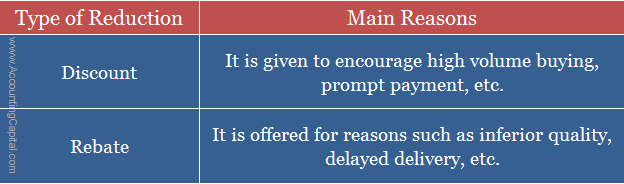

Discount vs Rebate

Discount and rebate are commonly used terms in today’s dynamic markets, especially in the e-commerce world. Rebates and discounts are distinct forms of price cuts that directly or indirectly promote the overall sales of a business. Both the terms may sound similar, however, there is some difference between discount and rebate. applied.

Rebate – It is provided by a seller to the buyer for reasons such as; inferior quality of goods, inaccurate quantity, missing buyer-specific features in the final product, delayed supply, etc. Unlike, a trade discount that is provided mainly for high quantity buying, a rebate is for reasons which help a supplier to provide healing touch in a situation that is unfavourable during the process of selling.

Example of Rebate – Goods worth 10,000 were sold by Unreal Corp. to ABC Corp. but some of the goods were of poor quality, therefore, after a mutual agreement Unreal Corp. allowed a rebate of 1,000 i.e. 10%.

Discount – A seller grants it to the buyer in two distinct forms; trade discount and cash discount. It may be allowed out of the selling price (also known as maximum retail price or catalogue price) or as a reduction from the net amount payable.

Trade Discount – It encourages large quantity buying and is mostly provided to resellers.

Cash Discount – it is provided to encourage early payment. This helps the seller to maintain cash flow and healthy working capital.

Example of Discount – Goods worth 10,000 were sold by Unreal Corp. to ABC Corp. @10% discount each. Cash discount allowed @5% if payment is made within 15 days. This means a trade discount of 10% and an additional 5% discount if the payment is made within 15 days of the sale.

Difference Between Discount and Rebate (Table Format)

| Discount | Rebate | |

|---|---|---|

| Definition | Discount is the reduction offered by a seller to the buyer from the purchase price of goods or services. | Rebate is refund or return of currency value that a seller of goods provides to the buyer for various different reasons. |

| Reasons | To promote high quantity purchases, receive timely payments, and increased sales. | For various reasons which are unfavourable during the purchase cycle, such as; poor quality, delay in delivery, etc. |

| Type of Transaction | Trade discount is offered both on cash and credit sale, however, cash discount is only offered on a prompt payment. | Rebate is allowed on both cash and credit sales. |

| Impact on Invoice | Trade discount is reduced from the original value even before the invoice is generated. Cash discount, on the other hand, is reduced from the final invoice value. | The amount of rebate does not affect the original invoice as the adjustment is made post-sale. The effect is shown in trading account & the income statement. |

| Recording in book of accounts | In case of a trade discount, it is not shown in the books of accounts whereas a cash discount is recorded in the income statement as an expense. | It is shown separately in the financial statements as it is provided after the sale has already been recorded. |

| Timing | It is applied at the time of occurrence of an event i.e. before the sale or purchase has been completed. | It is used after an event has been recorded i.e. post the sale or purchase has been completed. |

| Consideration | Trade discount is provided considering the quantity bought. Cash discount is provided considering the time of payment. | Rebate is provided considering all the reasons for which a trade discount or cash discount is not offered. |

Refund Vs Rebate: The terms ‘refund’ and ‘rebate’ are sometimes used synonymously. However, one important thing to keep in mind is the fact that where a refund is usually provided in full, a rebate is generally provided in part.

Examples of Rebate and Discount

Rebate

ABC brand has been in the mobile business for a few years. The company has come up with a new marketing strategy for a particular model X that is already popular in the market.

| Reason for Rebate | Delayed deliveries of mobile sets of the X model |

| Price of 1 set | 10,000 |

| Refund offered | 10% of the phone price |

| Eligible Customers | Each customer that has received the phone later than 1 month after ordering it |

| Required Steps | Register themselves on the company website, fill out a survey, and verify their purchase of the X model. |

| Additional offer | These customers can also qualify for 10% off on ABC earphones which are not that successful in the market. |

| Actual Cost to customers | 9,000 |

The above strategy will be termed a rebate. This is a well-known sales promotion strategy and hits the demand side of any product. It is identifiable with characteristics like a refund of some amount, the transaction taking place after some time of the actual sale, and the customers required to do something extra in order to claim the rebate.

Discount

XYZ is a supermarket. It is facing low demand for breakfast items due to the pandemic situation. It comes up with a simple marketing strategy.

| Discount Offers | 10% off on all ready-to-eat breakfast items

5% off on all breakfast cereals |

| Eligible Customers | All customers who buy the qualifying items and the required quantity |

| Actual Cost to customers | The discount will be a reduction in the total bill amount and the buyer will have to pay less at the check-out |

| Example | A customer will pay 900 for an item worth 1,000 and 950 for a breakfast cereal priced at 1,000 |

The above strategy is a simple trade discount strategy. It is still better to clear the inventory at lower prices than to risk the quality of perishable goods. The identifiable features of a discount can be easily seen such as all customers equally qualify for it, benefits are received at the time of purchase, and the discount is reducing the bill amount.

Journal Entries & Accounting

Discount

A cash discount is recorded in the books of accounts while a trade discount is not. Since the discount allowed is a clear expense for a business in order to earn revenue, the journal entry for a discount is:

| Cash A/c | Debit |

| Discount A/c | Debit |

| To Sales A/c | Credit |

Journal entry for recording a discount of 10% on products worth 50,000:

| Cash A/c | 45,000 |

| Discount A/c | 5,000 |

| To Sales A/c | 50,000 |

Rebate

Rebate is also an expense for the business. But it is recorded in two stages.

At the initial stage:

| Customer A/c | Debit |

| To Sales A/c | Credit |

At the time of rebate allowed:

| Rebate Allowed A/c | Debit |

| To Customer A/c | Credit |

Journal entry for recording a rebate of 10% on the phone set worth 10,000 that was sold to X:

| X A/c | 10,000 |

| To Sales A/c | 10,000 |

| Rebate Allowed A/c | 100 |

| To X A/c | 100 |

Short Quiz for Self-Evaluation

Revision & Highlights Short Video

Highly Recommended!!

Do not miss our 1-minute revision video. This will help you quickly revise and memorize the topic forever. Try it :)

>Read Journal Entry for Salary Paid