What are adjustments in accounting? It all starts mainly with the accrual concept of accounting, which says that all incomes earned and expenses incurred during an accounting period should be recorded whether or not money has exchanged hands or not. This is the primary reason for the need for adjustments in final accounts.

Why are adjustments important in final accounts? If such adjustments in preparation of financial statements are missed then the numbers shown by the business in their final accounts will not be accurate and true. Journal entries are posted to reflect any necessary adjusting entries.

Table of Contents

List of Adjustments in Final Accounts

Adjustments in final accounts refer to changes made to certain financial entries at the end of an accounting period. These adjustments are crucial for presenting a true and fair view of a company’s financial status. In this article, we have covered the following list:

- Closing Stock

- Outstanding Expenses

- Prepaid or Unexpired Expenses

- Accrued or Outstanding Income

- Income Received In Advance or Unearned Income

- Depreciation

- Bad Debts

- Provision for Doubtful Debts

- Provision for Discount on Debtors

- Manager’s Commission

- Interest on Capital

- Goods Distributed among Staff Members for Staff Welfare

- Drawing of Goods for Personal Use

- Abnormal or Accidental Losses

Remember: Adjustments would appear outside the trial balance.

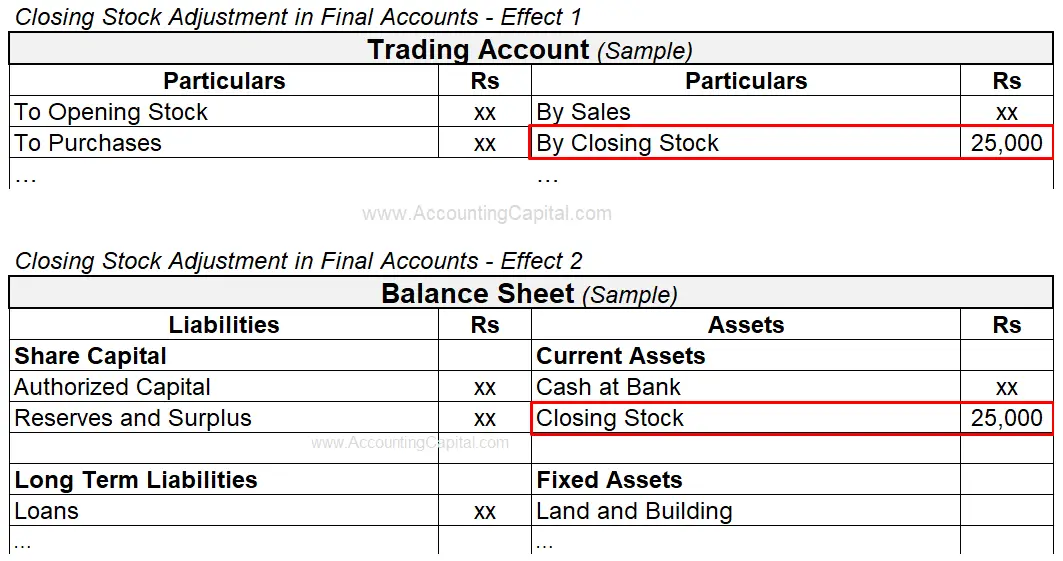

Adjustment of Closing Stock

Whatever stock of goods is remaining at the end of an accounting year is known as ‘closing stock’. This becomes the opening stock of the very next period. Oftentimes closing stock is not shown in the trial balance.

Journal Entry for Adjustment of Closing Stock in Final Accounts

| Closing Stock A/C | Debit |

| To Trading A/C | Credit |

(Recording ending inventory)

Closing stock is valued at cost or market value (aka net realizable value), whichever is less.

Treatment of Closing Stock Adjustment in Financial Statements

- Trading Account: Show on the credit side

- Profit & Loss Account: No effect

- Balance Sheet: Show on the assets side (usually under the head current assets)

Example

A company evaluates its closing stock at Rs 25,000, show the adjustment of closing stock in final accounts at the end of the year.

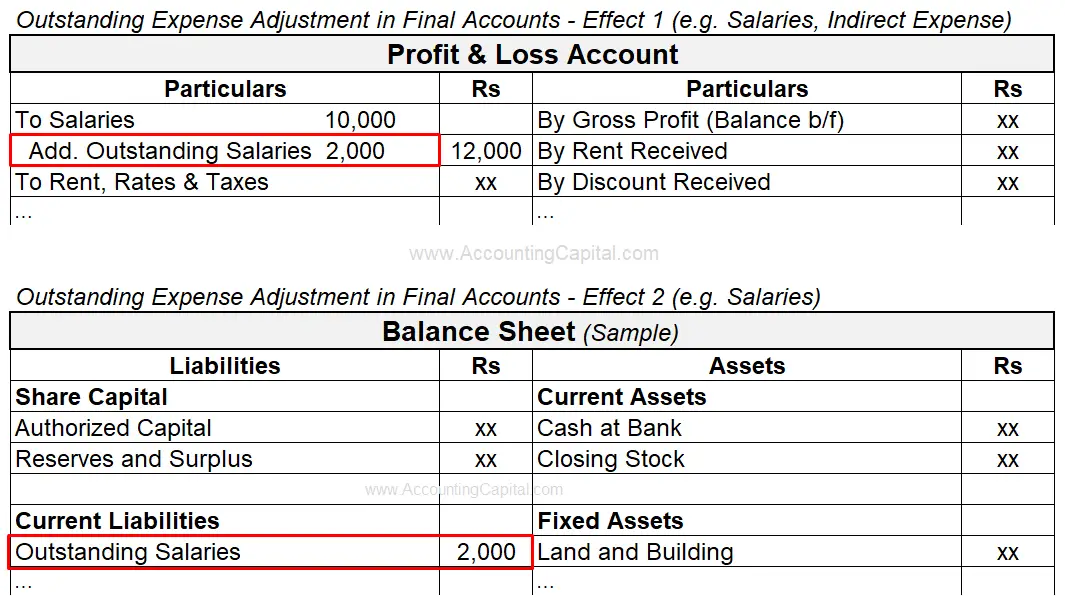

Adjustment of Outstanding Expenses

Expenses incurred but not paid yet are called outstanding expenses. In order to avoid overstating profits adjustments in final accounts are recorded. Examples: Outstanding Rent, Salary, Wages, Interest, etc.

