Journal Entry for Prepaid Expenses

Prepaid expenses are those expenses which are paid in advance for a benefit yet to be received. The perks of such expenses are yet to be utilised in a future period. Below is the journal entry for prepaid expenses;

According to the three types of accounts in accounting “prepaid expense” is a personal account.

| Prepaid Expense A/C | Debit | Debit the increase in asset |

| To Expense A/C | Credit | Credit the decrease in expense |

It involves two accounts: Prepaid Expense Account and the related Expense Account.

They are an advance payment for the business and therefore treated as an asset. The accounting rule applied is to debit the increase in assets” and “credit the decrease in expense” (modern rules of accounting).

They are also known as unexpired expenses or expenses paid in advance. It is important to show prepaid expenses journal entry in the financial statements to avoid understatement of earnings.

Simplifying Prepaid Expenses Adjustment Entry with an Example

Question – On December 20th 2019 Company-A pays 1,20,000 (10,000 x 12 months) as rent in cash for next year i.e. for the period (Jan’2020 to Dec’2020).

Show all entries including the journal entry for prepaid expenses on these dates;

- December 20th 2019 (Same day)

- December 31st 2019 (End of period adjustment)

- January 1st 2020 to December 1st 2020 (Beginning of each month next year)

1. December 20th 2019 – (Payment made for rent due next year)

| Rent Account | 1,20,000 |

| To Cash Account | 1,20,000 |

2. December 31st 2019 – (Rent payable in next year transferred to prepaid rent account)

| Prepaid Rent Account | 1,20,000 |

| To Rent Account | 1,20,000 |

3. January 1st 2020 to December 1st 2020 – (Expense charged to each period)

| Rent Account | 10,000 |

| To Prepaid Rent Account | 10,000 |

All 12 months from Jan’20 to Dec’20 will be charged in each period against the prepaid expense account to reduce the prepaid account to zero by end of the year.

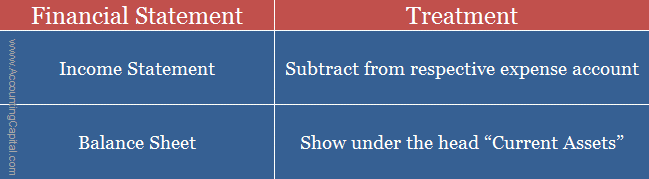

Treatment of Prepaid Expenses in Financial Statements

Once the journal entry for prepaid expenses has been posted they are then arranged appropriately in the final accounts.

Related Topic – Treatment of Prepaid Expenses in Final Accounts (Detailed)

Example – Journal Entry for Prepaid Insurance

Company-A paid 10,000 as insurance premium in the month of December, the insurance premium belongs to the following calendar year hence it doesn’t become due until January of the next year.

At the end of December the company will record this into their journal book using the below journal entry for prepaid expenses;

| Prepaid Insurance Premium A/C | 10,000 |

| To Insurance Premium A/C | 10,000 |

(Insurance premium related to next year transferred to prepaid insurance premium account)

Example – Journal Entry for Prepaid Salary or Wages

Journalize the prepaid items in the books of Unreal Corp. using the below trial balance and additional information provided along with it.

- Prepaid Salaries – 25,000

- Prepaid Wages – 10,000

| Account | Dr. | Cr. |

| Salaries | 50,000 | |

| Wages | 20,000 |

Journal entry for prepaid expenses in the books of Unreal Corp.

| Prepaid Salary A/C | 25,000 |

| To Salary A/C | 25,000 |

(Salaries related to next year transferred to prepaid salary account)

| Prepaid Wages A/C | 10,000 |

| To Wages A/C | 10,000 |

(Wages related to next year transferred to prepaid wages account)

Example – Journal Entry for Prepaid Rent

Company-B paid 60,000 rent (5,000 x 12 months) in the month of December which belongs to the next year and doesn’t become due until January of the following year.

Using the concept of the journal entry for prepaid expenses below is the journal entry for this transaction in the books of Company-B at the end of December.

| Prepaid Rent A/C | 60,000 |

| To Rent A/C | 60,000 |

(Rent related to next year transferred to prepaid rent account)

Short Quiz for Self-Evaluation

>Related Long Quiz for Practice Quiz 36 – Prepaid Expenses

>Read Income Received in Advance