Bad Debts Vs Doubtful Debts

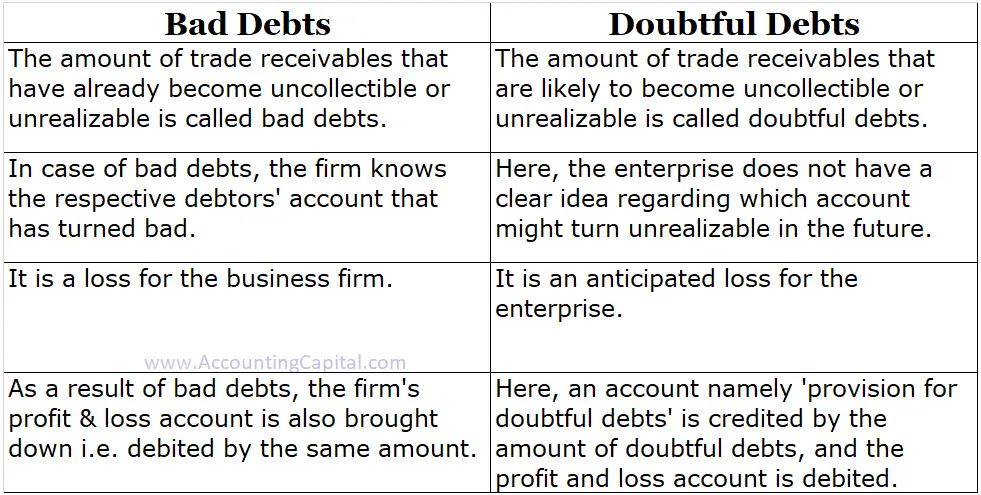

Bad debts & doubtful debts are two terms that are often considered synonymous, but there is a fine line between the two. Bad debts refer to the amount of trade receivables that have become uncollectible i.e. they cannot be recovered from the debtors. On the contrary, doubtful debts refer to the amount of trade receivables that are likely to become uncollectible and might eventually become a part of bad debts at some point of time in the future.

Related Topic – Reasons to create provision for doubtful debts

Broadly, there are two methods to account for bad debts & doubtful debts in the financial statements:

1) Direct Write-Off Method – in this method no provision is created for bad or doubtful debts & hence the bad debts when incurred by the firm are directly written off from that year’s profit & loss account.

2) Allowance Method – in this method a separate provision is created for bad & doubtful debts. Therefore, when bad or doubtful debts are incurred by the firm, these are written off from the provision maintained. However, the excess is to be written off from that particular year’s profit & loss account.

Most of the firms follow the allowance method only, majorly because it is more practical as well as in line with the principle of conservatism.

Bad Debts

It refers to the number of debtors & bills receivables, the amount against which has become uncollectible. The following are probable reasons behind bad debts;

- Debtors are not willing to repay their debts,

- Bankruptcy or insolvency of the debtor,

- Other financial difficulties.

Bad debts are also referred to as non-performing assets in the case of banks and other financial institutions.

Sometimes, a portion of debts (already written off) in any of the previous accounting years may be recovered in a future accounting period and is called bad debts recovered.

Following is the journal entry for bad debts recovery;

| Cash or Bank A/C Dr. | – |

| To Bad Debt Recovered A/C | – |

(a portion of previously written off bad debt recovered)

| Bad Debt Recovered A/C Dr. | – |

| To Profit & Loss A/C | – |

(amount of bad debt recovered transferred to profit & loss account)

Logic – The recovery of previously written off bad debts will add to the firm’s revenue in the year of its recovery.

Example

Suppose Dell Ltd. sells 100 desktops worth 4,000 each to XYZ Ltd. on a credit of 1 month. But on the due date, Dell Ltd. recovers only 40% of the amount due as XYZ Ltd. got insolvent.

Therefore the amount of bad debts incurred by Dell Ltd. will be equal to 60% of the total credit sale of 4,00,000 made to XYZ Ltd.

Amount of Bad Debts = 60% of total amount receivable from XYZ Ltd.

= 60% x (100 x 4,000) = 60% x 400,000 = 240,000

or

= Amount receivable from XYZ Ltd. – Amount actually recovered from XYZ Ltd.

= (100 x 4,000) – (40% x (100 x 4,000))

= 400,000 – (40% x 400,000) = 400,000 – 160,000 = 240,000

Formula to compute bad debts

| Bad Debts = Amount Due – Amount recovered

or Bad Debt = Amount due – (Amount due * % of the amount recovered) or Bad Debt = Amount due * (100 – % of amount recovered) |

There is no universal or fixed formula to calculate bad debts & it can be derived using basic maths and logic. Although a generic % based formula has been mentioned above that can be used generally.

Related Topic – How to calculate the provision for doubtful debts?