Journal Entry for Adjustment of Outstanding Expenses in Final Accounts

| Expense A/C | Debit |

| Input CGST A/C | Debit |

| Input SGST A/C | Debit |

| To Outstanding Expense A/C | Credit |

(Recording unpaid expenses)

Treatment of Outstanding Expenses Adjustment in Financial Statements

- Trading Account: Show on the debit side (add to respective direct expense)

- Profit & Loss Account: Show the debit side (add to respective indirect expense)

- Balance Sheet: Show on the liability side (usually under the head current liabilities)

Example

Suppose a company paid Rs 10,000 in salaries during the year and evaluates outstanding salaries at Rs 2,000 at the end, showing the adjustment of outstanding expenses in final accounts.

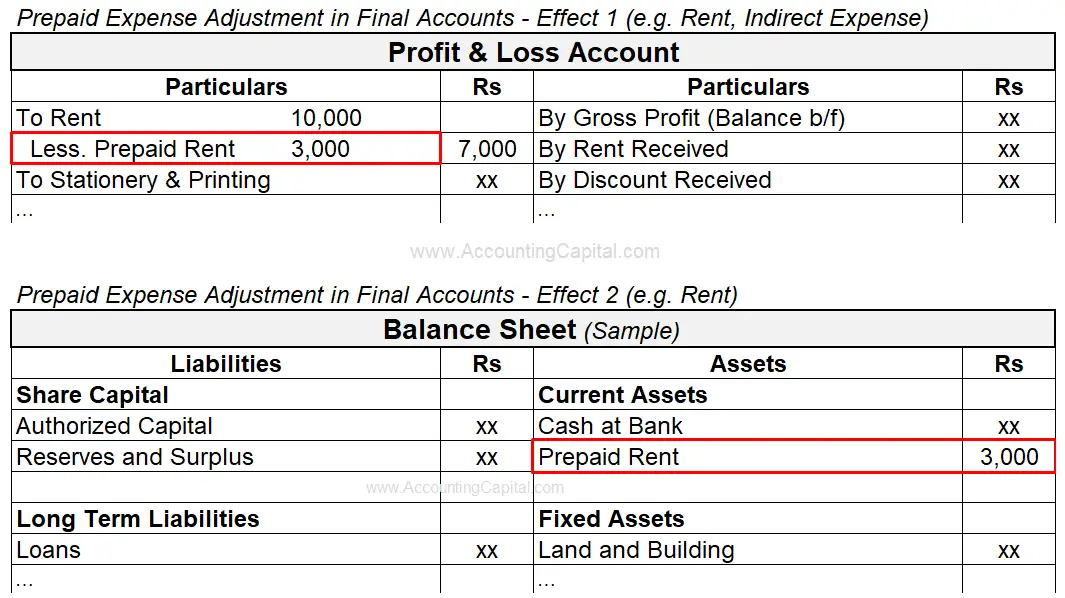

Adjustment of Prepaid Expenses or Unexpired Expenses

Such expenses are also called expenses paid in advance. Prepaid expenses are expenses that are paid in advance for a benefit that is not received yet.

In order to avoid understating profits, it is crucial to record them towards the end of an accounting year. Examples: Prepaid rent, prepaid interest, prepaid insurance, etc.

Journal Entry for Adjustment of Prepaid Expenses in Final Accounts

| Prepaid Expense A/C | Debit |

| To Expense A/C | Credit |

(Recording expenses paid in advance, GST paid is not transferred in Prepaid Expense A/C)

Treatment of Prepaid Expenses Adjustment in Financial Statements

- Trading Account: Show on the debit side (subtract from the respective direct expense)

- Profit & Loss Account: Show the debit side (subtract from the respective indirect expense)

- Balance Sheet: Show on the assets side (usually under the head current assets)

Example

A company paid Rs 10,000 in rent during the year and evaluates prepaid rent at Rs 3,000 at the end, show the adjustment of prepaid expense in final accounts.

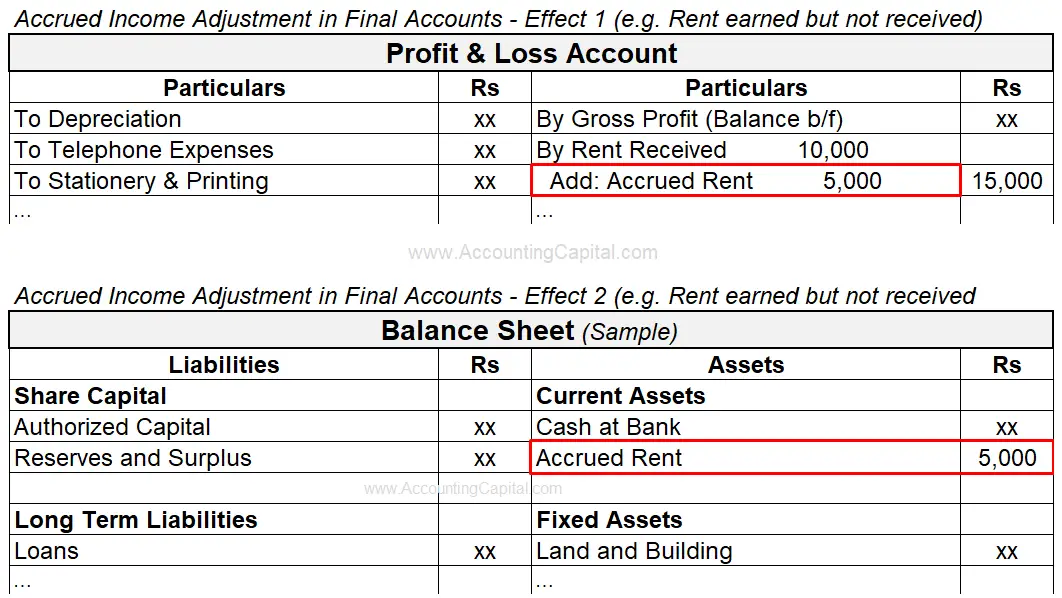

Adjustment of Accrued Income or Outstanding Income

Such expenses are also called income earned but not yet received. Accrued income is the income that the business has already earned, however, it has not been received yet. Examples: accrued rent, commission due but not received, etc.

