Final Accounts

As the name suggests they are the final accounts which are prepared at the last stage of an accounting cycle. Final accounts show both the financial position of a business along with the profitability, they are used by external and internal parties for various purposes.

Trading account, Profit and Loss account and Balance Sheet together are called final accounts.

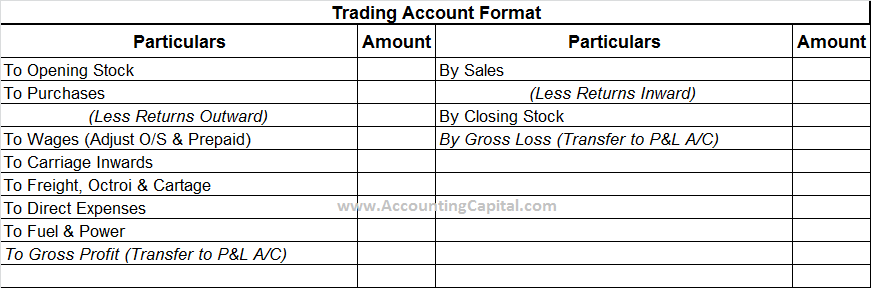

Trading Account

This account is the first account prepared as a final account, it is prepared to ascertain gross profit or gross loss incurred during an accounting period. On the debit side i.e. the LHS of the trading account items such as opening stock, purchases, and all direct expenses are shown.

Gross Profit – If the total of credit side is greater than debit side i.e. RHS > LHS the excess is called Gross Profit. It is transferred to the credit side of Profit and Loss account.

Gross Loss – If the total of the debit side is greater than the credit side i.e. LHS > RHS the excess is called Gross Loss. It is transferred to the debit side of Profit and Loss account.

Below is a sample format of trading account

Related Topic – Difference between Gross Profit and Net Profit

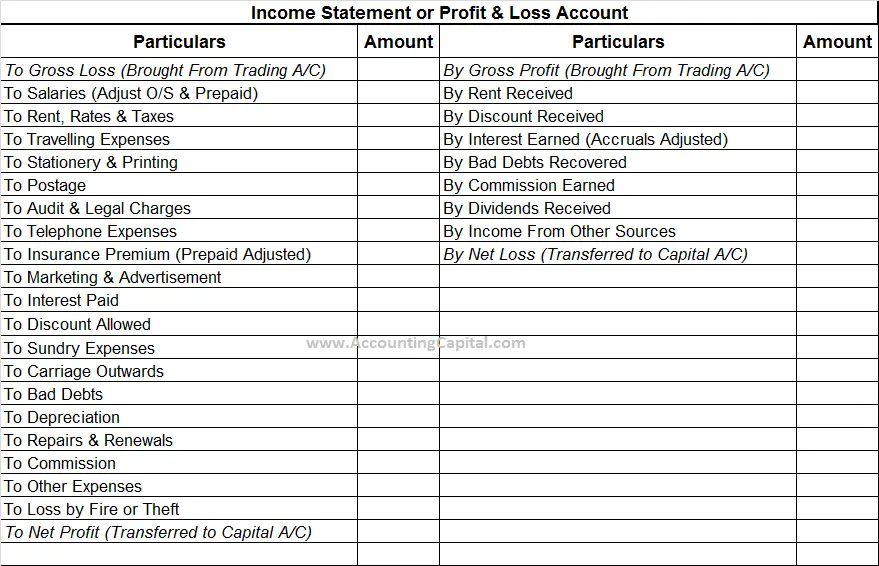

Profit and Loss Account

After preparation of trading account a profit and loss account also known as an income statement is prepared to ascertain the Net Profit or Net Loss incurred by a business. It begins with Gross Profit or Gross Loss being transferred from the trading account.

On the debit side of a Profit and Loss account, all indirect expenses such as salary, rent, office and admin, marketing, stationery etc. and loss incurred by the sale of assets or fire/theft etc. are mentioned.

On the credit side of a Profit and Loss account, all indirect incomes such as interest earned, dividends received on shares, bad debts recovered, profit on the sale of assets etc. are mentioned.

Below is a sample format of profit and loss account or income statement

Related Topic – Difference between Trial Balance and Balance Sheet

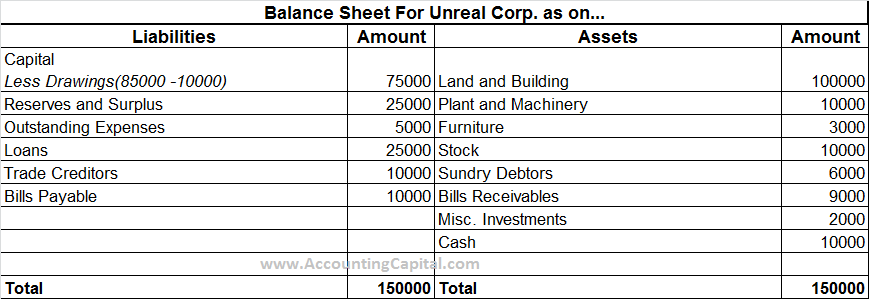

Balance Sheet

Both trading account and income statement help to determine the profitability of a business whereas a balance sheet is constructed to find out the financial position of the business as on a particular date. The balance sheet consists of capital, assets, and liabilities of a business.

It is a statement and not an account, it has no debit or credit side there “To” & “By” are not used inside a balance sheet. On the LHS of a balance sheet are all liabilities including capital and RHS will be all assets, for a balance sheet liabilities will always be equal to assets.

Below is a sample format of profit and loss account or income statement

Short Quiz for Self-Evaluation

>Read What is Posting?