Bookkeeping Vs Accounting

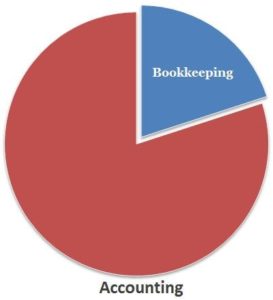

Both bookkeeping and accounting are used interchangeably in the financial world, however, there is a notable difference between bookkeeping and accounting. Bookkeeping is a part of accounting whereas accounting itself is a wider concept.

Definition of Bookkeeping – Literally, it means the activity of keeping (or maintaining) financial books, i.e. recording financial transactions & events. The books referred to, in this context, are the books of accounts. This involves extensive data input. Few activities under book-keeping are;

- The input of invoice and voucher details into ERP systems.

- Receiving and recording payments by customers.

- Making and recording payments to vendors.

- Efficiently processing payroll information, etc.

Definition of Accounting – Accounting, on the other hand, is the process that includes recording, classifying, summarizing, and interpreting the financial information of an economic unit. The economic unit is considered as a separate legal entity. Accounting information is widely used by various types of parties for several different reasons. Few activities under accounting are;

- Preparation of a trial balance, ledger accounts, etc.

- Preparation of financial statements.

- Analysis of financial data.

Related Topic – Difference between Financial and Cost Accounting

Difference between Bookkeeping and Accounting (Table)

| Bookkeeping | Accounting | |

|---|---|---|

| Definition | 1. Bookkeeping is mainly related to the process of identifying, measuring, recording, and classifying financial transactions. | 1. Accounting is the process of summarizing, interpreting, and communicating financial transactions that were classified in the ledger account as a part of bookkeeping |

| Stage | 2. It is the beginning stage and acts as a base for accounting | 2. Accounting begins where bookkeeping ends. |

| Management Decisions | 3. Management can not make decisions based on bookkeeping. | 3. Management can make decisions based on accounting. |

| Objective | 4. The objective of bookkeeping is to keep proper and systematic records of financial transactions. | 4. The objective of accounting is to ascertain the financial position and further communicate the information to the relevant parties. |

| Financial Statements | 5. Financial statements are not prepared during bookkeeping. | 5. Financial statements are prepared on the basis of records obtained through bookkeeping. |

| Skill Level | 6. Bookkeeping doesn’t require any special skills as it is mechanical in nature. | 6. Accounting, on the other side, requires special skills due to its analytical and somewhat complex nature. |

Duties of a Bookkeeper & Accountant

In light of the above discussion, it can be established that there is a usual overlapping between the roles of a bookkeeper and an accountant. It can be hard at times to clearly distinguish the two but the generally accepted convention is that the bookkeeper contributes to the early stages of the common accounting cycle, while an accountant contributes to the latter stages.

Duties of a Bookkeeper

- To look out for financial data and identify economic transactions for a business.

- To distinguish between material economic activities and immaterial economic activities.

- To record events measured in monetary terms, in an orderly manner in a journal or other subsidiary books.

- To properly maintain the required books of original entry.

- To produce required bills and invoices with reference to transactions.

- To post all debits and credits in the general ledger.

- To classify all transactions in a systematic manner.

- To balance and reconcile all the accounts in the books of accounts.

- To summarize the balances in an accurate trial balance.

- To prepare the bank reconciliation statement.

- To follow and report on budgetary compliance.

- To follow due diligence in following the generally accepted conventions of recording and maintaining books of accounts.

Duties of an Accountant

- To examine the recorded transactions in order to check the efficiency of the records.

- To suggest adjustment entries if any error is present in the bookkeeping process.

- To analyze the trial balance in order to prepare the financial statements.

- To prepare the Trading as well as Profit and Loss account to capture the profitability of the business.

- To prepare the Balance Sheet to reflect the financial position of the business.

- To estimate the cost of operations and revenue generated for the business.

- To gauge the income tax and other compliance-related requirements of the company.

- To interpret the financial statements in a way that can be useful for business decision making by the owners and other stakeholders.

- To communicate necessary accounting information to the internal as well as the external users.

- To provide consultation and insights to the owners to help them make an informed decision.

Related Topic – Difference between Journal Entry and Journal Posting

Auditing and Accountancy

The most accepted definition of an audit is given as an evaluation of a personal organization, process, system, or business. The term is most ordinarily used with respect to audits in accounting, and sometimes in project management, legal departments, and financial management also. In other words, an audit is a necessarily unbiased analysis or examination of an organization’s statements. The audit can be both internal as well as external.

Auditing vs Bookkeeping

Auditing starts after the accounting cycle is completed. It is not a part of traditional bookkeeping and/or accountancy. Bookkeeping and auditing are similar in the way that both of them deal with the financial records of the business involved. Also, the utmost care and due diligence is the way to go for both a bookkeeper as well as an auditor. The Bookkeeper works for the organization, while an auditor can be external or internal.

Despite all this, auditing is a completely different process when compared to bookkeeping. The basic difference between the two lies in the tasks involved and the objective of performing the two activities.

- Bookkeeping is the process of maintaining the records of the business and making sure that all requirements are fulfilled. On the other hand, auditing involves doing analytical and backtesting on the records to establish authenticity.

- Bookkeeping is done with the simple purpose of recording all material economic activities of a firm in a uniform manner so that it can form the base for decision making. On the other hand, auditing is performed with the objective of evaluating the truthfulness and fairness of the records.

Accountancy vs Accounting vs Auditing

Accountancy and accounting are used interchangeably. In-depth analysis shows that while accounting refers to the steps in the accounting process like recording, classifying, summarizing, etc, accountancy is used to denote the overall duties or functions performed by an accountant.

Accountancy and auditing are also related in the same fashion. Accountancy starts where bookkeeping ends while auditing is performed after accountancy is complete. Both of them are similar in a way that they both have to rely on the records as maintained by the bookkeeping. Both accountancy and auditing are analytical in nature and are performed to make the most of the financial records. The techniques and tools are different in both cases, however.

- Accountancy involves summarizing and interpreting financial data to facilitate informed decision making. Auditing is the process of checking and ensuring that financial records are reliable.

- Accountancy is very detailed and generally tries to not miss any detail. If a detailed audit is not being performed, an auditor will usually rely on random samples of financial information.

- Accountancy is governed by accounting standards while auditing is governed by legal acts that are not very flexible in their approach.

- An accountant is generally appointed by the management and will be paid a salary. An auditor on the other hand may be appointed by some external authority also and will be paid a specific fee.

Related Topic – Difference between Journal and Ledger

Difference Between Bookkeeping and Accounting (PDF)

Download PDF to see the comparison between bookkeeping and accounting.

Short Quiz for Self-Evaluation

>Read What is an Accounting Cycle or Accounting Trail?