Journal Entry for Adjustment of Accrued Income in Final Accounts

| Accrued Income A/C | Debit |

| To Income A/C | Credit |

| To Output CGST A/C | Credit |

| To Output SGST A/C | Credit |

| To Output IGST A/C | Credit |

(Recording income earned but not received)

Treatment of Accrued Income Adjustment in Financial Statements

- Trading Account: No effect

- Profit & Loss Account: Show on the credit side (Add to respective income)

- Balance Sheet: Show on the assets side (usually under the head current assets)

Example

A firm received Rs 10,000 in rent during the year and estimates rent due but not received at Rs 5,000 at the period close, show the adjustment of accrued income in final accounts.

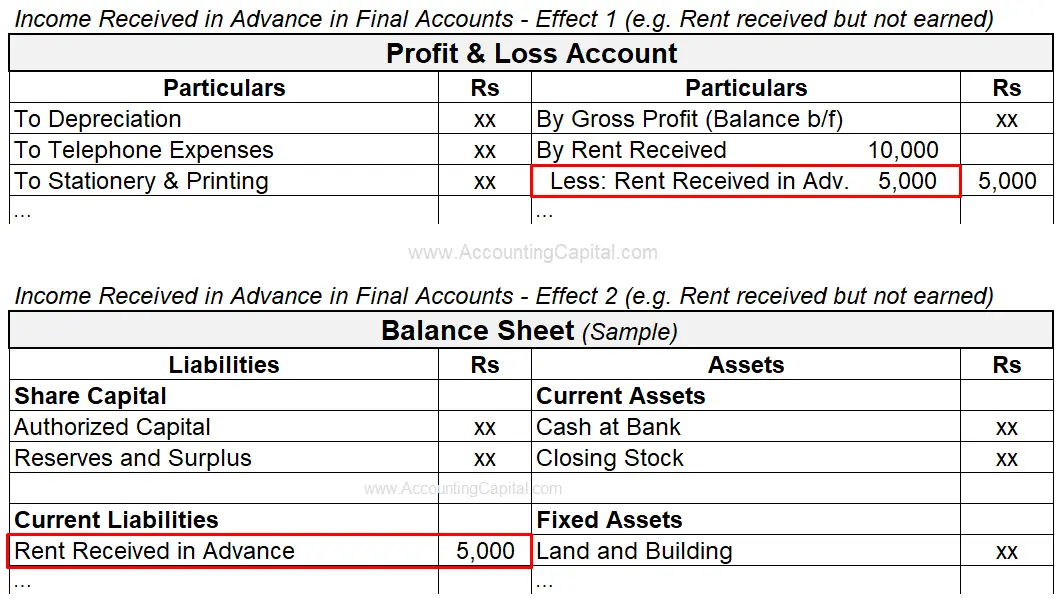

Adjustment of Income Received in Advance

It is also called unearned income. Income received in advance is the income that the business has already received, however, it has not been earned yet. Examples: Rent received in advance, Commission received in advance, etc.

Journal Entry for Adjustment of Income Received in Advance in Final Accounts

| Income A/C | Debit |

| To Income Received in Advance A/C | Credit |

| To Output CGST A/C | Credit |

| To Output SGST A/C | Credit |

(Recording income received but not earned)

Treatment of Income Received in Advance in Financial Statements

- Trading Account: No effect

- Profit & Loss Account: Show on the credit side (Subtract from the respective income)

- Balance Sheet: Show on the liability side (usually under the head current liabilities)

Example

A firm received Rs 10,000 in rent during the year and estimates rent received but not due Rs 6,000 at the period close, show the adjustment of income received in advance in final accounts.

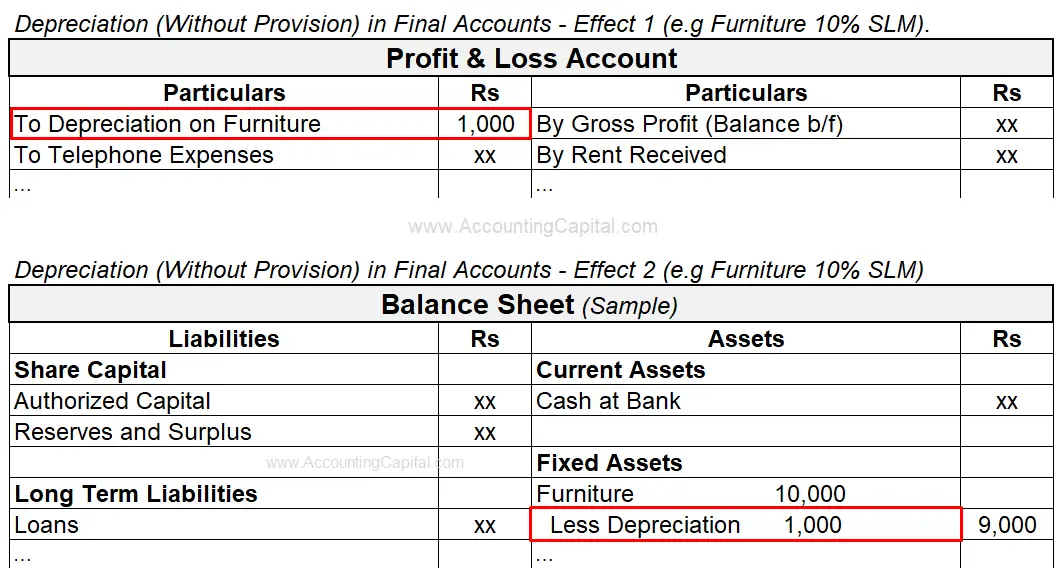

Adjustment of Depreciation

It is a non-cash expense i.e. it is not paid in form of cash or a cash equivalent. Depreciation is the allocation of the cost of a fixed asset over its estimated useful life. Since fixed assets are utilized to earn revenue, a decrease in their value is treated as an expense incurred to earn the said revenue.

When Provision for Depreciation is Not Maintained

Journal Entry When Provision is Not Maintained

| Depreciation A/C | Debit |

| To Asset A/C | Credit |

(Charging depreciation on fixed asset)

| Profit and Loss A/C | Debit |

| To Depreciation A/C | Credit |

(Depreciation charged transferred to Profit & Loss A/C)

Treatment of Depreciation in Financial Statements (No Provision)

- Trading Account: No effect

- Profit & Loss Account: Show on the debit side (calculate as per % & method given)

- Balance Sheet: Show on the asset side (subtract depreciation from the fixed asset)

Example

The trial balance of a business shows furniture at Rs 10,000.

