Debit Note Vs Credit Note

Debit and credit notes are an important part of today’s business culture as corporations have grown large and so have their credit sales and purchases.

Accounts payable management and accounts receivable management including dealing with credit and debit notes on a daily basis. Therefore, knowing the difference between a debit note and credit note is important.

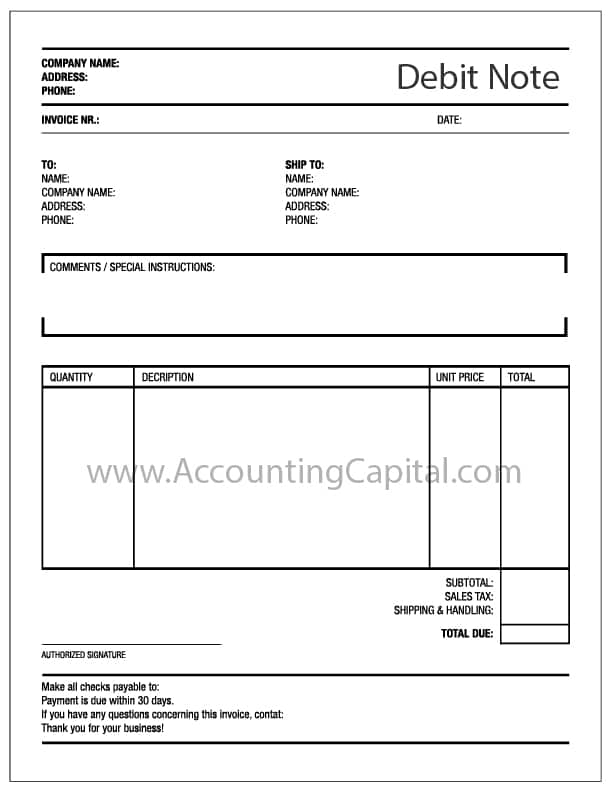

Debit Note

1. When a buyer returns goods to the seller, he sends a debit note as an intimation to the seller of the amount and quantity being returned and requesting the return of money.

2. A debit note is sent to inform about the debit made in the account of the seller along with the reasons mentioned in it.

3. The purchase returns book is updated on the basis of the debit note. (In case of return of goods)

4. It is often used to return goods on credit.

5. A debit note is generally prepared like a regular invoice and shows a positive amount.

6. Journal entry to record a debit note in the books of seller

| Sales Returns A/C | Debit |

| To Debtor’s A/C | Credit |

Related Topic – Accounts Payable with Journal Entries

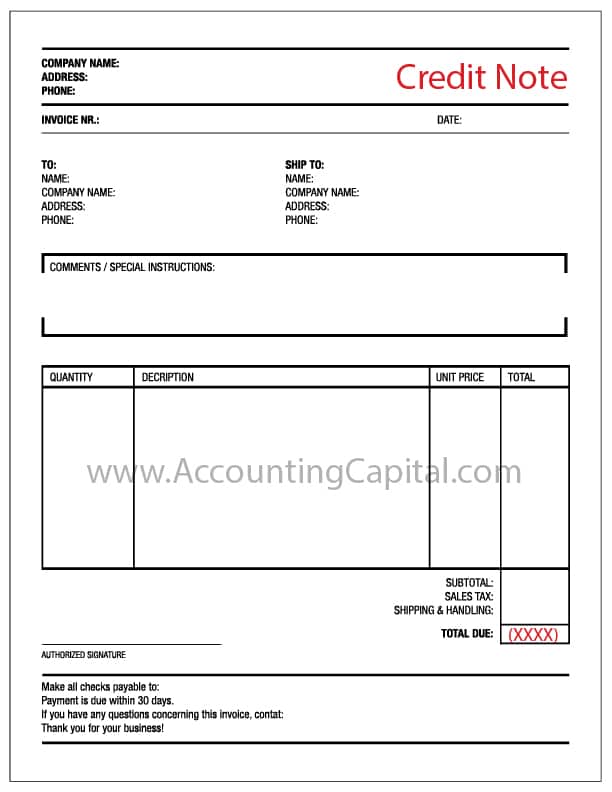

Credit Note

1. When a Seller receives goods (returned) from the buyer, he prepares and sends a credit note as an intimation to the buyer showing that the money for the related goods is being returned in the form of a credit note.

2. A credit note is sent to inform about the credit made in the account of the buyer along with the reasons mentioned in it.

3. The sales return book is updated on the basis of the credit note. (In case of return of goods)

4. It is generally sent by the seller if the goods are found incomplete, damaged or incorrect.

5. A credit note generally shows a negative amount.

6. Journal entry to record a credit note in the books of buyer

| Creditor’s A/C | Debit |

| To Goods Returned A/C | Credit |

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 19 – Credit Note

>Related Long Quiz for Practice Quiz 25 – Debit Note

>Read Top Accounting and Finance Interview Questions