Table of Contents

Introduction

Along with already existing owner’s equity, new loans help businesses fund acquisitions, expand operations, buy assets, invest, refinance debt, and boost working capital. As a result, when borrowed money is repaid, the firm usually pays some sort of interest on top of the principal. This is recorded with the help of a journal entry for interest paid on loan.

A loan is an external liability for the business. It can be a long-term or short-term obligation. A short-term loan has to be paid back within 12 months. On the other hand, a long-term loan has a longer tenure.

Interest on a loan is an expense for the business. Payments are typically made to the lender periodically, such as monthly, quarterly, semi-annually, or annually along with the repayment of the principal.

Recommended Quiz – Accounting Fundamentals – (Intermediate)

Journal Entry

The Journal entry for Interest paid on loan is as follows;

| Interest on Loan A/c | Debit |

| To Bank A/c | Credit |

(Being interest paid on loan)

Accounting Rules applied – “Interest on Loan A/c” is debited as Dr. the increase in expense. “Bank A/c” is credited as Cr. the decrease in assets (bank balance).

3 Golden Rules applied – “Interest on Loan A/c” is a nominal account therefore Dr. all expenses and losses. “Bank A/c” is a personal account therefore Cr. the giver.

Related Topic – Journal Entry to Place Money in Fixed Deposit

Example of the Accounting Entry for Interest Paid on Loan

Here is an example to help you understand the above journal entry;

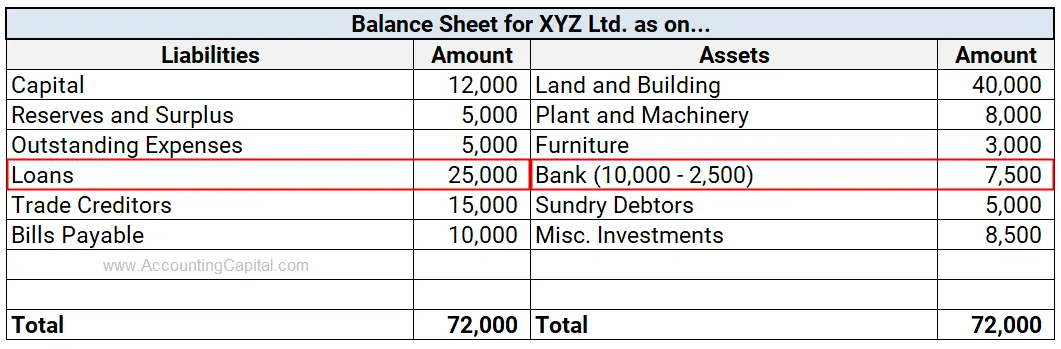

XYZ Ltd. has taken a loan of 25,000 from HSBC Bank. The bank charges an interest of 10% per annum on the loan. Pass the necessary journal entry to record the interest expense incurred at the time of payment.

For the above transaction, the following journal entry would be recorded (annual);

| Interest on Loan A/c | 2,500 |

| To HSBC Bank A/c | 2,500 |

(Being interest paid to HSBC bank on loan)

Percentage of interest p.a. x Amount of loan = 10% of 25,000 = 2,500

- Firstly, Interest on Loan A/c is an expense for the firm so the account is debited to recognize the cost incurred by the business.

- Meanwhile, the Bank A/c is credited with the interest payment to reflect a decrease in cash.

Related Topic – Journal Entry for Opening Stock

Impact on Financial Statements

Balance Sheet: the reduced bank balance would be shown under the “Current Assets” head of the Assets side.

A loan is a liability for the business. Hence, it is shown on the liabilities side of the Balance Sheet. When the loan is repaid, the balance is reduced accordingly.

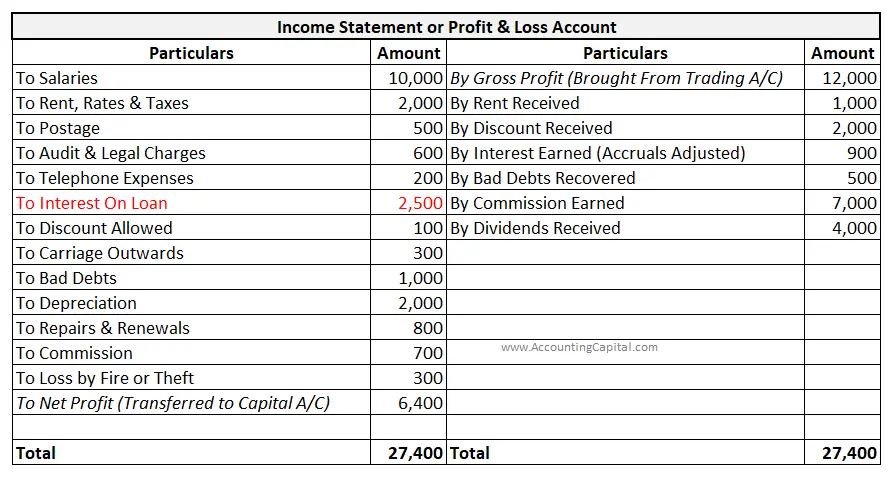

Profit and Loss Account: Interest on the loan is shown on the debit side as it is an expense for the business. Payment of interest reduces the net profit & net income of the business.

In accounting, interest expense is treated as a cost of borrowing. It is the cost of using external funds to finance business operations.

Trading account: No impact.

Cash Flow Statement: Interest on the loan is shown under “Financing Activities”. It is an outflow of cash as the bank balance is reduced by the payment. Bank balance is a form of cash and cash equivalents.

Related Topic – Journal Entry for Bounced Cheque

Conclusion

From the above discussion, we can conclude that:

- As a result, paying interest on loans directly impacts the profitability of the business by reducing the amount of earnings available to shareholders or owners.

- Interest on a loan is debited to the Profit and Loss account as it is a charge on the profits of the business.

- The interest paid on loans is classified as a financial expense because it represents the cost of financing for the business.

- While recording this accounting entry “Interest on Loan” account is debited and the “Bank” account is credited in the the journal book.

- In the Cash Flow statement, interest expense is shown as a “Financing Activity”. It is an outflow of cash.

>Read Journal Entry for Payment to Creditor