Additional Information: Depreciation of 10% p.a. is charged using the straight-line method. Show the adjustment of depreciation in final accounts when provision for depreciation not maintained.

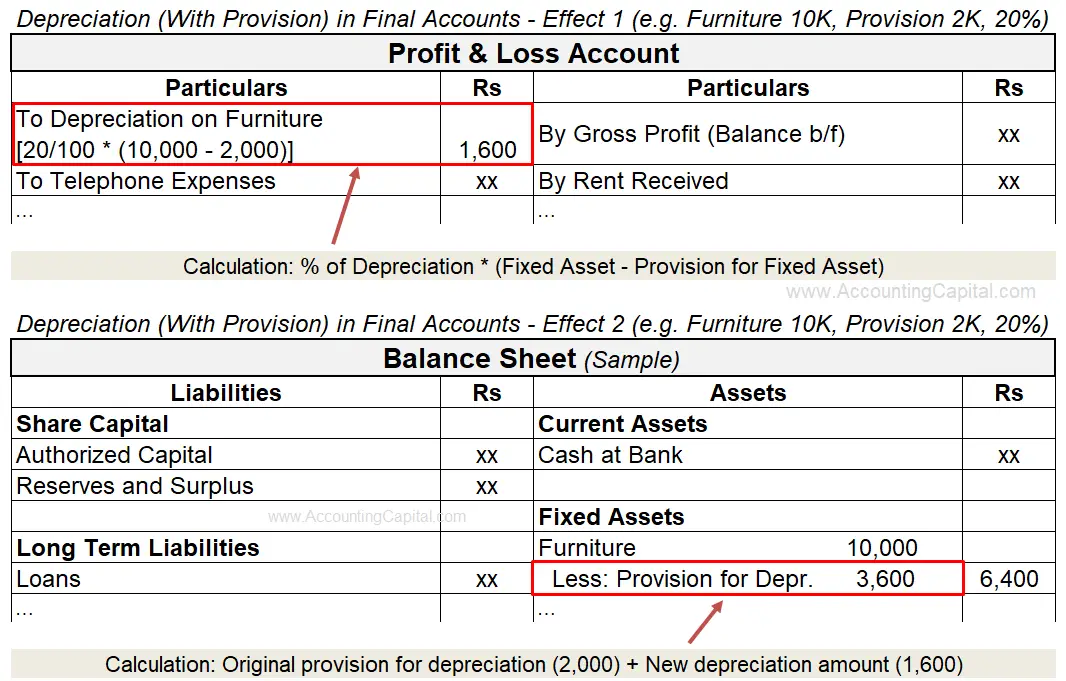

When Provision for Depreciation is Maintained

Journal Entry When Provision is Maintained

| Depreciation A/C | Debit |

| To Provision for Depreciation A/C | Credit |

(Being provision for depreciation made)

Step 2

| Profit and Loss A/C | Debit |

| To Depreciation A/C | Credit |

(Depreciation charged transferred to Profit & Loss A/C)

Treatment of Depreciation in Financial Statements (Provision for Depreciation is Maintained)

- Trading Account: No effect

- Profit & Loss Account: Show on the debit side (calculate as below)

- Calculation: % of Depreciation * (Fixed Asset – Provision for Fixed Asset)

- Balance Sheet: Show on the asset side (subtract total accumulated depreciation from the fixed asset)

New accumulated depreciation = Original provision for depreciation + new depreciation amount

Note – Provision for depreciation is the same as accumulated depreciation and the terms may be used synonymously.

Example

The trial balance of a business shows furniture at Rs 10,000 and provision for depreciation on furniture at 2,000.

Additional Information: Depreciation of 20% p.a. is charged using the straight-line method. Show the adjustment of depreciation in final accounts when provision for depreciation is maintained.

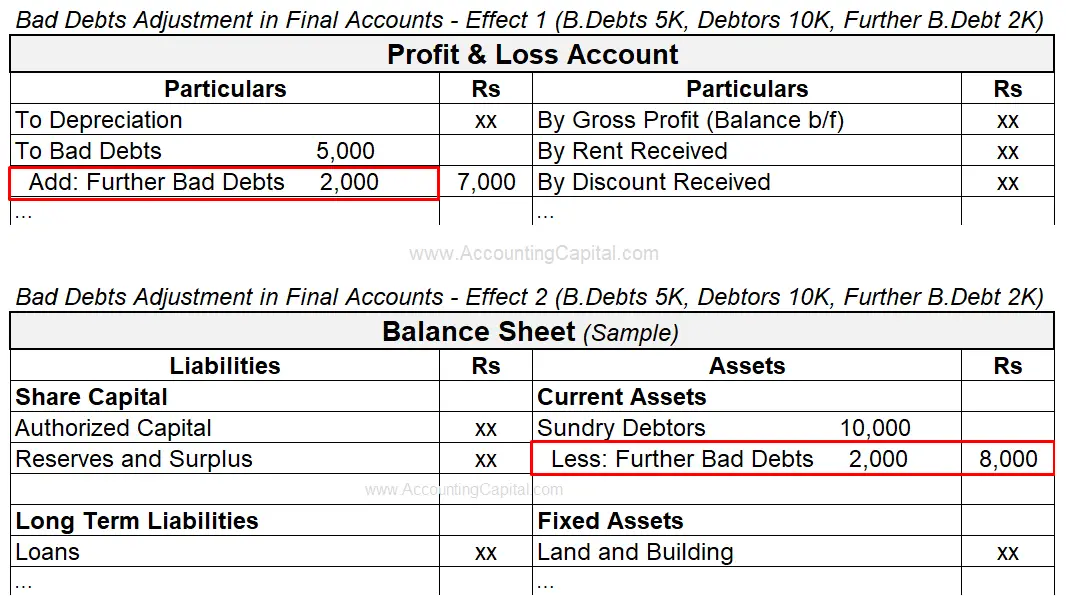

Adjustment of Bad Debts

Not all the debtors of a business may be able to pay 100% of their debts at all the time. This may lead to a loss to the receiving business and is termed as bad debts.

