- Overview

- Depreciation Journal Entry

- Example & Steps

- Journal Entry for Depreciation on Furniture

- Journal Entry for Depreciation on Machinery

- Journal Entry for Depreciation on Equipment

- Journal Entry for Depreciation on Building

- Journal Entry for Depreciation on Land

- Quiz

Overview

A reduction in the value of tangible fixed assets due to normal usage, wear and tear, new technology or unfavourable market conditions is called Depreciation. Whether you maintain the provision for depreciation/accumulated depreciation account determines how to do the journal entry for depreciation.

Assets such as plant and machinery, buildings, vehicles, furniture, etc., expected to last more than one year but not for an infinite number of years, are subject to depreciation.

Related Topic – Which Contra Account is used to Record Depreciation?

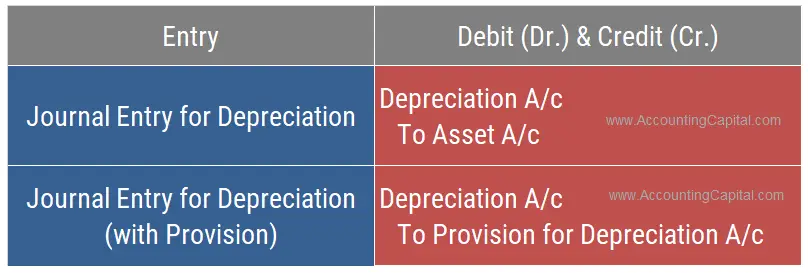

Depreciation Journal Entry

In the books of accounts, depreciation can be recorded by any of the following two methods,

1. When depreciation is charged to the ‘Asset’ account.

2. When provision for depreciation/accumulated depreciation is maintained.

More often than not, the second method is used.

Method 1 – Depreciation Charged to the Asset Account

In this method, the asset account is charged (credited) with depreciation. There is one disadvantage of this method, which is that it is not possible to find out the original cost of an asset and the total amount of depreciation.

| Depreciation A/c | Debit |

| To Asset A/c | Credit |

(Depreciation charged directly to the fixed asset)

Accounting rules applied in the above journal entry are;

Depreciation A/c – Debit the increase in expense

Asset A/c – Credit the decrease in assets

Golden rules of accounting applied in the above journal entry are;

- Depreciation A/c – Nominal Account > Debit all expenses & losses

- Asset A/c – Real Account > Credit what goes out

To Transfer Depreciation into P&L

| Profit & Loss A/c | Debit |

| To Depreciation A/c | Credit |

(Being depreciation charged transferred to profit & loss account)

After the asset’s useful life is over and when all depreciation is charged, the asset approaches its scrap or residual value.

Method 2 – Entry when Provision for Depreciation or Accumulated Depreciation Account is Maintained

When using this method, depreciation is not credited to the asset account. A provision for depreciation or an accumulated depreciation account is maintained where depreciation is credited separately.

As a result of this method, the asset can be shown at its original cost, and the provision for depreciation (contra account) can be shown on the liabilities side. It helps counterbalance.

It is also possible to deduct the accumulated depreciation from the asset’s cost and show the balance on the balance sheet.

| Depreciation A/c | Debit |

| To Provision for Depreciation A/c | Credit |

(Being depreciation charged accumulated in a separate account for the asset)

To Transfer Depreciation into P&L

| Profit & Loss A/c | Debit |

| To Depreciation A/c | Credit |

(Being depreciation charged transferred to profit and loss account)

Depreciation accumulated over the life of an asset is shown in the accumulated depreciation account.

Related Topic – Is Accumulated Depreciation an Asset or Liability?

Journal Entry for Depreciation Example & Steps

Let’s assume that a piece of machinery worth 100,000 was purchased on April 1st 2023, with a scrap value of nil and a depreciation rate of 10% (straight-line method). The company will close its accounts on 31st March.

Show entries for depreciation, all relevant accounts, and the company’s balance sheet for the next 2 years using both methods.

