- Overview and Meaning

- Three Golden Rules

- Examples

- How to use

- Modern Approach

- Quiz

- Revision Video

- Practice

- PDF Download

- Conclusion

Overview and Meaning

In the general sense of the English language, something described as “Golden” means prime quality. In the context of accounting, the golden rules are the main rules used to record financial transactions at the time of their inception. These rules determine which accounts should be debited and credited.

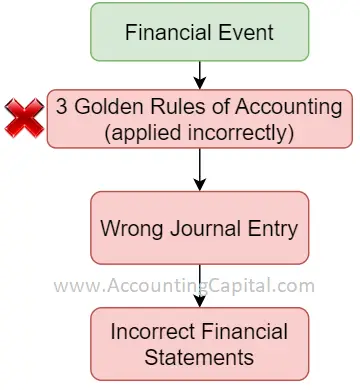

A journal entry is the foundation of the financial statements of a company. Financial data becomes unreliable when debit and credit rules are incorrectly applied. Financial statements, for example, are based on trustworthy accounting data that is backed up by this rule and other accounting principles.

Each accounting entry is recorded chronologically in “the book of original entry” (journal or subsidiary books) according to the 3 golden rules of accounting.

Source documents are used to support the entry of transactions in the books of account. For example; invoices, cheques, receipts, debit notes, credit notes, etc.

After the activity has been recorded the next step is to ‘post’ the entry i.e. transfer it to the appropriate ledger account.

What is an account? – It is kind of a table in “T” form where transactions are recorded under specific headings. The data is not only used to track the amount of a transaction but also its effect and direction as well.

On the left-hand side, you will find all the debit transactions, and on the right-hand side, you will see all the credit transactions.

Debit & Credit – According to the nature of an account, it could mean either an increase or a decrease. Debits and credits are governed differently depending on the account type.

Debit – It means an increase in the value of an asset or expense or a decrease in the value of liability (including equity) or revenue.

Credit – It is the opposite of debit and it means a decrease in the value of an asset or expense or an increase in the value of liability (including equity) or revenue.

Related Topic – What is Debit and Credit?

Three Golden Rules Of Accounting With Example

These rules are used to prepare an accurate journal entry that forms the basis of accounting and acts as a cornerstone for all bookkeeping.

They are also known as the traditional rules of accounting or the rules of debit and credit.

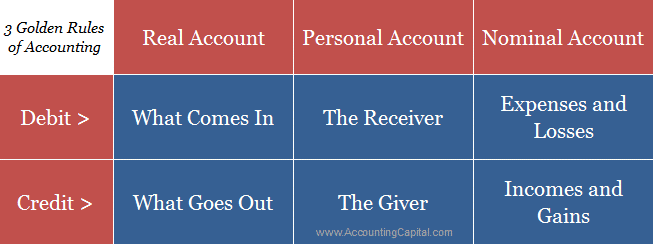

Easy Interpretation of 3 golden rules of accounting

- Real Account

If the item (real account) is coming into the business then – Debit

If the item (real account) is going out of business then – Credit

- Personal Account

If the person (or) legal body (or) group is receiving something – Debit

If the person (or) legal body (or) group is giving something – Credit

- Nominal Account

If it is an expense or loss for the business – Debit

If it is an income or gain for the business – Credit

While making a journal entry there are essentially three types of accounts i.e. Real, Personal and Nominal. Each account has a specific rule that needs to be applied and it is of utmost importance to identify the account correctly for accurate journalisation.

Related Topic – 100 Basic Terms for an Accounting Interview

Examples Of Golden Rules Of Accounting

- Purchased furniture for 10,000 in cash.

| Accounts Involved | Debit/Credit | Rule Applied |

| Furniture A/C | 10,000 | Real A/C – Dr. what comes in |

| To Cash A/C | 10,000 | Real A/C – Cr. what goes out |

- Paid 15,000 cash to Unreal Pvt Ltd.

| Accounts Involved | Debit/Credit | Rule Applied |

| Unreal Pvt Ltd. A/C | 15,000 | Personal A/C – Dr. the receiver |

| To Cash A/C | 15,000 | Real A/C – Cr. what goes out |

- Paid 18,000 from the bank for rent.

| Accounts Involved | Debit/Credit | Rule Applied |

| Rent A/C | 18,000 | Nominal A/C – Dr. all expenses |

| To Bank A/C | 18,000 | Personal A/C – Cr. the giver |

- Depreciation is charged for 29,000 on the machine.

| Accounts Involved | Debit/Credit | Rule Applied |

| Depreciation A/C | 29,000 | Nominal A/C – Dr. all expenses |

| To Machine A/C | 29,000 | Real A/C – Cr. what goes out |

- Goods sold for 5,000 on credit to Mr Unreal.

