Meaning, Example & Uses

“Realisation Account” is mostly used to determine the profit or loss on the realisation of assets and settlement of liabilities. It is prepared in the event of the dissolution of a partnership firm.

Example

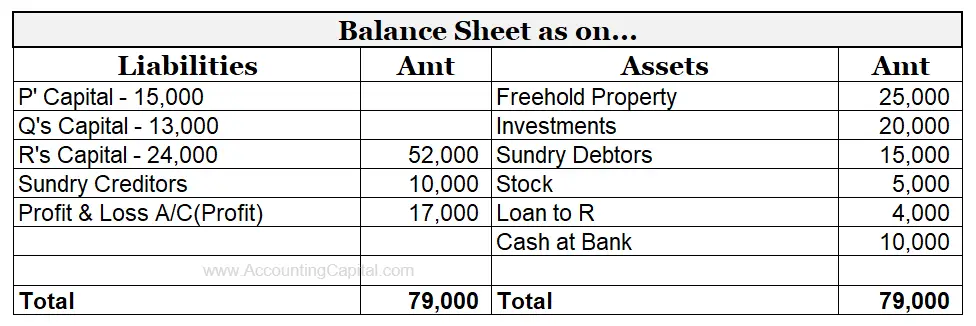

Suppose 3 partners P, Q & R with a profit-sharing ratio of 1:1:1 decide to dissolve their partnership firm at will. Also, assuming that the firm’s balance sheet on the date of dissolution is as shown below;

Further, P takes the investments at a value of 16,000.

Cash realized from the firm’s assets is as follows;

- Freehold Property – 30,000

- Sundry Debtors – 10,000

- Stock – 2,000

Moreover, the firm settles the creditors at a discount of 20% and pays the realisation expenses worth 1,000.

Thus, the Realisation Account will be prepared as follows;

Realisation Account

| Particulars (Dr.) | Amt | Particulars (Cr.) | Amt |

| Sundry Assets (Transfer) | Sundry Creditors A/C (Transfer) | 10,000 | |

| Freehold Property A/C – 25,000 | Bank A/C (Assets Realized) | ||

| Investments A/C – 20,000 | Freehold Property A/C – 30,000 | ||

| Sundry Debtors A/C – 15,000 | Sundry Debtors A/C – 10,000 | ||

| Stock A/C – 5,000 | 65,000 | Stock A/C – 2,000 | 42,000 |

| Bank A/C (Creditors Paid = 10,000 x 80%) | 8,000 | P’s Capital A/C (Investments at agreed value) | 16,000 |

| Bank A/C

(Realisation Expenses) |

1,000 | ||

| Loss on realisation transferred to partner’s Capital A/C:- (1:1:1) | |||

| P’s Capital A/C – 2,000 | |||

| Q’s Capital A/C – 2,000 | |||

| R’s Capital A/C – 2,000 | 6,000 | ||

| Total | 74,000 | Total | 74,000 |

Points to be noted

- The credit balance of Profit & Loss A/C is not to be transferred to the Realisation A/C, instead, it will be credited directly to the partners’ Capital A/C in their profit sharing ratio.

- The amount of loan given to R that is 4,000, is to be debited to R’s Capital A/C and not Realisation A/C.

Related Topic – Accounts not closed at the end of an accounting period

Type of Account and Format of Realisation Account

Knowing the type of account is crucial for accounting because the application of accounting rules is based on it.