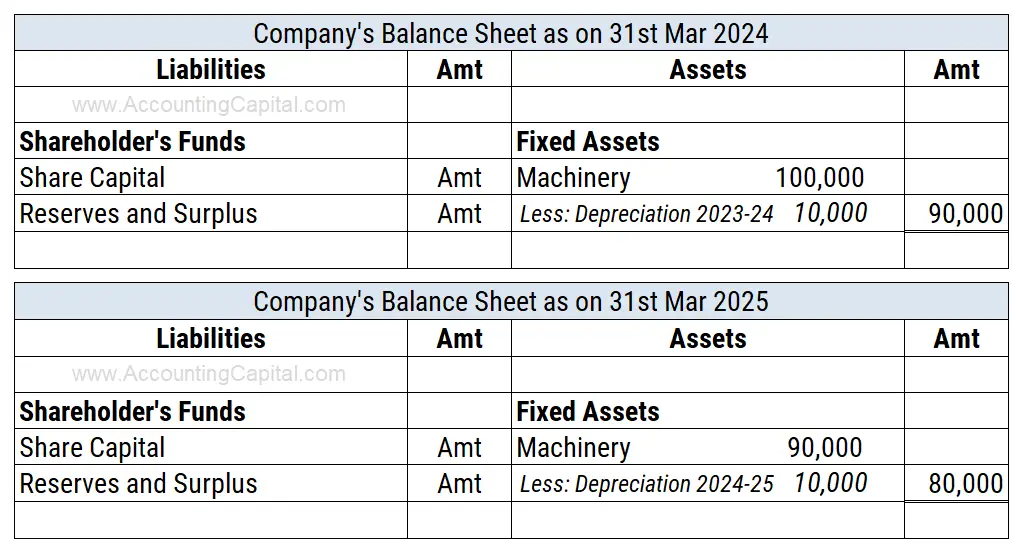

Method 1 – When no provision is maintained

31 Mar 2024 (end of year 1) – Depreciation charged on machinery

| Depreciation A/c | 10,000 |

| To Machinery A/c | 10,000 |

(Being depreciation charged on the machine @ 10% for year 1 SLM)

31 Mar 2025 (end of year 2) – Depreciation charged on machinery

| Depreciation A/c | 10,000 |

| To Machinery A/c | 10,000 |

(Being depreciation charged on the machine @ 10% for year 2 SLM)

Machinery A/c & Depreciation A/c for the next two years

Balance Sheet for the next two years (extract)

