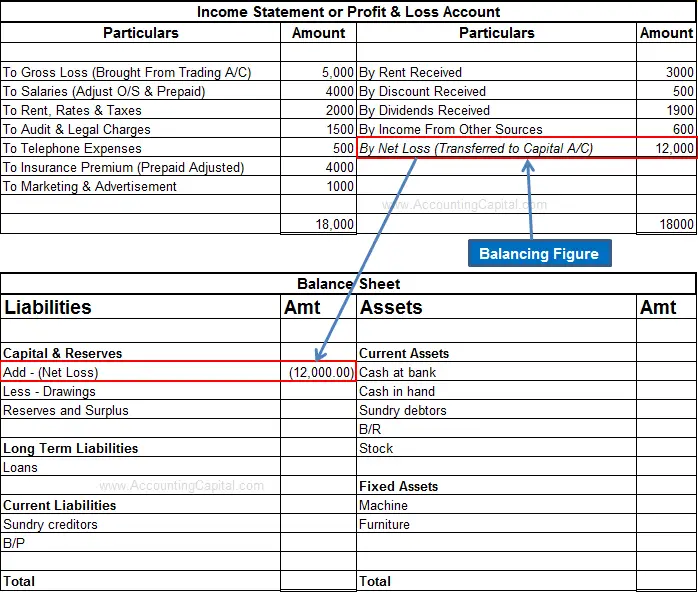

In a company’s income statement if the debit side i.e. the expense side is greater than the credit side i.e. the income side it is said to have earned a net loss. The amount calculated is the balancing figure to be put on the credit side as a part of balancing the account. (Refer to the image below)

Debit Side (Indirect Expenses) > Credit Side (Indirect Incomes)

Net loss is transferred to the Capital Account and shown on the Liability side of a balance sheet. (Shown in the image)

Short Quiz for Self-Evaluation

>Read Gross Profit and Gross Loss