Table of Contents

Introduction

In your business, a debtor is a person or another business that owes money to your firm. For example, let’s say you have a small grocery shop. When someone comes into your shop and buys something but chooses to pay later, they become your debtor. They owe you money for the items they purchased.

The amount of time for debtors to pay the money varies from business to business; however, as a general rule, they have between 30 and 90 days to do so. Whenever debtors pay back their bills, it is recorded with the help of a journal entry for money received from the debtor.

Such payment might be made by the party in various ways, like cash, cheque, electronic transfer, bank drafts, etc.

Received Money from Debtor Journal Entry

Upon a general assumption that the money received from the debtors is via electronic transfer, the following journal entry will be passed,

| Bank A/C | Debit |

| To Debtor’s A/C | Credit |

- Dr. the increase in ‘Assets’ as money comes into the business.

- Cr. the decrease in ‘Debtors’ as receivables are reduced.

- ‘Bank’ is a Personal A/c; therefore, Dr. the receiver.

- ‘Debtor’ is a Personal A/c; therefore, Cr. the giver.

Note: The “Cash A/c” will be debited instead of the “Bank A/c” if the money is received in cash. It is also possible to credit the “Accounts Receivable A/c” instead of the “Debtor’s A/c”.

Related Topic – Debtor Vs Creditors

Example

XYZ Ltd. received 80,000 from John through electronic transfer as payment for goods sold to him a month ago. Pass necessary journal entry for money received from the Debtor (XYZ Ltd.)

Journal entry for receiving money from John

| Bank A/C | 80,000 |

| To John’s A/c | 80,000 |

Bank A/c is debited due to an increase in assets, and John’s (debtor) A/c is credited due to a decrease in receivables.

Effect on Accounting Equation

Assume a firm’s opening balance is [Assets at 50,000, Capital at 50,000, and Liabilities at zero]. As a result of recording journal entry for money received from the debtor, the accounting equation will be impacted as follows:

| Assets = | Liabilities | + Capital | |

|---|---|---|---|

| Opening Balance | 50,000 | 0 | 50,000 |

| Bank A/c | 80,000 | 0 | 50,000 |

| John’s A/c (Debtor) | (80,000) | 0 | 50,000 |

| Total | 50,000 | 0 | 50,000 |

Related Topic – Debtor’s Turnover Ratio

Effect on Financial Statements

Upon receiving money from debtors,

- There would be no effect on the income statement. It represents the collection of revenue that was already recorded when the sales were made. The affected accounts are both assets.

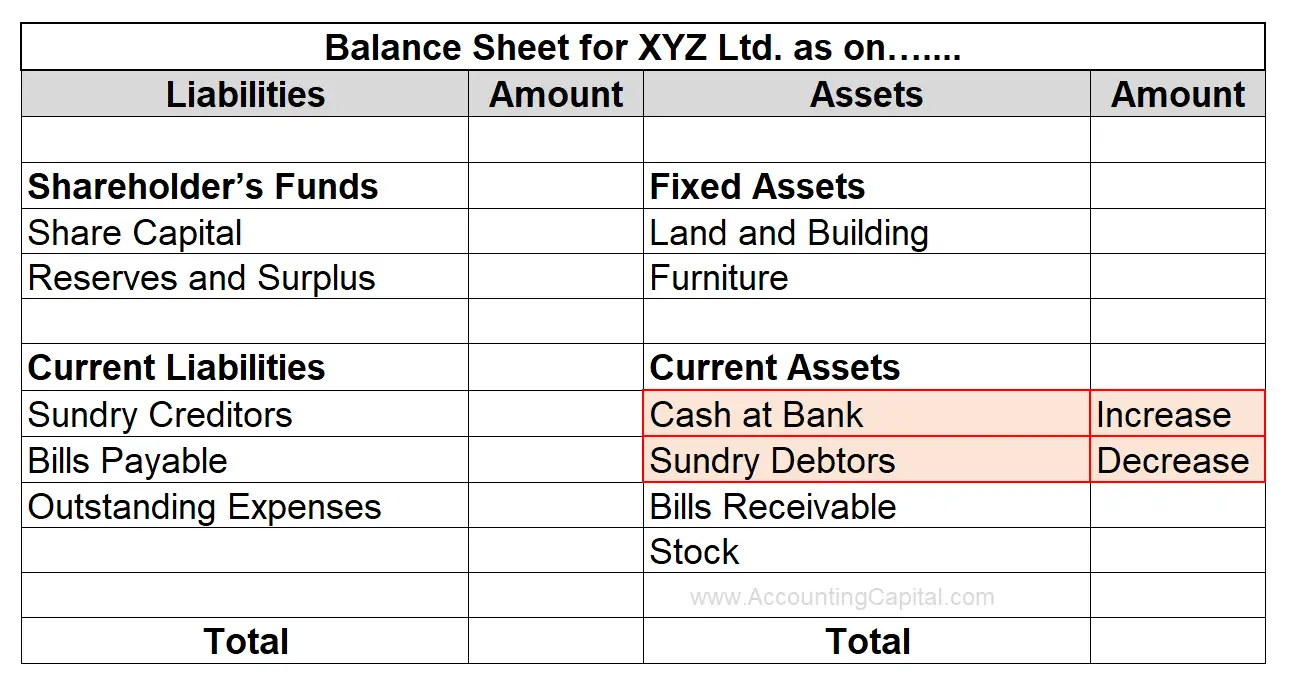

- The balance sheet will show a decrease in debtors and an increase in bank balance. There would be no change in the total assets.

- The cash received from debtors is also recorded as an inflow in the operating activities section of the cash flow statement. As a result, the company’s core operations generate more cash, increasing cash flow from operating activities.

Effect of journal entry for money received from the debtor on the Balance sheet :

Related Topic – Difference between Debt and Liability

Discounts & Allowances

Both discounts & allowances are a reduction in the selling price of goods or services.

Discounts are offered to customers as a percentage or fixed amount of reduction from the regular selling price. It may motivate the customer to make an early payment or buy large quantities. It is an expense for the business and is therefore debited to the Income statement.

- Cash Discounts are given to customers for paying their invoices early. It is a reduction in the invoice amount if the customer pays within a specified period, often within a certain number of days.

- Trade Discounts are given to customers for buying large quantities. It is a reduction in the listed price of a product or service, typically represented as a percentage.

Allowances are usually granted to customers to adjust for issues or defects with the goods or services they have purchased. Also, when a business sells goods that are of lower quality or do not meet the expected standards, it may provide allowances to the buyers as a form of compensation or adjustment.

Suppose the customer gets a damaged product; the seller may offer an allowance to make up for it. Allowances can also be given for returns and complaints. The adjusted selling price is calculated by subtracting allowances from revenue.

>Read Quiz on Discount and Rebates

>Read Provision for Discount on Debtors