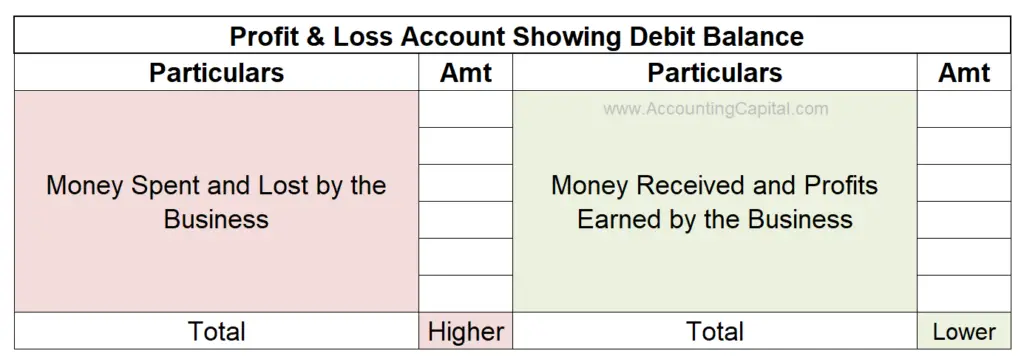

There are two sides to accounting: debit and credit. Profits & incomes are placed on the credit side (right). This is because we gain money, and in accounting terms, this is credit. Similarly, the debit side (left) shows all the expenses & losses.

Now, if we have a debit balance in the Profit and Loss account, it means the debit side is larger than the credit side. The money we spent (debit) was more than the money we earned (credit).  So, if you hear someone say, “We have a debit balance in our Profit and Loss account”, it’s like saying, “We spent more than we earned. We have a loss!”. Therefore Debit Balance of Profit and Loss Account means “Loss” or “Net Loss” for a business.

So, if you hear someone say, “We have a debit balance in our Profit and Loss account”, it’s like saying, “We spent more than we earned. We have a loss!”. Therefore Debit Balance of Profit and Loss Account means “Loss” or “Net Loss” for a business.

Table of Contents

Meaning and Definition

The income statement or Profit & Loss account is a financial statement that provides a summary of a company’s expenses, losses, incomes, and gains over a specific period of time. As a result of this account, the company can determine whether it can grow revenue or lower costs in order to generate profit.

Debit balance, in layman’s terms, means the “Debit Total > Credit Total”.

In the world of accounting, Profit and Loss accounts have a debit balance when the debit side (expenses & losses) exceeds the credit side (incomes and gains). Such a balance is called Net Loss, and it is adjusted from the reserves or capital. If continued over a longer period, it could lead to the insolvency of the company.

Net loss reduces the overall capital invested by the owners. For stakeholders, this reflection gives them a good idea of how the company is doing financially.

Similarly, a credit balance means that the “Credit Total > Debit Total.”

Related Topic – Assets have a Debit Balance, and Liabilities have a Credit Balance

Example

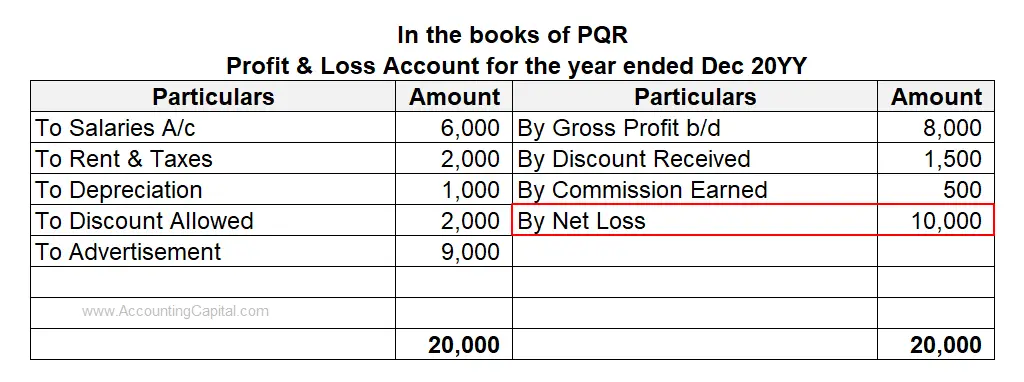

Following is the Profit and Loss account of PQR for the year ending Dec 20YY In the above example, the debit total is 20,000, and the credit total is 10,000. The balance of 10,000 on the credit side represents the balancing figure, which has been highlighted in red.

In the above example, the debit total is 20,000, and the credit total is 10,000. The balance of 10,000 on the credit side represents the balancing figure, which has been highlighted in red.

The above example shows a debit balance of the Profit and Loss account. The firm incurred a loss during the year even though there was a Gross Profit. This simply means that the indirect expenses of the firm are higher than the income generated.

10,000 will be reduced from the Capital account, thereby reducing the total capital invested in the business.