Journal Entry for Adjustment of Bad Debts in Final Accounts

| Bad Debts A/C | Debit |

| To Debtor’s A/C | Credit |

(Recording bad debts)

Step 2

| Profit and Loss A/C | Debit |

| To Bad Debts A/C | Credit |

(Bad debts transferred to Profit & Loss A/C)

Treatment of Bad Debts in Financial Statements

Situation 1 – When bad debts are given inside the trial balance – No Adjustment, only show in P&L

Situation 2 – When bad debts are given outside the trial balance as an adjustment – They are called further bad debts and adjustments in final accounts are posted.

- Trading Account: No effect

- Profit & Loss Account: Show on the debit side (add to bad debts already written off)

- Balance Sheet: Show on the asset side (subtract from sundry debtors)

Journal Entry for Adjustment of Further Bad Debts in Final Accounts

| Bad Debts A/C | Debit |

| To Debtor’s A/C | Credit |

(Recording further bad debts)

Example

The trial balance of a business shows bad debts at Rs 5,000 & debtors at 10,000.

Additional Information: Written off 2,000 as further bad debts. Show the adjustment of further bad debts in final accounts

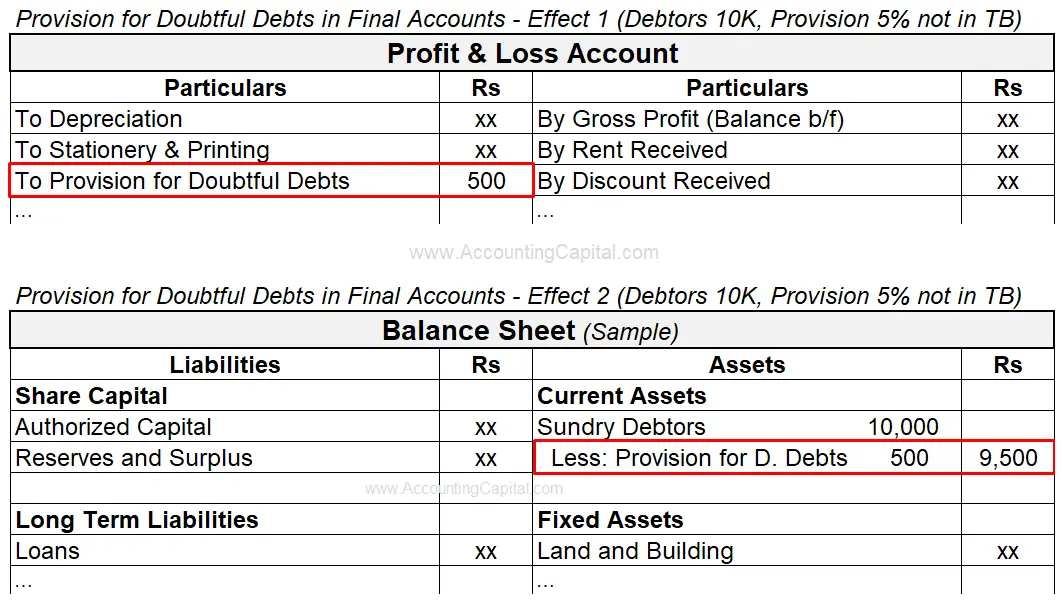

Adjustment of Provision for Doubtful Debts

The accounting concept of prudence and conservatism cautions that each business should be ready to absorb all anticipated losses. Due to this, all businesses provide for possible bad debts arising due to non-payment by creditors in form of provision for doubtful debts.

When Provision for Doubtful Debts does not Appear in Trial Balance

Journal Entry for Adjustment of Provision for Doubtful Debts in Final Accounts

| Profit and Loss A/C | Debit |

| To Provision for Doubtful Debts A/C | Credit |

(Recording provision for doubtful debts)

Treatment of Provision for Doubtful Debts in Financial Statements

- Trading Account: No effect

- Profit & Loss Account: Show on the debit side (calculate as % on Debtors)

- Balance Sheet: Show on the asset side (subtract from sundry debtors)

Note: Provisions do not reduce the amount due from debtors.

Example

The trial balance of a business shows sundry debtors at Rs 10,000.

Additional Information: Create a provision for 5% on Debtors. Show the adjustment of provision for doubtful debts in final accounts.

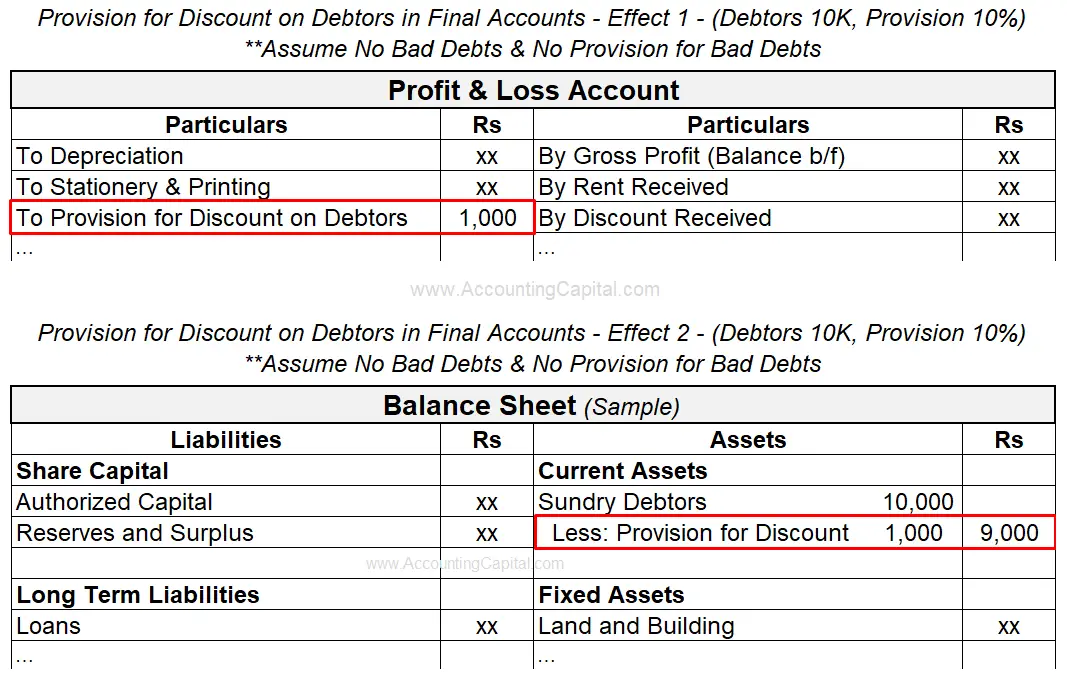

Adjustment of Provision for Discount on Debtors

A cash discount is provided to debtors as an encouragement for early payments. In some cases the payment may be received in the next accounting year this means that as per the accrual concept of accounting such discounts should be treated as an expense in the current year. When such a provision is created it is called a provision for discount on debtors.

