Revenue Vs Profit

Revenue – is the excess of revenue earned over expenditure incurred by a business for a given accounting period. It increases the total capital invested in a business.

Such monetary benefit arise due to the;

- Business operations – Relating to business activities.

- Non-recurring events – Relating to unforeseen events e.g. fire, theft, loss on sale of fixed assets, etc.

- Accounting loss – Relating to accounting policy or accounting standard changes, etc.

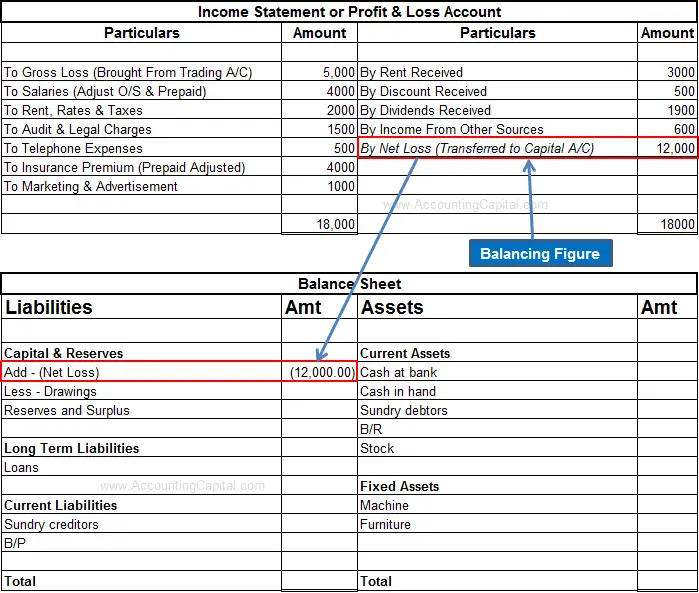

Loss Shown in Financial Statements

Net Loss incurred by a business is shown on the credit side of an income statement as a balancing figure. At the time of preparation of final accounts, the loss is transferred to the balance sheet.

Profit – Money spent by a firm for generating revenue is termed as expenditure or expenses. The cost incurred as expense usually expires during the same accounting period, i.e. it is not carried forward to a future period.

Expenses may occur in the following forms;

- Cash payment of currency, for e.g. paying bills such as rent, salaries, etc.

- A decline in the value of assets (e.g revaluation loss or investment loss), etc.

- Accepting a liability, for example – accrual of rent, etc.

- The total cost of goods sold.

- Depreciation & Amortization.

- Bad debts, etc.

Expenses are classified in various different ways;

- Direct or Indirect Expense – Based on the relationship with the core business.

- Capital or Operating Expense – Based on the type of expenditure.

- Petty or Sundry Expenses – Based on the size, quantity & relevance.

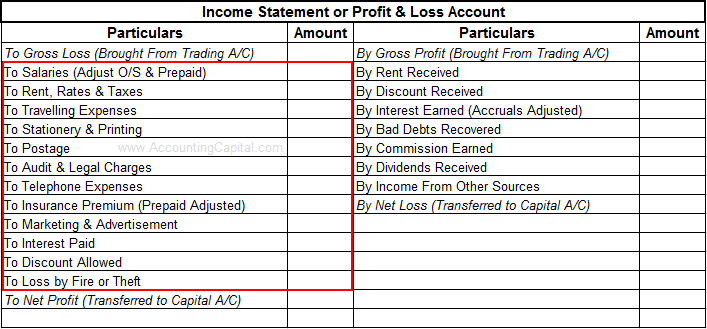

Expenses Shown in Financial Statements

Expenses incurred by a business are shown on the debit side of an income statement and are further used to compute the net gain or net loss of the company.

One of the main differences between loss and expense is that total loss is computed with the help of total expenses and affects the total capital invested in the business. On the other hand, expenses do not directly affect the capital invested in a business.

Table Format of Difference

| Basis of difference | Revenue | Income |

| Definition | It is the amount of money generated from the primary operations(selling of goods or services) of an organisation | It is the excess of revenue over expenses |

| Calculation | Gross Revenue= Number of goods× selling price per unit.

Net Revenue= Gross Revenue – Sales return- Discount |

Income= Revenue- Total cost(operating costs, administrative expenses etc |

| Position in the Production cycle | It is the starting point of income | It provides monetary cash flow to continue the next production cycle and thus generates revenue |

| Placement | It is placed at the top of a Company’s financial statement thus Revenue is referred to as Topline | It is placed at the bottom of a Company’s financial statement thus Income is referred to as the Bottom line |

| Depiction | It shows the details of the number of goods or services sold and the price.

It does not depict the utilization of resources |

It shows how well a company utilizes its resources and controls its operational costs and other expenses to increase the income of the company |

| Superset/ Subset | Revenue includes Income thus it is the Superset | Income is included in Revenue thus it is a Subset |

| Example | ABC Ltd sold 2000 units of its product @ Rs 10.

Thus the Revenue is Rs 20000 |

ABC Ltd incurred Rs 5000 as operating and administrative expenses.

Income= Rs 20000- Rs 5000 = Rs 15000 |

>Read Difference Between Loss and Expense