Table of Contents

Introduction

Generally, a business makes and receives payments through a bank account. It provides various services such as cheques, overdrafts, current accounts, loans, transfers, etc. These services are crucial to perform day-to-day business activities.

Banks charge a fee for some of the services provided by them. It may also impose a penalty in cases of a cheque bounce, not maintaining a minimum balance, exceeding the overdraft limit, etc. Each bank has different policies for bank charges. Such types of fees and penalties are included in bank charges. It is a source of income for the banks.

Bank charges are generally deducted directly from the business’ bank account. These charges are an expense for the business and reduce the overall profit. They are recorded periodically in the books of accounts.

Journal Entry

The Journal Entry for Bank charges is;

| Bank Charges A/c | Debit |

| To Bank A/c | Credit |

(Being bank charges debited from the current account)

| Bank Charges | Expense Account | Debit the increase in expenses |

| Bank Account | Asset Account | Credit the decrease in assets |

| Bank Charges | Nominal Account | Debit all expenses and loses |

| Bank Account | Personal Account | Credit the giver |

Related Topic – Journal Entry for Money Received from Debtor

Example of the Accounting Entry

The journal entry for bank charges paid can be understood better with the example given below;

John Ltd. paid 600 as annual account maintenance fees to HSBC Bank (auto-deducted by the bank on a certain day every year). Pass the necessary bank charges paid accounting entry.

| Bank Charges A/c | 600 |

| To HSBC Bank A/c | 600 |

(Being annual maintenance charges paid to HSBC Bank)

- The first aspect of the entry is that the “Bank Charges” account is debited. Bank charges are an expense for the business. An increase in expense is debited. Hence, the bank charges account is debited.

- The second aspect of the entry is that the “HSBC Bank” account is credited. The bank is an asset for the business. When Bank charges are paid, the bank balance is reduced. A decrease in the assets is credited. Therefore, the HSBC Bank account is credited.

Related Topic – Closing Stock Adjustment Entry

Impact on the Financial Statements

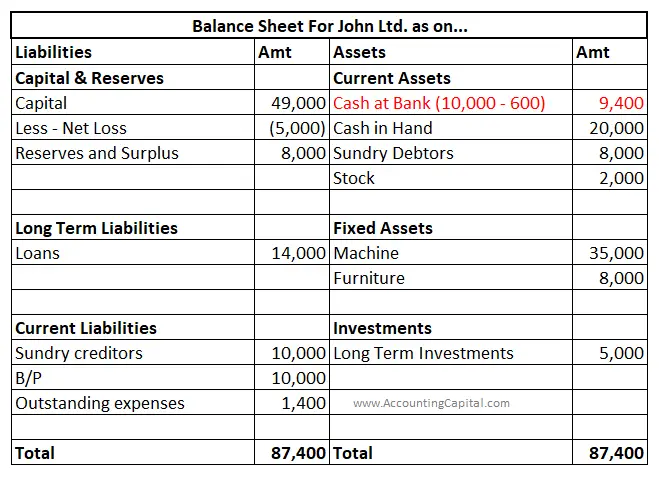

In the Balance Sheet, the reduced bank balance may be shown under the current assets subhead of the Assets side. Bank charges are not shown in the balance sheet (also called the statement of financial position) as it is neither an asset nor a liability of the business.

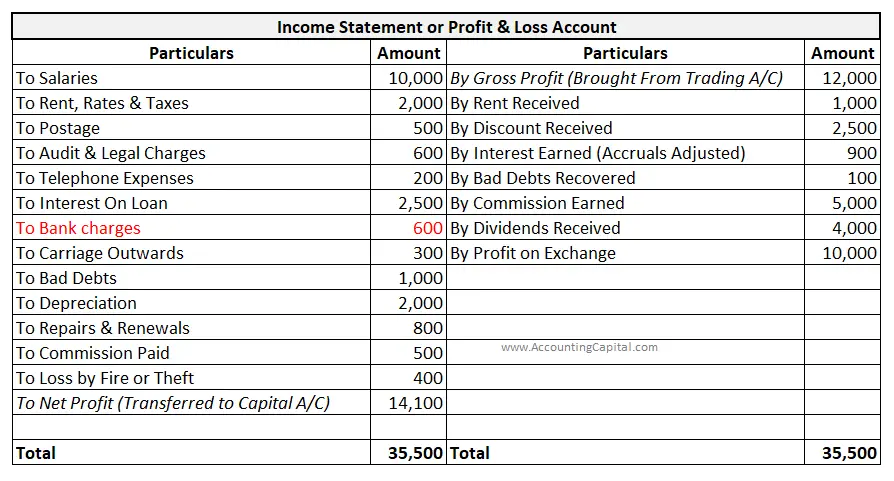

Bank charges are shown in the income statement for the current period.

In the Income Statement or Profit and Loss Account of the business, the bank charges would be debited as it is an expense and it reduces the profit.

This journal entry would have no impact on the Trading Account of the business.

In the Cash Flow Statement, bank charges would be recorded as an operating activity. The bank balance is included in cash equivalents.

Correctly noting these bank charges isn’t just about following rules; it’s also about being precise & clear about a firm’s money.

Related Topic – Where is Prepaid Expense Shown in Trial Balance?

Conclusion

From the above discussion, it can be understood that:

- Banks charge a certain amount as a fee for some of the services provided by it. It may also impose a penalty on certain transactions. These charges are known as Bank charges.

- These charges are an expense for the business.

- They are recorded periodically in the books of accounts.

- Bank charges are generally deducted directly from the bank.

- In the Journal entry for bank charges paid, the “Bank Charges A/c” is debited and the “Bank A/c” is credited.

- In the Income Statement or Profit and Loss Account of the business, the bank charges would be debited as it is an expense and it reduces the profit.

- In the Cash Flow Statement, there would be an outflow of cash at the bank under the operating activity.

- A bank reconciliation statement is made by a firm to ensure that the bank balance at the end of an accounting period matches the books of accounts.

>Read Sold Goods for Cash Journal Entry