Related Topic – Debit and Credit Balance in Trial Balance Quiz

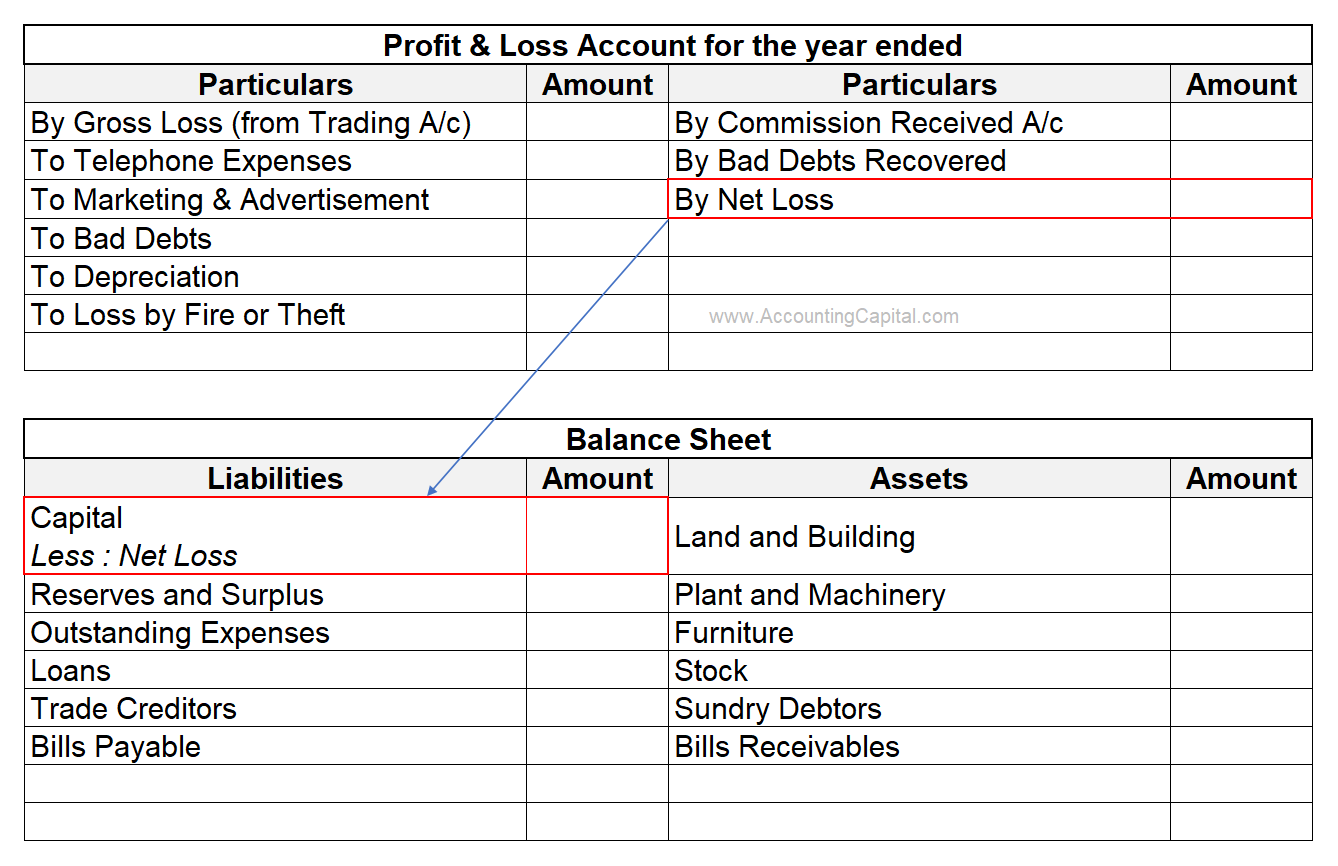

Debit Balance of Profit and Loss Account shown in the Balance Sheet

At the end of a financial year, the net loss is transferred to the balance sheet and shown as a deduction from Capital. This indicates that the company has not made enough money to cover its costs.

It is reflected as a negative amount, indicating the company has suffered losses. This reduction in equity signifies that the company’s overall financial position has been negatively impacted.

The image given below shows the transfer:

Net Profit

Net Profit

When the credit side of the Profit and Loss account is greater than the debit side, it is a credit balance. This credit balance is called Net Profit. It means that the indirect income of the business is more than the expenses. The net profit is added to the capital.

Related Topic – Profit and Loss Suspense Account

Gross Profit and Gross Loss

In the trading account, the terms “gross profit” and “gross loss” refer to the financial results of a company’s core trading activities, specifically related to the buying and selling of goods. It shows all the direct incomes and expenses like Sales, Purchases, Wages, etc.

Gross Profit – In simple terms, it means the “Revenue Earned from the Sale of Goods > Total Cost of Goods Sold.” It is the profit generated before considering indirect expenses, taxes, and interest.

A company’s gross profit tells you how profitable and efficient it is at managing its direct costs of production or acquisition. This shows a credit balance in a Trading account.

Gross Loss – On the other hand, a gross loss means that the “Revenue Earned from the Sale of Goods < Total Cost of Goods Sold.” It indicates that the company has incurred more costs in acquiring or producing goods than it has generated in sales income.

A gross loss or debit balance in a Trading account tells you the company’s direct costs are too high or its pricing strategy isn’t generating enough revenue to cover those costs.

- Both gross profit and gross loss are critical measures in assessing the profitability and performance of a company’s trading activities.

- They provide insights into the efficiency of cost management, pricing strategies, and the overall success of the company’s core operations.

- GP & GL are further analyzed and used in combination with other financial statements to evaluate the overall financial health of the business.

>Read Credit Balance of Profit and Loss Account