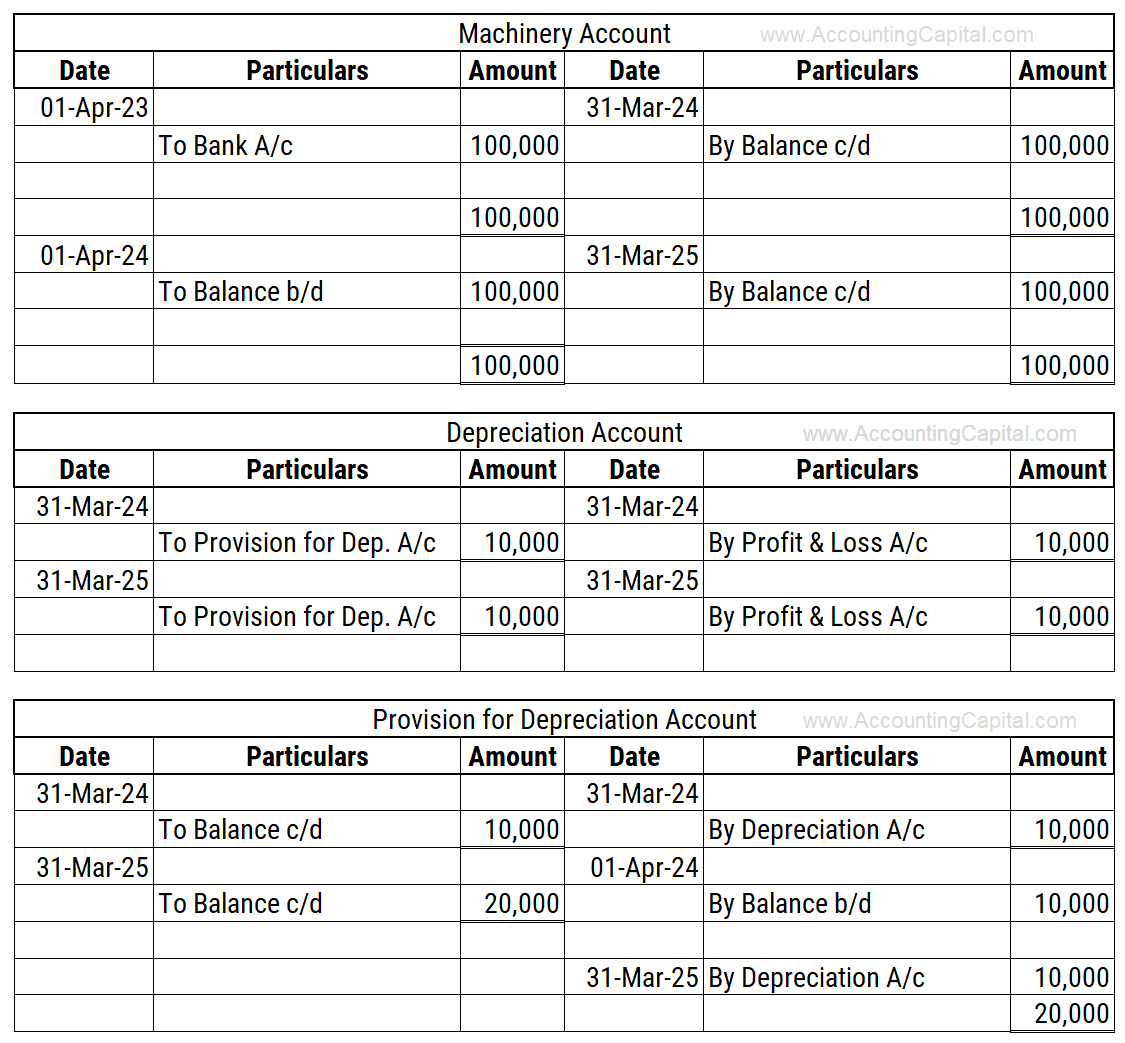

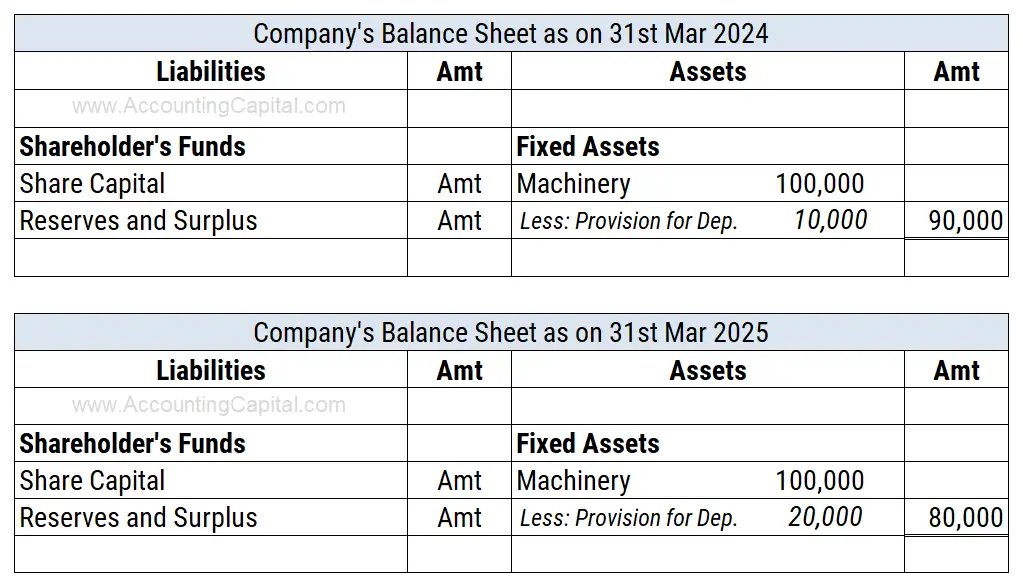

Method 2 – When provision for depreciation is maintained

Machinery A/c & Depreciation A/c for the next two years

Balance Sheet for the next two years (extract)