As per the golden rules of accounting

| Type of Account | Nominal Account |

| Rule Applied | Debit all expenses & losses. Credit all incomes & gains. |

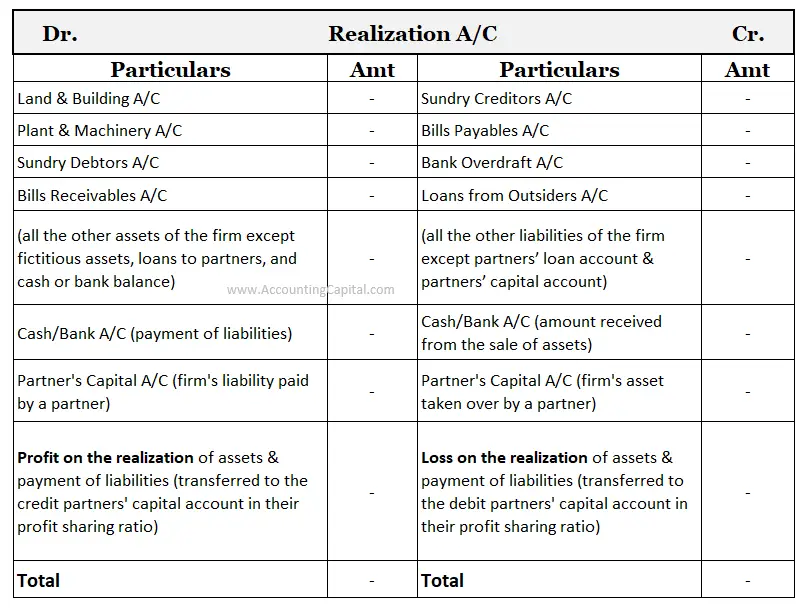

Template of Realisation Account

Note – Transactions involving the settlement of the firm’s liabilities against its assets are not to be recorded in the Realisation Account, because the final effect of such a transaction would be nil on the Realisation Account.

Related Topic – Difference between receipt, payment, income and expenditure

Steps to Prepare

- Transfer all the assets of the firm except fictitious assets, loans to partners, and cash or bank account to the debit side of the Realisation Account to close these accounts.

- Likewise, transfer all the liabilities of the firm except partners’ loan account & partners’ capital account on the credit side to close these accounts as well.

- Now, credit the Realisation Account by the amount received from the sale of the firm’s assets.

- Similarly, debit the account by the amount paid to settle the liabilities of the firm.

- Record the expenses incurred by the firm on dissolution on the debit side of the realisation account.

- In case the firm’s liability is settled by the partner, debit the Realisation Account by the respective partner’s Capital A/C.

- Correspondingly, credit the account by that partner’s Capital A/C, who has taken over the firm’s one or more assets.

- The balance of this account would be either profit or loss, which is to be transferred to the Credit or Debit side respectively, of the partners’ Capital A/C in their profit sharing ratio.

Important Points to Remember

- Amount realized on unrecorded Assets is credited and the amount paid for unrecorded Liabilities is debited in the Realisation Account.

- All Provisions and reserves for which there is an asset in the balance sheet (ex. Provision for depreciation or doubtful debt) should be transferred to the credit of the Realisation Account.

- Free Reserves and Capital Reserves should not be transferred to the realisation account instead, should be Credited directly to the partners capital account.

- A loan given to a partner (asset) is transferred to the respective capital account whereas, a loan taken from a partner by the firm (liability) is transferred neither in the realisation account nor in the partners capital account. It is settled directly in cash after the payment of outsiders liability but before the payment towards the partners capital.

- A loan related to any relative of a partner is credited in the realisation Account as it is an outsiders liability only.

- A debit balance in the Realisation account is considered a “Loss on Realisation”.

- A credit balance in the Realisation account is classified as “Profit on Realisation”.

Related Topic – Interest on Capital Adjustment in Final Accounts

Difference between Revaluation Account and Realisation Account

| Basis | Revaluation Account | Realisation Account |

| 1) Meaning | Revaluation A/C records the effect of reassessment of assets & liabilities of the firm. | Realisation A/C records the effect of realisation of the firm’s assets & settlement of the firm’s liabilities. |

| 2) Purpose | It helps in making necessary adjustments in the value of assets & liabilities. | It helps in calculating the profit or loss on realisation of assets & payment of the outsider liabilities. |

| 3) Time | It is prepared at the time of admission, retirement, or death of a partner and, change in profit sharing ratio. | It is prepared only at the time of dissolution of the partnership firm. |

| 4) Contents | Includes only those Assets and Liabilities which are Revalued. | Includes all the Assets (except fictitious assets, cash/bank and loan to partners) and outsiders liabilities of the firm. |

| 5) Effect on assets & liabilities | All the assets & liabilities accounts recorded in the Revaluation A/C are just revalued and not closed. | All the assets & liabilities accounts recorded in Realisation A/C are closed. |

| 6) Frequency of preparation of this account | This account can be prepared multiple times during the life of a business. | This account is prepared only once, during the dissolution of the firm. |

Short Quiz for Self-Evaluation

>Read Difference Between Revaluation Account and Realisation Account