Ledger in Accounting

It is also known as the principal book of accounts as well as the book of final entry. It is a book in which all ledger accounts and related monetary transactions are maintained in a summarized and classified form. All accounts combined together make a ledger and form a permanent record of all transactions.

It is the most important book of accounting as it helps in the creation of trial balance which then acts as a base for the preparation of financial statements.

Example: An account can be either an Asset, Liability, Capital, Revenue or an Expense account. Few examples of each are Furniture, Cash, Creditors, Bank Loan, Capital, Drawings, Sales, Rent, etc.

Related Topic- What is a subledger?

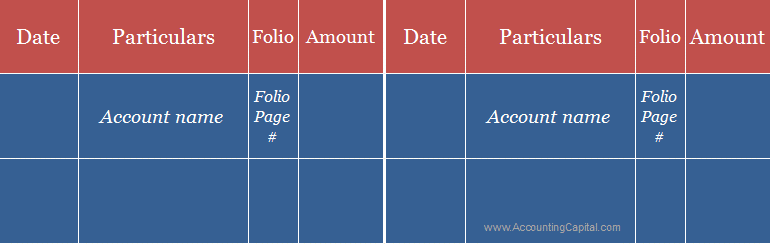

Sample Format of a Ledger Account

- It is shown in “T” format and divided into 2 columns: the left-hand side represents the debit side and the right-hand side represents the credit side.

- The process of transferring a transaction from a journal to a ledger account is called Posting. It is an essential task as it summarizes all transactions related to that account at one place.

- Posting is made to accounts from journal entries and various subsidiary books.

Account Types and their Balances

| Type of Account | Normal Balance |

| Assets | Debit |

| Liabilities | Credit |

| Capital | Credit |

| Revenue | Credit |

| Expenses | Debit |

| Drawings | Debit |

Short Quiz for Self-Evaluation

>Read Different Types of Ledgers