Income Statement or Profit and Loss Account

An income statement is also known as a profit and loss account, statement of income or statement of operations. Besides balance sheet and statement of cash flows, income statement is also among important financial statements which measures the financial performance of a company over a certain period.

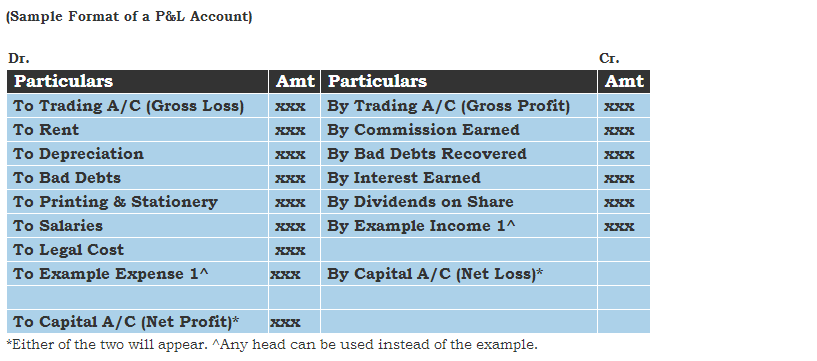

After the preparation of a trading account, a profit & loss account is prepared to determine the net profit earned or net loss incurred due to the operations of a business. It is an important final account of a business which shows the summarized view of revenues and expenses for a particular accounting period.

An income statement shows the profitability of a company for a specified time interval as mentioned in the heading. It may be a fiscal quarter, fiscal year or a custom range as per requirement.

Income statement displays expenses, losses, revenue and gains. Cash transactions are never included in an income statement whether they are cash receipts or cash disbursements. It helps to determine a company’s current position whether it is in profit or loss. It is important for a company to disclose their income statement especially to those who are associated with the company e.g. investors, lenders, company management, labor unions, government agencies, potential investors etc. A profit-making company therefore not only increases its credibility in the market but also attracts more investors.

Profit and Loss Account or Income Statement will have the following constituents:

Revenues and Gains

- Operating revenues derived from primary activities of a business, it may differ according to the nature of business. For a manufacturer his primary activities would be production and sale of his products but for a wholesaler or retailer his primary activities will be buying and then selling of his merchandise.

- Revenues or income from secondary activities – Other than its main activities a business may earn from other activities as well. For example a retailer could get his extra finances by renting a place, interest revenue, etc.

- Gains – For example: gains from lawsuits or gains from the sale of long-term assets used in business, etc.

These are shown on the right hand side of a profit and loss statement.

Expenses and Losses

- Operating expenditure incurred related to all primary activities of a business.

- Other expenses incurred related to secondary activities.

- Losses. For example: loss from natural disasters, costs of writing down good will or intangible assets etc.

These are shown on the left hand side of a profit and loss statement.

The difference of two sides of this account is either net profit or net loss, which is then transferred to the capital account.

Short Quiz for Self-Evaluation