Related Topic – How to show Accumulated Depreciation in Trial Balance?

Depreciation on Furniture Journal Entry

Office furniture is subject to depreciation. Depending on the local laws, fittings may also be included in the definition of ‘furniture’.

This may include wiring, switches, sockets, light fittings, fans, and other electrical fittings. Every country’s regulatory bodies determine how furniture and fittings are depreciated.

Entry to depreciate office furniture,

| Depreciation A/c | Debit |

| To Furniture A/c | Credit |

(Assuming no provision/accumulated depreciation account is maintained)

The rules applied while charging depreciation on office furniture are,

- Depreciation – Dr. the increase in depreciation expense.

- Furniture – Cr. decrease in furniture value, which is an asset for the firm.

Related Topic – Can Depreciation be Charged in the Year of Sale?

Depreciation on Machinery Journal Entry

An expenditure directly related to making a machine operational and improving its output is considered a capital expenditure. In other words, this is a part of the machine cost that can be depreciated. For example, installation, wages paid to install, freight, upgrades, etc.

Entry to depreciate machinery,

| Depreciation A/c | Debit |

| To Machinery A/c | Credit |

(Assuming no provision/accumulated depreciation account is maintained)

The rules applied while charging depreciation on machinery are,

- Depreciation – Dr. the increase in depreciation expense.

- Furniture – Cr. decrease in machine’s value, which is an asset for the firm. In this case, it is important to add any capital expenditure incurred on the machinery’s cost.

Related Topic – Examples of Contingent Assets

Depreciation on Building Journal Entry

When an asset is purchased, any expenses incurred on the purchase of the asset (except for goods) increase its cost. They are debited to the “Asset A/c” and not recognised as expenses.

It is important to note that all expenses incurred for the construction of the building are added to the cost of the building. These include purchasing construction materials, wages for workers, engineering, etc.

Entry to depreciate building,

| Depreciation A/c | Debit |

| To Building A/c | Credit |

(Assuming no provision/accumulated depreciation account is maintained)

The rules applied while charging depreciation on machinery are,

- Depreciation – Dr. the increase in depreciation expense.

- Furniture – Cr. decrease in machine’s value, which is an asset for the firm. In this case, it is important to add any capital expenditure incurred on the machinery’s cost.

Related Topic – Can Assets have a Credit Balance?

Depreciation on Equipment Journal Entry

Sometimes referred to as PPE (Property, Plant & Equipment), they are physical items held for use to operate a business. They are intended for use beyond 12 months.

Spare parts, stand-by equipment, and servicing equipment are not considered to be PPE unless they comply with the standards defining the term. In the absence of such items, they are considered inventory.

Entry to depreciate equipment is,

| Depreciation A/c | Debit |

| To Furniture A/c | Credit |

(Assuming no provision/accumulated depreciation account is maintained)

The rules applied while charging depreciation on office furniture are,

Depreciation – Dr. the increase in depreciation expense.

Furniture – Cr. decrease in furniture value, which is an asset for the firm.

Related Topic – 20 Journal Entry Examples with a PDF

Depreciation on Land Journal Entry

Due to the fact that there is no estimated useful life associated with this asset, the land is not depreciated. It is not because “it is always appreciated”. In fact, in exceptional scenarios, land may depreciate as well. For these reasons, there is no journal entry for depreciation on land.

Related Topic – Reclassification Entries

Short Quiz for Self-Evaluation

>Read Amortization with an example