Journal Entry for Rent Received

If a business owns a property that is not being used then it may decide to rent it out and collect periodical payments as rent. Such a receipt is often treated as an indirect income and recorded in the books with a journal entry for rent received. This adds an extra source of income for the firm. The other party may post a journal entry for rent paid in their books.

Rental income received from the tenant is,

- Recurring in nature

- Pre-decided amount

- Received every month

- Likely shown as “rent received” in the financial statements.

Landlord – The legal owner of the property is called ‘landlord’.

Tenant – The party who rents the property and pays rent to the landlord is called ‘tenant’.

Journal entry for rent received (in cash/cheque)

Accounting rules applied – Modern Rules

| Cash/Bank Account | Debit | Debit the increase in asset |

| To Rent Account | Credit | Credit the increase in income |

Accounting rules applied – Three Golden Rules

| Cash/Bank Account | Debit | Debit what comes in – Real A/c |

| To Rent Account | Credit | Credit all incomes – Nominal A/c |

Accounting Treatment for Rent Received

Payment of rent received (in cash/cheque) is treated with a couple of steps as shown below;

Step 1 – Journal entry for rent received (in cash/cheque)

| Cash/Bank A/c | Debit |

| To Rent A/c | Credit |

Step 2 – Transferring receipt of rental income to the income statement (profit and loss account).

| Rent A/c | Debit |

| To Income Statement | Credit |

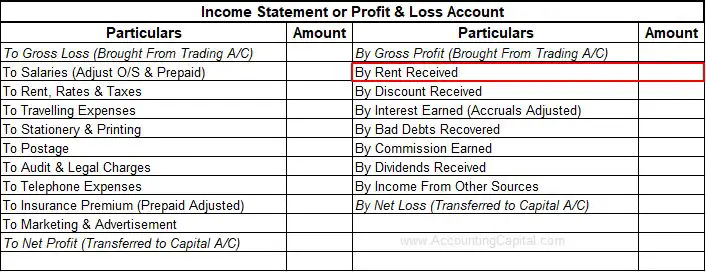

Presentation in the Financial Statements

It is shown on the credit side of an income statement (profit and loss account).

Example of Receipt of Rent

On the 10th of March, Unreal Corporation received rent 20,000 via a cheque from tenant ABC for one of its property on rent. The receipt relates to the same month. Show related journal entries for office rent received in the books of Unreal Corporation.

March 10 – Journal entry at the time of rent received

| Bank A/c | 20,000 |

| To Rent Received from ABC A/c | 20,000 |

March 31 – When the business books Closing entries

| Rent Received from ABC A/c | 20,000 |

| To Income Statement | 20,000 |

Journal Entry for Rent received in Advance

Rent received in advance is the amount of rent received before it was actually due, however, the related benefits equivalent to the advance received are yet to be provided to the tenant. Such an intake of money belongs to the future accounting period.

It is displayed as a “current liability“ in the balance sheet, as it is income received but not earned.

Journal Entry

| Rent A/c | Debit | Debit the decrease in income |

| To Rent Received in Advance A/c | Credit | Credit the increase in liability |

(Being rent received in advance/ pre-received rent adjusted at the end of the period)

Example – On 20th December ABC Ltd received office rent from its tenant in cash 75,000 (25,000 x 3) for the next 3 months ie. Jan, Feb & Mar. The accounting period followed by ABC Ltd is from January to December. Show journal entries to be passed in the books of ABC Ltd.

December 20 – Journal entry at the time of rent received

| Cash A/c | 75,000 |

| To Rent A/c | 75,000 |

December 31 – Journal entry for adjustment of the rent received in advance at the end of the current accounting period

| Rent A/c | 75,000 |

| To Rent Received in Advance A/c | 75,000 |

January 1, February 1 & March 1 – Rent income allocated to each of the 3 months

| Rent Received in Advance A/c | 25,000 |

| To Rent A/c | 25,000 |

Related Topic – Income Received in Advance

Journal Entry for Rent received with TDS & GST

Entities paying GST have to charge GST on the rental services provided by them to the tenants. Also, tenants who have rented the property or office premises have to deduct TDS on the rent amount payable to the landlord.

GST and TDS will be considered taking into account the local tax requirements.

Journal Entry

| Bank A/c | Debit | Debit the increase in asset |

| TDS Asset A/c | Debit | Debit the increase in asset |

| To Rent A/c | Credit | Credit the increase in income |

| To GST Liability A/c | Credit | Credit the increase in liability |

(Being rent received taking into consideration TDS & GST)

- GST charged is a liability for the entity because it has to be collected from the tenant and deposited with the Government.

- TDS deducted by the tenant is an asset for the entity ie. the landlord. This is because the tenant will deposit the TDS with the government and then it may be claimed as a tax credit by the landlord.

Example – XYZ Ltd charges monthly office rent of 100,000 from its tenant. It also charges GST e.g. 18% on 100,000. On the 10th of every month, the tenant deducts TDS say 10% on the rent amount i.e. 100,000 at the time of payment of rent to XYZ Ltd.

Show journal entries in the books of XYZ Ltd for rent received considering TDS & GST implications.

10th of every month – Journal entry at the time of receipt with TDS & GST

| Cash/Bank A/c | 1,08,000 |

| TDS Asset A/c | 10,000 |

| To Rent A/c | 100,000 |

| To GST Liability A/c | 18,000 |

Short Quiz for Self-Evaluation

>Read What is Authorized Capital