Journal Entry for Director’s Remuneration

The word “Remuneration” means any money or its equivalent paid to someone in exchange for using their services. Any such payment made to directors of a company is to be recorded in the books of accounts with the help of a journal entry for director’s remuneration.

Director’s remuneration is the amount paid to the directors of a company either in cash or by using the company’s property with approval from the shareholders and board of directors.

It includes salary, bonus, other rewards, etc. The board of directors control the compensation structure of the directors and the shareholders have the authority to sue the directors in case of an overpayment.

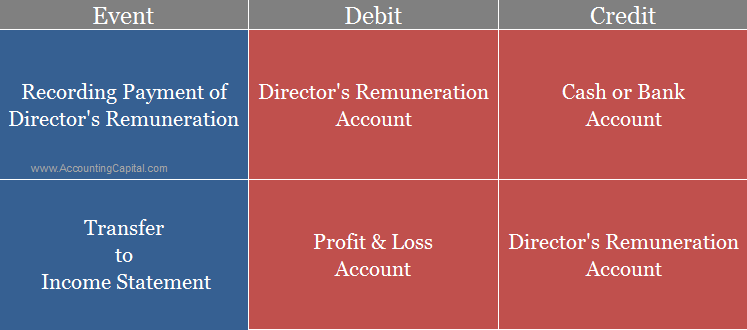

Journal entry for director’s remuneration is as follows;

| Director’s Remuneration A/C | Debit | Personal | Debit the receiver |

| To Cash A/C | Credit | Real | Credit what goes out |

(Assuming the payment is made in cash)

Accounting rules as per modern accounting

| Director’s Remuneration A/C | Debit the increase in expense |

| Cash A/C | Credit the decrease in asset |

Here, the Director’s remuneration is an expense to the company. The company is paying money to the director so the director’s remuneration account has been debited. Also, cash is going out of the organization upon such payment, therefore it has been credited.

Related Topic – How to Post from Journal to ledger?

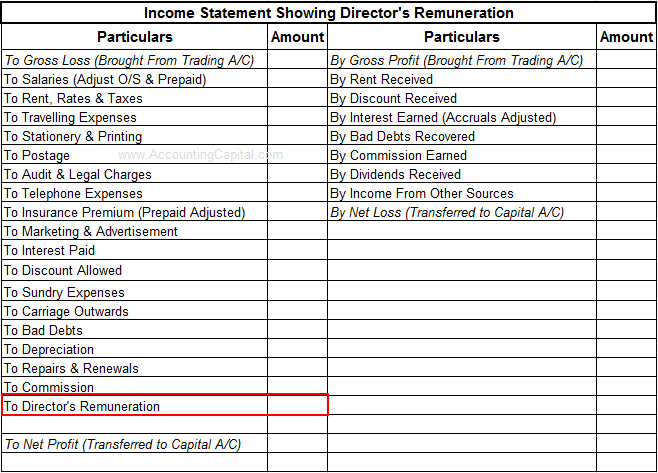

Director’s Remuneration Shown in the Income Statement

If the director is not an employee of the company then a separate account may be created to book all director remuneration related payments.

In case if the director is an employee then all expenses related to him/her may be included under the head “Employee Benefits A/C”.

Related Topic – What is Bookkeeping?

Example – Journal Entry for Director’s Remuneration

The board of directors for Unreal corp. approved a payment package of 1,00,000 per month including the bonus for one of its directors. Show accounting and journal entry for director’s remuneration at the end of the year if the payment is done via cheque.

In the books of Unreal Corp.

| Director’s Remuneration A/C | 12,00,000 |

| To Bank A/C | 12,00,000 |

(Payment of 1,00,000 over 12 months paid from the bank)

| Profit and Loss A/C | 12,00,000 |

| To Director’s Remuneration A/C | 12,00,000 |

(Transferring 12,00,000 as an indirect expense to the current income statement)

Short Quiz for Self-Evaluation

>Read What is Capitalized Expenditure?