Capitalized Expenditure or Capitalized Expense

Capitalized expenditure is nothing but a revenue expenditure which is essential to acquire and function a new asset or improve an existing asset’s earning capacity. All such expenses are treated as if it were for the purchase of the fixed asset itself and are termed as a capitalized expenditure.

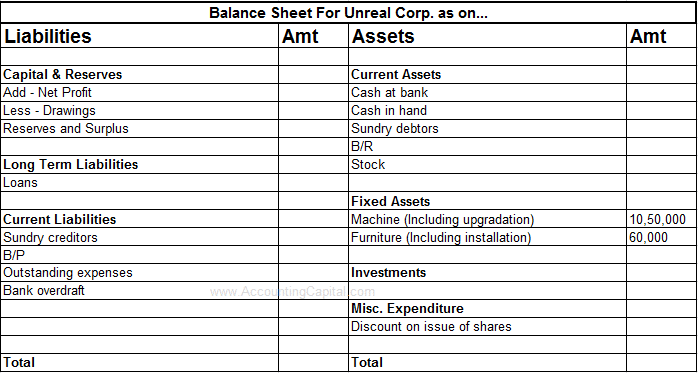

All such expenses are either shown as fixed assets or added to the cost of a related fixed asset and shown in the balance sheet, whereas all revenue expenses are shown in the profit and loss account (income statement).

An expense is said to be capitalized when its benefits do not expire in the same accounting period or in other words, same accounting year.

Example of expenses which are capitalized – Purchase of a fixed asset, the installation cost of a fixed asset, upgrading a fixed asset, the legal cost incurred to acquire the fixed asset, etc.

Related Topic – What is Capex and Opex?

Treatment in Financial Statements

Reason – If a revenue expenditure extends its benefits for more than one accounting year such an expense is capitalized and shown inside the balance sheet, furthermore, any expense which expires within the same accounting year is treated as revenue in nature.

All capitalized expenses are written off in future accounting periods with the help of depreciation of fixed assets.

Detailed Example of Capitalized Expenditure

Furniture – 50,000, Machine – 1,000,000

Installation of Furniture – 10,000, Upgrading Machine – 50,000

All these items are examples of capital expenses incurred by a business. Installation and upgrading cost incurred are treated as capital expenses and added to the book value of machine and furniture respectively.

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 16 – Capital Expense

>Read Sundry Expenses