Treatment in Financial Statements

Bad debts will be reflected in the books of accounts as follows;

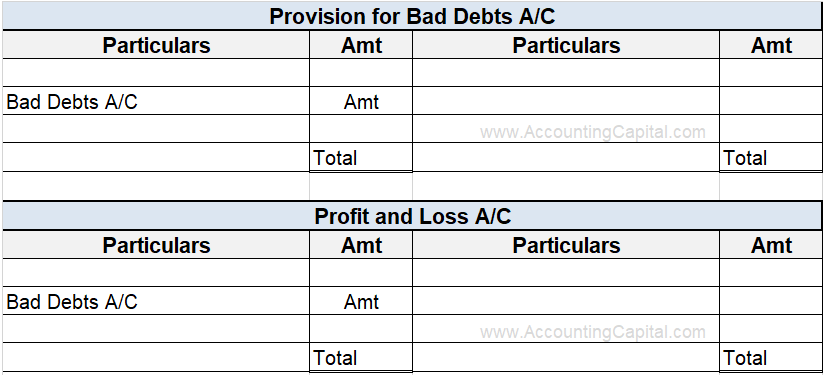

Case 1: When provision for bad debts account is maintained

If an enterprise maintains a provision for b/debts account then debit the amount of bad debts to that account, whereas any amount exceeding such provision will be debited to the firm’s profit & loss account.

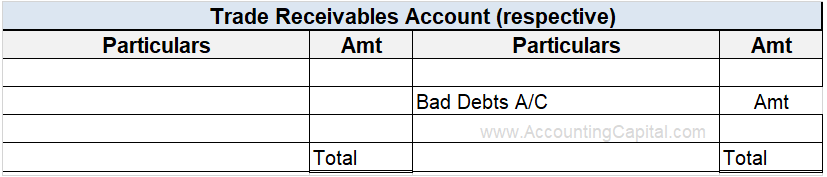

Case 2. When no provision is maintained

Debit the entire amount of bad debts to the firm’s profit & loss account in case the firm does not maintain provision for bad debts.

Further, the bad debts will also reduce the amount of accounts receivables. Hence, credit it to the respective asset account.

Related Topic – Are bad debts shown in the income statement?

Doubtful Debts

It refers to the amount against the number of debtors or bills receivables that might turn bad at some point of time in the future. In other words, it directs to the amount of accounts receivables that are unlikely to be repaid by the firm’s debtors in the future.

Also, as doubtful debts have not yet become a part of bad debts & are just anticipated losses, thus these are not to be recorded in the books, instead, a provision is made for the same.

Example

Let’s assume that Amazon has total accounts receivables of 99,000. However, the firm expects 10% of its trade receivables to turn bad at some point of time in the future.

Therefore,

Amount of Doubtful Debts = 10% x 99,000 = 9,900

Related Topic – Treatment of provision for doubtful debts in the trial balance

Formula to compute doubtful debts

There is no fixed formula. In fact, the amount of such debts is based upon the firm’s evaluation & judgment.

However, the standard formula used is as follows;

| Provision for Doubtful Debts = Given Rate x [Gross Amount of Accounts Receivables – Good Debts (including the amount of provision for discount on debtors) – Bad Debts – Further Bad Debts – Provision for Bad Debts (if any, already exists in the firm’s balance sheet)] |

Treatment in Financial Statements

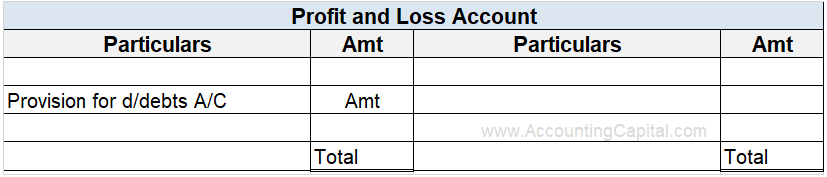

Doubtful debts are just anticipated losses that have not been actually incurred by the business entity. Hence, these will be shown in the books of accounts only if it becomes a part of bad debts.

However, the provision created to anticipate such d/debts will be shown in the books as follows;

To reflect the creation of provision for d/debts in the books of accounts, debit the profit & loss account by the amount of such provision.

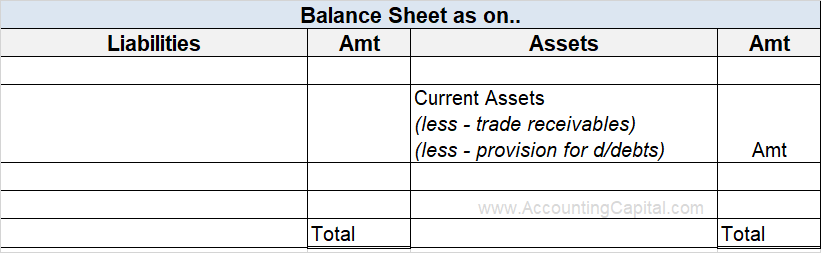

Also, the provision for doubtful debts is a contra asset account. Hence, show it as a deduction from the concerned trade receivables in the firm’s balance sheet.

>Read How to show contra assets on the balance sheet?