Journal Proper or General Journal

Journal Proper is mainly used for original records of a transaction which due to their importance or rareness of occurrence do not find a place in any of the subsidiary books of accounting. It is also known as a Miscellaneous Journal and it looks much like any other journal.

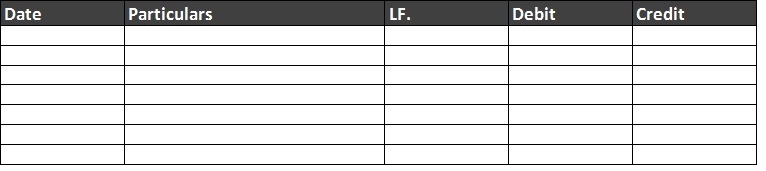

Sample Format of a Journal Proper

Types of entries that are entered in the journal proper:

- Opening Entries

- Closing Entries

- Rectification Entries

- Transfer Entries

- Adjustment Entries

- Miscellaneous Entries

Related Topic – What is a Journal (With Sample Format)?

Opening Entries

As the name suggests, opening entries are recorded at the beginning of a financial period. The balances mentioned in the balance sheet of the previous year are brought forward by recording the liabilities, capital, and assets from the previous year.

Example

The rule to be applied to make an opening entry is

| Assets A/C | Debit |

| To Liabilities A/C | Credit |

| To Capital A/C | Credit |

Sample Format of an Opening Entry in a Journal Proper

| Date | Particulars | LF. | Debit | Credit |

| mm/dd | Cash A/C | 35,000 | ||

| Furniture A/C | 15,000 | |||

| To Sundry Creditors A/C | 24,000 | |||

| To Capital A/C | 26,000 |

All amounts mentioned in the sample format are the closing balances of the previous year balance sheet.

Closing Entries

Almost the opposite of the opening entries, they are recorded at the end of a financial period; closing entries are related to nominal accounts. These accounts are closed by transferring their balances to trading and profit and loss accounts. A record is not included in the ledger without a journal entry, so closing entries are recorded with the help of a journal proper and then recorded in the ledger.

Example

| Profit & Loss A/C | Debit |

| To Salaries A/C | Credit |

At the end of a period Salary account is closed by transferring its balance to profit and loss account.

Rectification Entries

In the world of accounting erasing or removing a journal entry once recorded is a strict NO!. Mistakes should only be corrected by passing another entry in the journal.

Example

Purchase for 10,000 was omitted by mistake, it belonged to Unreal Pvt Ltd.

Rectification entry, in this case, will be

| Purchase A/C | 10,000 |

| To Unreal Pvt Ltd. | 10,000 |

Transfer Entries

In simple terms, the transfer entry is used to transfer an item from one account into another. All such transfers are made with the help of journal entries.

Example

Let us take an example where a general reserve is created for a business by transferring 5,00,000 from the profits.

| Date | Particulars | LF. | Debit | Credit |

| mm/dd | Profit & Loss A/C | 5,00,000 | ||

| To General Reserve | 5,00,000 |

Adjustment Entries

The amount of expenses or incomes may need to be adjusted for advances paid or received at the end of a financial period, these types of adjustments are made with the help of a journal entry. They are very common at the end of an accounting period. Adjustment entries are mainly used for accrual or depreciation related entries.

Example

There are outstanding wages of 50,000 which need to be accounted for

| Date | Particulars | LF. | Debit | Credit |

| mm/dd | Wages A/C | 50,000 | ||

| To Outstanding Wages A/C | 50,000 |

Miscellaneous or Other Entries

In addition to the above entries, there are other entries that can be recorded in a journal proper. They are:

- Discount allowed and received

- Purchase or sale of items on credit other than goods

- Effects of accidents such as losses due to fire

- Consignment and joint venture transactions

- Endorsement and dishonour of bills of exchange

- Transaction for goods distributed as samples

- Sale of obsolete assets

Short Quiz for Self-Evaluation