Steps to become a Chartered Accountant in India?

There are two ways to pursue a branded CA career;

- Foundation Course Route

- Direct Entry Route

The direct entry route takes you directly to the intermediate stage of the course, meaning skipping the CA Foundation exam.

The candidates who are eligible to register themselves with the Direct Entry Route are given below –

- Commerce Graduates / Post Graduates scored minimum 55% marks or other graduates or Postgraduates who scored minimum 60% marks.

- Candidates who have passed the Intermediate level of Institute of Companies Secretaries of India or Institute of Cost Accountants of India.

Direct Entry Course details can be seen on the following link.

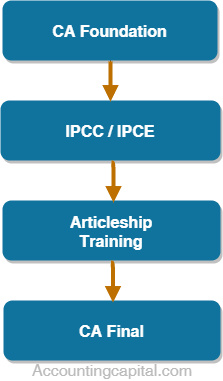

CA Foundation course route has a total of Four Major steps, this flow chart will help understand it better.

Direct entry course, on the other hand, reduces the first step and gives direct entry to the aspirants to the next level. Eligibility can be checked along with other criteria(s) for both the entry types at the following link.

Stage 1 – CA Foundation (Previously CPT)

CA – Foundation is the first stage of CA course. It comprises of four subjects. A candidate is required to secure at least 40% marks in each subject and a total of 50% in aggregate to clear this stage. CA Foundation syllabus, course papers, and all other related information can be accessed on this link.

This paper is divided into 4 parts-

- Paper 1: Principles and Practices of Accounting

- Paper 2: Mercantile Law and General English

- Paper 3: Business Mathematics, Logical Reasoning, and Statistics

- Paper 4: Business Economics & Business and Commercial Knowledge

Stage 2 – IPCC or IPCE

After the results for CA Foundation, the candidates get a period of 9 months to prepare for the next stage, which is the intermediate stage.

The next stage in the CA course is IPCC/IPCE (Integrated Professional Competence Course/Examination). A candidate reaches this stage after clearing CA – Foundation. IPCC is divided into two groups;

- Group – 1

- Group – 2

For clearing this stage a student needs to get a minimum of 40 marks in each stage and a total of 50% in aggregate in each group. Students need to appear in Intermediate Examination on completion of 8 months of study course as on the first day of the month in which the examination is to be held.

Stage 3 – Apprenticeship training

The next stage for candidates who have cleared both the groups of IPCC/IPCE and even any one of the groups is apprenticeship training of 3 years. Though, before that, one must go through the ITT and Orientation Program.

After the one can go ahead with the practice, it can be done under any practicing CA or a chartered accountancy firm.

A candidate is not eligible to appear in CA – Final exams if he/she has not completed the apprenticeship training of 3 years.

One always prefers to go with firms like Big 4 or various other big firms. The bottom line stays the same, which says the practice is the Key. It is very important to get the most possible exposure during this period, which helps one place better in a dream company later on. We have to trust that there is no substitute for learning.

Stage 4 – CA Final

The last stage of the CA course is CA – final examination. A candidate who has cleared both groups of IPCC/IPCE and who has completed the apprenticeship training is eligible to apply for CA – Final exams. This is the final stage of CA course.

CA – Final is divided into two groups and each group has four papers.

CA Final Group I

Paper 1: Financial Reporting (100 Marks)

Paper 2: Strategic Financial Management (100 Marks)

Paper 3: Advanced Auditing and Professional Ethics (100 Marks)

Paper 4: Corporate Laws and other Economic Laws (100 Marks)

CA Final Group II

Paper 5: Strategic Cost Management and Performance Evaluation (100 Marks)

Paper 6: Elective Paper (100 Marks)

For clearing CA – Final a student needs to get at least 40% marks in each paper and a minimum total of 50% in aggregate in each group to clear this stage. After successfully completing the CA Final exam, one can enroll as a member of the ICAI and be designated as “Chartered Accountant”. Which is just like the final step to dream come true.