Journal Entry for Adjustment of Provision for Discount on Debtors in Final Accounts

| Profit and Loss A/C | Debit |

| To Provision for Discount on Debtors A/C | Credit |

(Recording provision for discount on debtors)

Treatment of Provision for Discount on Debtors in Financial Statements

- Trading Account: No effect

- Profit & Loss Account: Show on the debit side (calculate on good debtors i.e. after adjusting bad debts & provision for doubtful debts)

- Balance Sheet: Show on the asset side (subtract from sundry debtors)

Example

The trial balance of a business shows sundry debtors at Rs 10,000.

Additional Information: Assume nil bad debts and provision for bad debts. Create a provision for a discount of 10% on debtors. Show the adjustment of provision for discount on debtors in final accounts.

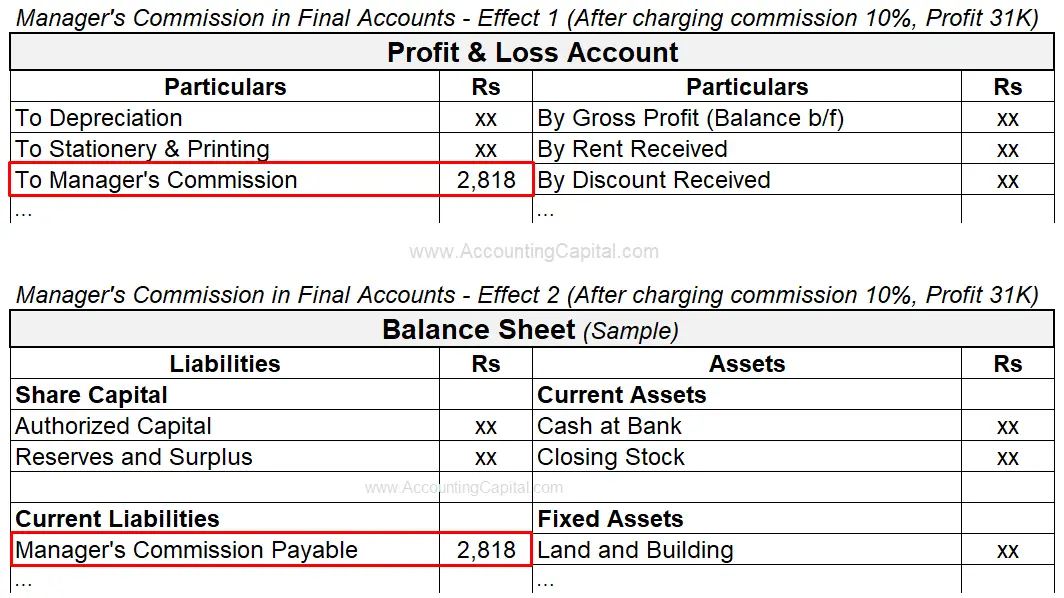

Adjustment of Manager’s Commission

A business may decide to share a fixed percentage of profits with the managers in the form of a commission. It is called a manager’s commission and it may be calculated on profits before or after charging such commission.

Manager’s Commission Payable Before Charging the Commission

In this situation, the calculation is simply done by multiplying the rate of commission with the amount of net profit earned by the business.

Formula to calculate:

Journal Entry for Adjustment of Manager’s Commission in Final Accounts

| Profit and Loss A/C | Debit |

| To Manager’s Commission Payable | Credit |

(Recording outstanding commission payable to managers)

Treatment of Manager’s Commission in Financial Statements

- Trading Account: No effect

- Profit & Loss Account: Show on the debit side as an expense

- Balance Sheet: Show on the liability side (usually under the head current liabilities)

Manager’s Commission Payable After Charging the Commission

In this situation, the calculation is done on the net profit remaining after such a commission is charged.

Formula to calculate:

Treatment in the final account remains the same in both cases.

Example

Net profit shown in the income statement is Rs 31,000.

Additional Information: The manager is entitled to a commission of 10% after charging such a commission. Show adjustment of the manager’s commission in final accounts.

Working Note

Net Profit = Rs 31,000

Formula (shown above) = (Manager’s Commission Rate % / 100 + Manager’s Commission Rate) * Net Profit

(10% / 100 + 10%) * 31,000 = 2,818 Rs

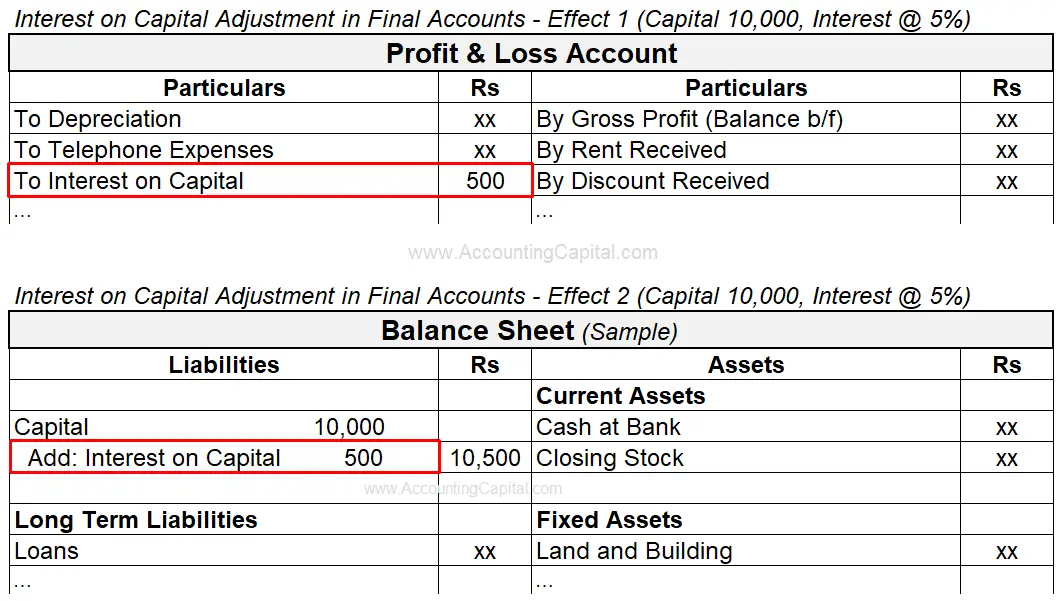

Adjustment of Interest on Capital

When the owner of a business invests money in a business it is termed as capital. It is a common practice for the business to pay some form of (pre-decided) interest on capital. Such an interest paid is treated as an expense and is charged before determining the net profit or net loss of a business.