| Accounts Involved | Debit/Credit | Rule Applied |

| Mr Unreal A/C | 5,000 | Personal A/C – Dr. the receiver |

| To Sales A/C | 5,000 | Nominal A/C – Cr. all incomes |

Related Topic – Journal Entry for Inventory Purchased

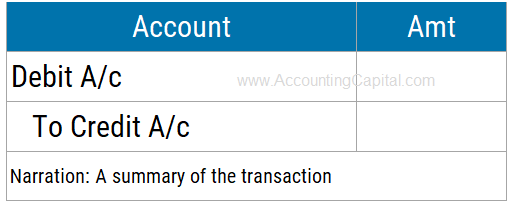

How to Use these Rules in a Journal Entry

When recording a journal entry, one must adhere strictly to the golden rules of accounting in order to ensure that the entry is accurately recorded. The following steps are used to register an entry in the primary book of accounting:

- Identify the accounts involved

- Determine the type of accounts

- Apply the golden rules of accounting

- Record the Transaction

Here is an example to help you understand. This example shows a business receiving cash and making a sale.

| Cash A/c | Debit | Real – Debit what comes in |

| To Sales A/c | Credit | Nominal – Credit all income/gain |

Step 1 – The first step of a journal entry is to identify the accounts involved in a transaction. A minimum of two such accounts shall be identified. According to the above example, the two accounts affected are “Cash” and “Sales”.

Step 2 – After identifying the type of accounts in step 1, the next step is to determine their type (real, personal, or nominal). According to the above example, the two accounts affected are “Cash” which is a real account and “Sales” which is a nominal account.

Step 3 – The highlight of our topic is the application of golden rules. It should be done correctly after determining the type of accounts.

- As per the three rules of debit and credit (shown below) “Cash A/c” (Real) should be treated as per the 1st rule since cash is coming into the business “Debit what comes in”.

- Similarly, “Sales A/c” should be treated as per the 3rd rule since the sale is an income for the business “Credit all incomes & gains”.

| Real | Dr. what comes in | Cr. what goes out |

| Personal | Dr. the receiver | Cr. the giver |

| Nominal | Dr. all expenses/losses | Cr. all incomes/gains |

Step 4 – After recording the transaction with the exact date, saving all evidence, and adding a short narration, the process of preparing and recording a journal entry is complete.

Related Topic – Why Should a Ledger be Balanced?

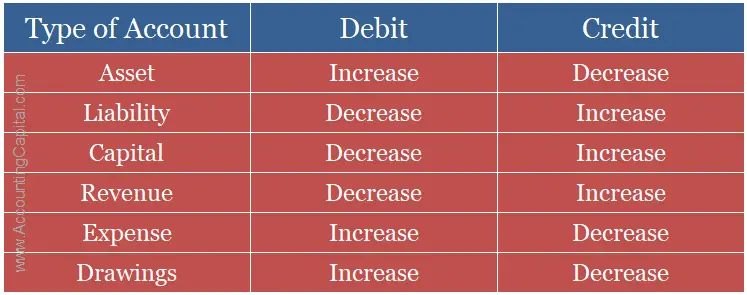

Rules of Debit and Credit According to Modern Approach

If you are posting an entry in the journal, you may use the Modern Accounting Approach instead of the three golden rules of accounting.

You should try to use the American or modern rules of accounting to compare and find out which one suits your learning style and is easy to apply. It is true that some people find the modern approach easier than the traditionally used three golden rules of accounting.

Example – Modern Rules of Accounting

- Received cash 3,000 as rent from Unreal Pvt Ltd.

| Accounts Involved | Debit/Credit | Modern Rule Applied |

| Cash A/C | 3,000 | Asset A/C – Dr. the increase |

| To Rent A/C | 3,000 | Revenue A/C – Cr. the increase |

Short Quiz for Self-Evaluation

Related Topic – What are Posting References in a Journal?

Revision & Highlights Video

Highly Recommended!!

Do not miss our 1-minute revision video. This will help you quickly revise and memorize the topic forever. Try it :)

Practice

This section is dedicated to the practice of the three golden rules in accounting. Practising this will help you gain a better understanding of the subject.

Question – For 1 to 10, give the nature of each account as well as the relevant rule to be applied. From 11 to 15, identify the accounts involved, along with their nature and the respective rules.

1. Cash

Type & Rule – Real A/c, Rule – Dr. what comes in and Cr. what goes out

Cash is an asset for the business and all assets (tangible and intangible are real accounts)

2. Loco Pvt Ltd. (Debtor)

Type & Rule – Personal A/c, Rule – Dr. the receiver and Cr. the giver

It is important to understand that a debtor is not categorized as a real account even though it is an asset to the business, however, it is classified as a personal account because it belongs to an individual or entity. A personal account is used to determine a person’s or organization’s balance due.

