Journal Entry for Carriage Inwards

Carriage inwards is the freight and carrying cost incurred by a business while acquiring a new product. Journal entry for carriage inwards depends on the item and the intent behind its usage.

The product may or may not be for resale, the word “Inwards” shows that the cost is incurred while the goods are being brought into the business.

Case I – Journal Entry When Purchasing Inventory

In this case, carriage inwards is treated as a direct operating expense as the intent is to use the product for operations. It is shown on the debit side of trading account.

| Purchase Account | Debit |

| Carriage Inwards | Debit |

| To Bank Account | Credit |

(Journal entry for carriage inwards paid while purchasing inventory)

| Trading Account | Debit |

| To Carriage Inwards | Credit |

(Transferring carriage inwards to Trading account, it may be added to the cost of goods sold)

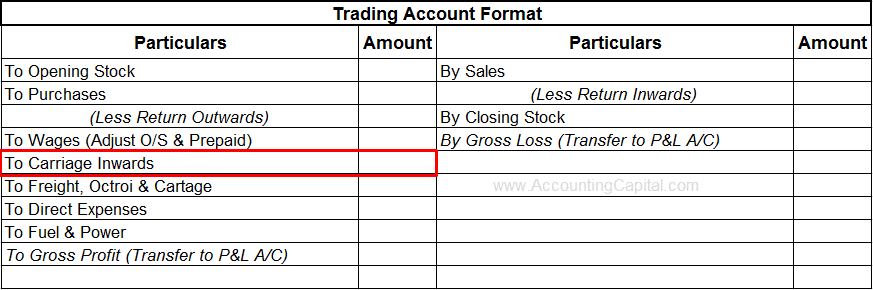

Carriage Inwards Shown in Trading Account

Case II – Journal Entry When Purchasing a Fixed Asset

Carriage inwards is treated as a capital expense when incurred while purchasing fixed assets for self-use.

In this case, carriage inwards is added to the cost of the asset and not journalized separately.

| Fixed Assets | Debit |

| To Bank Account | Credit |

(The amount debited and credited will include the amount paid for carriage inwards)

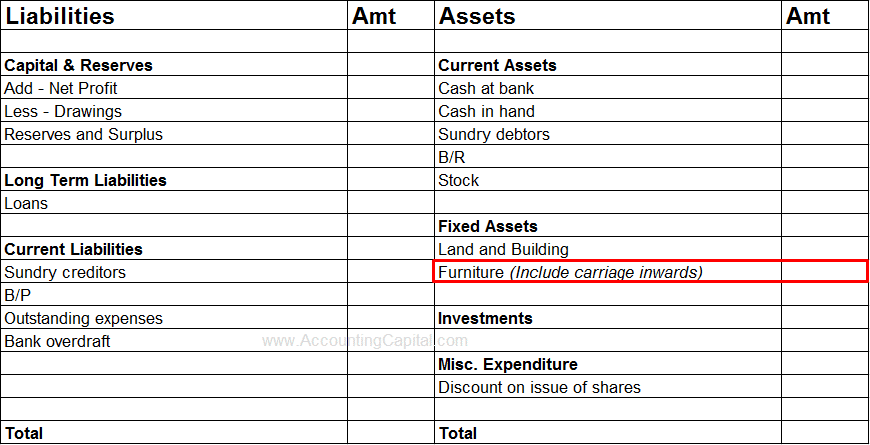

Carriage Inwards Included in the Cost of Fixed Asset

Short Quiz for Self-Evaluation

>Read Carriage Inwards and Carriage Outwards