Journal Entry for Adjustment of Interest on Capital in Final Accounts

| Interest on Capital A/C | Debit |

| To Capital A/C | Credit |

(Recording interest on capital)

Step 2

| Profit and Loss A/C | Debit |

| To Interest on Capital A/C | Credit |

(Interest charged on capital transferred to Profit & Loss A/C)

Treatment of Interest on Capital Adjustment in Financial Statements

- Trading Account: No effect

- Profit & Loss Account: Show the debit side

- Balance Sheet: Show on the liability side (Add to owner’s capital)

Note: If interest on capital is given in the trial balance then it will be shown only in the Profit and Loss account as the credit entry has already been passed.

Example

Capital is Rs 10,000 for the business.

Additional Information: The owner is entitled to 5% interest on capital. Show adjustment of interest on capital in final accounts.

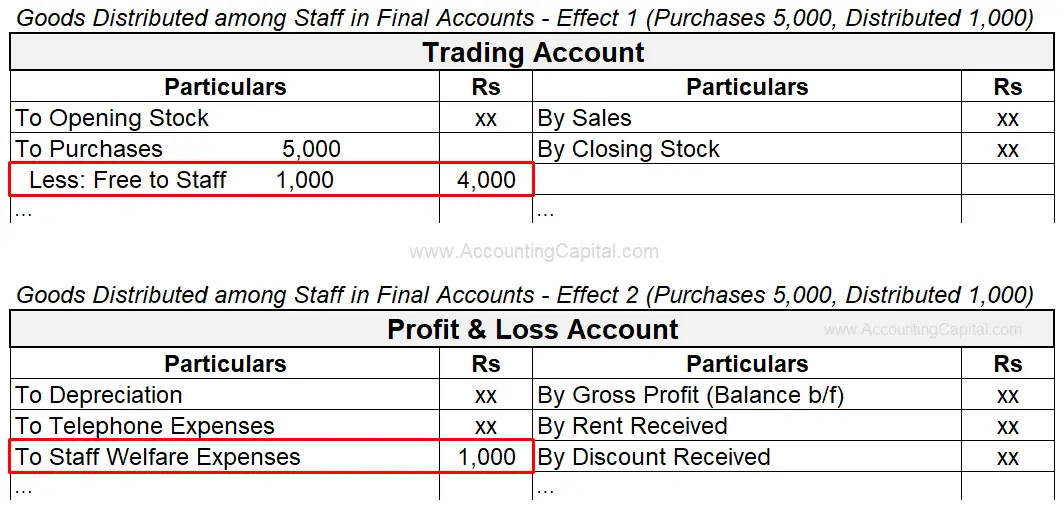

Adjustment of Goods Distributed among Staff Members for Staff Welfare

Employees may receive goods as a part of staff welfare, this transaction should be adjusted in monetary terms to determine the accurate net profit or net loss to the business. Adjustments in final accounts are passed to record this expense, usually against purchases.

Journal Entry for Goods Distributed among Staff Members for Staff Welfare in Final Accounts

| Staff Welfare Expense A/C | Debit |

| To Purchases A/C | Credit |

| To Input CGST A/C | Credit |

| To Input SGST A/C | Credit |

(Recording staff welfare expenses for goods distributed)

Note: GST (CGST, SGST, IGST, etc. is reversed as tax paid on these goods can not be setoff against tax collected)

Treatment of Goods Distributed among Staff Members for Staff Welfare in Financial Statements

- Trading Account: Debit Side (Subtract from purchases) or Show on Credit Side

- Profit & Loss Account: Debit side (Shown as ‘Staff Welfare Expense’)

- Balance Sheet: Show on the liability side (Add to owner’s capital)

Example

Net purchases are Rs 5,000 for the business.

Additional Information: The company distributed goods among staff members for staff welfare worth Rs 1,000. Show the adjustment of goods distributed among staff members for staff welfare in final accounts.

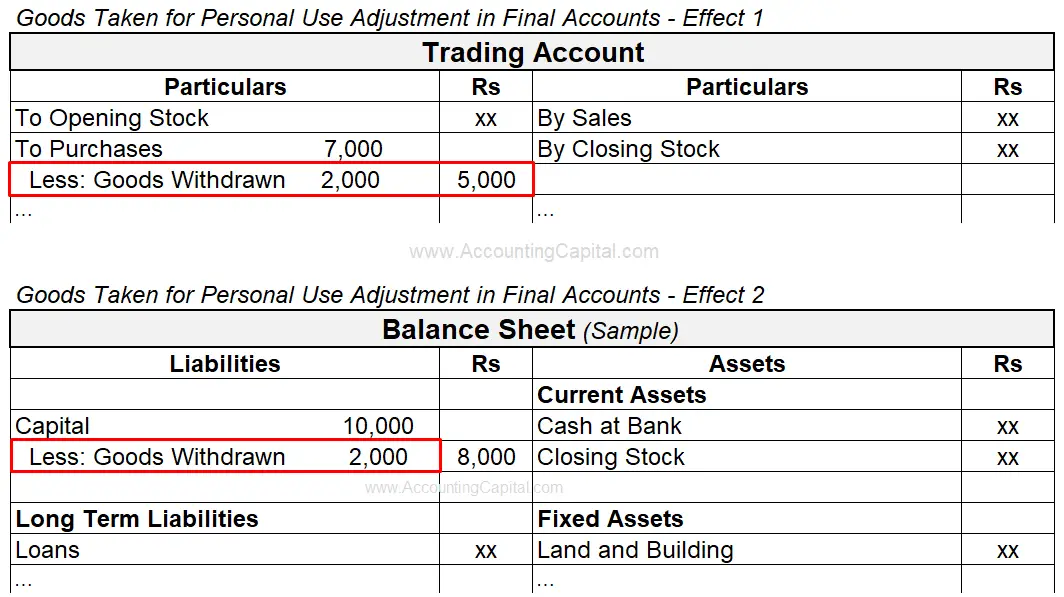

Adjustment of Drawings of Goods for Personal Use

The owner of a business may choose to withdraw cash or goods from their own business this is not an uncommon practice. It is called drawings and it reduces the total purchases of a company.

