Journal Entry For Provident Fund (PF)

Provident fund or PF is a compulsory retirement savings plan managed by the government where employees contribute a fixed percentage of their monthly pay-out and the same amount is contributed by the employer. Accounting and Journal entry for provident fund is a 3 step process.

When salaries are paid to employees, the employer deducts the employee’s contribution from it and only the net amount is paid. Employer’s own contribution along with the employee’s share is later on deposited with the proper authority.

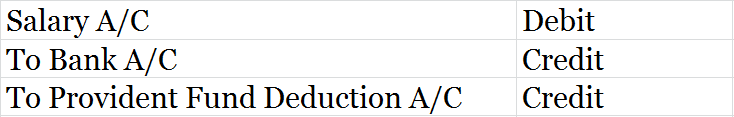

1. When salaries are paid, the below entry is posted.

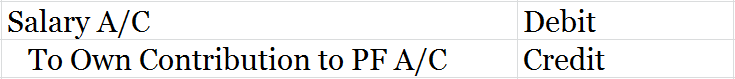

2. For employer’s own contribution to provident fund, the below entry is posted.

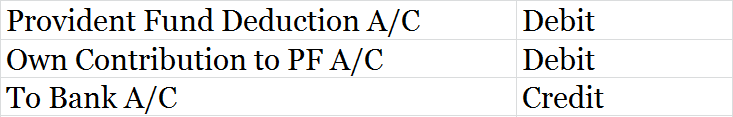

3. When both the amounts are deposited, the below entry is posted.

If the amount has not been deposited within the accounting period, it is to be shown on the balance sheet as a current liability.

Related Topic – Journal Entry for Income Tax Paid

Example of Accounting for Provident Fund

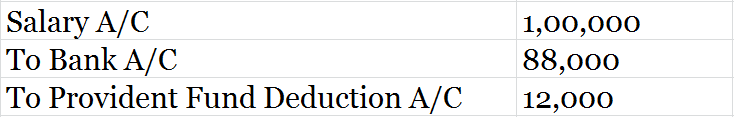

Show accounting and journal entry for provident fund deposits and deductions for the below information.

Total salaries – 1,00,000, PF deduction (employees) – 12,000, Employer share – 12,000

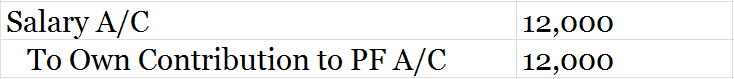

1. When salaries are paid (employee’s share is deducted)

2. For employer’s own contribution to PF account (employer’s contribution journalized as salary)

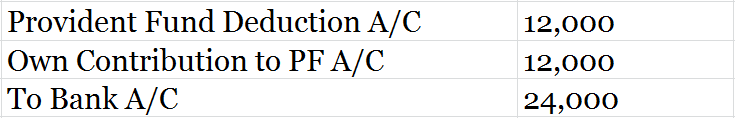

3. When both employee’s and self-contribution to PF account is deposited with the required authority.

Short Quiz for Self-Evaluation

>Read Accounting and Journal Entry for Credit Card Sales