3. Goodwill

Type & Rule – Real A/c, Rule – Dr. what comes in and Cr. what goes out

It is treated as a real account since it is an asset to the business.

4. Purchases

Type & Rule – Nominal A/c, Rule – Dr. all expenses and losses & Cr. all incomes and gains

Purchases are an expense for the business therefore it is a nominal account.

5. Bank

Type & Rule – Personal A/c, Rule – Dr. the receiver and Cr. the giver

It is easy to confuse the Bank as a real account whereas it is actually categorized as a personal account because it belongs to an entity.

6. Inventory

Type & Rule – Real A/c, Rule – Dr. what comes in and Cr. what goes out

As a business asset, it is treated as a real account.

7. Salaries

Type & Rule – Nominal A/c, Rule – Dr. all expenses and losses & Cr. all incomes and gains

Salaries are an expense for the business therefore it is a nominal account.

8. Outstanding Salaries

Type & Rule – Personal A/c, Rule – Dr. the receiver and Cr. the giver

Salaries are an expense for the business whereas outstanding salaries are related to a worker or several workers which means the o/s salary account becomes a personal account. The thumb rule in the case of a prefix or suffix (outstanding, prepaid, accrued, etc.) is the type of account changes from nominal to personal.

Related Topic – Journal Entry for Outstanding Salary

9. Leasehold Property

Type & Rule – Real A/c, Rule – Dr. what comes in and Cr. what goes out

A leaseholder has the right to use the property for a specified period of time according to a lease agreement. An extremely low down payment is made by the lessee to acquire and use the property. Such a property is treated as a real account since it is a business asset.

10. Bad Debts Written Off

Type & Rule – Nominal A/c, Rule – Dr. all expenses and losses & Cr. all incomes and gains

The write-off of bad debts is the act of writing off receivables which the company now considers irrecoverable. It should be shown on the income statement and removed from the books of accounts. Since it is a loss for the business, it is treated as a nominal account.

11. Sold goods for cash 50,000

Accounts Involved – Cash A/c & Sales A/c

Type and Rules – Cash is a Real account so Dr. what comes in (50,000), Sales is a Nominal account so Cr. the income (50,000).

12. Sold goods on credit to Unreal Co. for 11,000

Accounts Involved – Unreal Co. A/c (Debtor) & Sales A/c

Type and Rules – Unreal Co. A/c is a personal account so Dr. the receiver (11,000), Sales is a Nominal account so Cr. the income (11,000).

It is important to note that in the above question the business is dealing with another entity. The account will be categorized as personal even though it is an asset for the firm.

13. Purchased Equipment for 10,000 (paid by Cheque)

Accounts Involved – Equipment A/c & Bank A/c

Type and Rules – Equipment A/c is a real account so Dr. what comes in (10,000), Bank is a personal account so Cr. the giver (10,000).

In many cases, a bank account is mistaken for a real account, when in fact it is a personal account because it belongs to a separate business entity.

14. Paid Salaries of 90,000 (Direct Deposit from Bank)

Accounts Involved – Salaries A/c & Bank A/c

Type and Rules – Salaries A/c is a nominal account so Dr. all expenses (90,000), Bank is a personal account so Cr. the giver (90,000).

15. 9,500 received in cash from Unreal Co. as the full and final settlement of their account worth 10,000. (Compound Journal Entry)

When many accounts are debited or credited, it is called a compound journal entry. As opposed to a simple journal entry that only includes a maximum of 1 debit and 1 credit. Usually, such an entry has 3 or 4 affected accounts.

Accounts Involved – Cash A/c, Discount Allowed A/c, and Unreal Co. A/c

Type and Rules – Cash is a Real account so Dr. what comes in (9,500), Discount Allowed A/c is a Nominal account so Dr. all expenses/losses (500), and Unreal Co. A/c (Debtor) is a Personal account so Cr. the giver (10,000).

Related Topic – Journal Entry for Trade Discount

PDF Download

We have created a printer-friendly PDF version of the rules. For those who use the golden rules of accounting regularly, it is highly recommended that they print this page and stick it on their desk or wall.

3 Golden Rules of Accounting – Print Version

Conclusion

The three golden rules of accounting ensure that all the financial events of a business are accounted for and done accurately. As a result, in the light of the accounting equation, debits are always equal to credits and the balance sheet is always a match.

To ensure maximum financial transparency and accountability, businesses should ensure the implementation of these accounting principles and standards.

Due to the fact that both internal and external users of accounting information rely on financial data, the rules applied should be accurate at all times.

Nowadays, companies can hire professional accounting services to ensure compliance with accounting standards and principles.

>Read What are Accounting Concepts?