GST is reversed on these goods as tax paid on them cannot be set off against tax collected. The entry is made at the cost price because no profit is earned.

Journal Entry for Drawings of Goods for Personal Use in Final Accounts

| Drawings A/C | Debit |

| To Purchases A/C | Credit |

| To Input CGST A/C | Credit |

| To Input SGST A/C | Credit |

(Recording drawings in form of goods for personal use)

Treatment of Goods Taken for Personal Use in Financial Statements

- Trading Account: Debit Side (Subtract from purchases)

- Profit & Loss Account: No effect

- Balance Sheet: Show on the liability side (Subtract from owner’s capital)

Example

Net purchases are Rs 7,000 for the business and Capital is Rs 10,000.

Additional Information: The owner took goods from the business for personal use worth Rs 2,000. Show the adjustment of drawings of goods for personal use in final accounts.

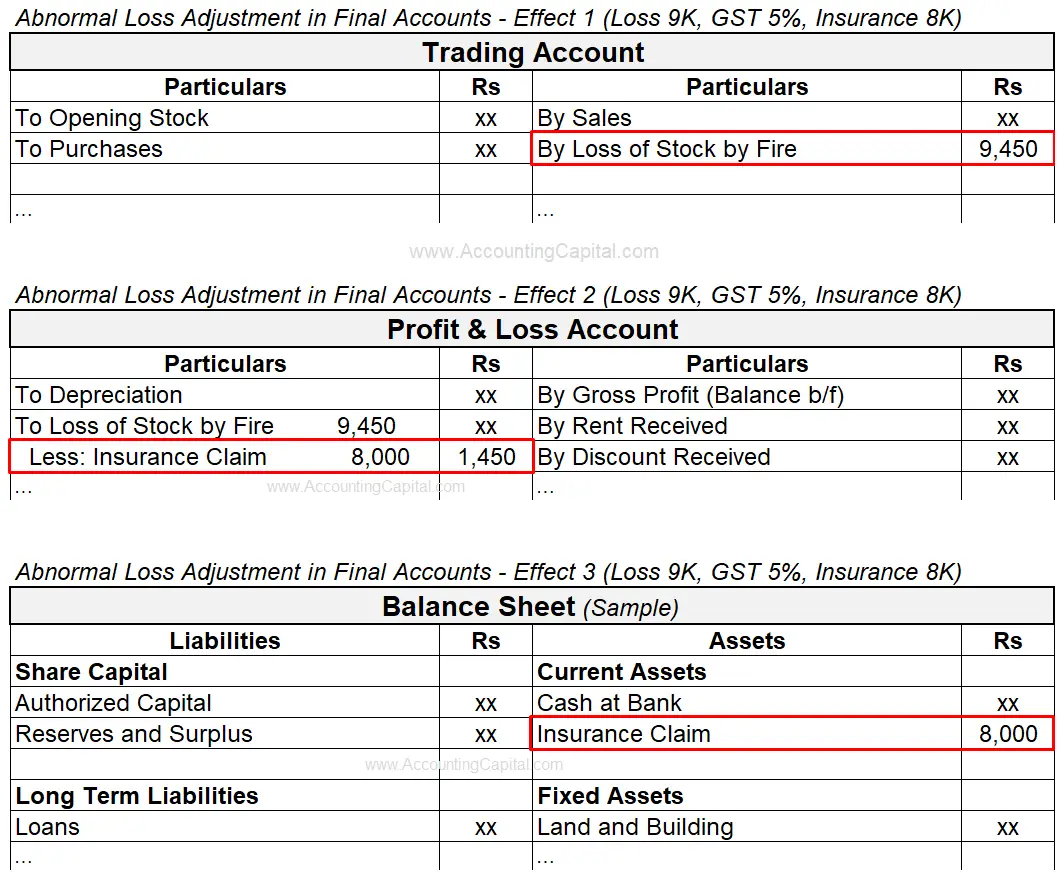

Adjustment of Abnormal or Accidental Loss

Accidental losses or abnormal losses are incurred when a business suffers any type of loss due to a fire, an accident, an earthquake, or some other natural calamity.

The loss is booked in the profit and loss account and the asset account is credited. The stock of goods may be destroyed which leads to a decrease in gross and net profit of the firm. GST is reversed on these goods as tax paid on them cannot be set off against tax collected.

If Goods are Not Insured

Journal Entry for Abnormal or Accidental Loss in Final Accounts (Goods Not Insured)

| Profit and Loss A/C | Debit |

| To Trading A/C | Credit |

| To Input CGST A/C | Credit |

| To Input SGST A/C | Credit |

(Recording total value of abnormal loss)

Treatment of Abnormal or Accidental Loss in Financial Statements (Goods Not Insured)

- Trading Account: Show on the credit side (with the cost of goods destroyed)

- Profit & Loss Account: Show on the debit side (with the cost of goods destroyed)

- Balance Sheet: No effect

If Goods are Insured

Journal Entry for Abnormal or Accidental Loss in Final Accounts (Goods Insured)

| Accidental Loss A/C | Debit |

| To Trading A/C | Credit |

| To Input CGST A/C | Credit |

| To Input SGST A/C | Credit |

(Recording total value of abnormal loss)

Step 2

| 1 | Insurance Claim A/C | Debit |

| 2 | Profit and Loss A/C | Debit |

| 3 | To Accidental Loss A/C | Credit |

(Adjusting the insurance claim received)

- Amount of insurance claim

- Amount of irrecoverable loss

- Total abnormal loss

Treatment of Abnormal or Accidental Loss in Financial Statements (Goods Insured)

- Trading Account: Show on the credit side (with the cost of goods destroyed)

- Profit & Loss Account: Show on the debit side (with the cost of goods destroyed)

- Balance Sheet: No effect

Example

Due to a fire in the storehouse, a business lost goods costing Rs 9,000 which were purchased at 5% GST. As the goods were insured the insurance company paid Rs 8000 lump sum to settle the claim. Show the adjustment of abnormal or accidental loss in final accounts.

>Read Journal Entry for Amortization