Paid Rent Journal Entry

If a business does not own an office premise it may decide to hire a property and make periodical payments as rent. Such a cost is treated as an indirect expense and recorded in the books with a journal entry for rent paid. The party receiving the rent may book a journal entry for the rent received.

Payment for rent to the landlord is often;

-

- Recurring in nature

- Pre-decided amount

- Paid every month

- Likely shown as “office rent” in the financial statements.

The landlord may be an individual or another business providing their services. A rent agreement is prepared and agreed upon between the landlord and the tenant.

Journal entry for rent paid (in cash)

Accounting rules applied – Modern Rules

| Rent Account | Debit | Debit the increase in expense |

| Cash Account | Credit | Credit the decrease in asset |

Accounting rules applied – Three Golden Rules

| Rent Account | Debit | Dr. all expenses – Nominal A/C |

| Cash Account | Credit | Credit what goes out – Real A/C |

Accounting Treatment for Rent Payment

The life cycle to account for payment of rent expenses (in cash) goes through a couple of steps as shown below;

Step 1 – Journal entry for rent paid (in cash)

| Rent A/C | Debit |

| To Cash A/C | Credit |

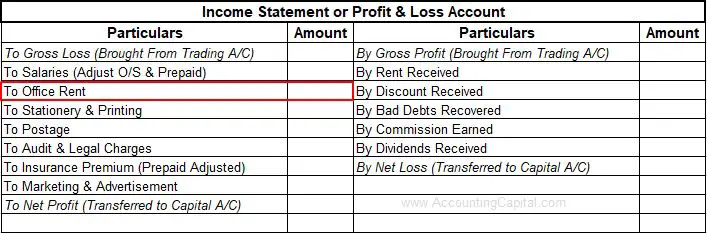

Step 2 – Transferring office rent expense into income statement (profit and loss account).

| Income and Expense A/C | Debit |

| To Rent A/C | Credit |

Presentation in the Financial Statements

It is shown on the debit side of an income statement (profit and loss account)

Example

On the 15th of March, Unreal Corporation paid a rent of 10,000 (in cash). The payment belongs to rent due for the same month. Show related journal entries for office rent paid in the books of Unreal Corporation.

March 15 – Journal entry at the time of payment

| Rent A/C | 10,000 |

| To Cash A/C | 10,000 |

March 31 – When the business books Closing entries

| Income Statement | 10,000 |

| To Rent A/C | 10,000 |

Related Topic – Accounting and Journal Entry for Outstanding Expenses

Journal Entry for Rent paid by Cheque

Small businesses pay office rent either in cash or by cheque. But larger organizations usually prefer paying it only by cheque. This is done to keep legal evidence of the accounting transaction and maintain an audit trail.

Following are the steps for recording the journal entry for rent paid by cheque. In this case, the cash account is replaced with a bank account.

Step 1 – At the time of the cheque issue,

| Rent A/C | Debit |

| To Bank A/C | Credit |

Step 2 – When rent expense is transferred to the income statement (profit and loss account)

| Income and Expense A/C | Debit |

| To Rent A/C | Credit |

Example – On 10th March, XYZ Ltd paid office rent to its landlord by cheque for the same month amounting to 20,000. Show journal entries for office rent paid by cheque in the books of XYZ Ltd.

March 10 – Journal entry for office rent paid by cheque

| Rent A/C | 20,000 |

| To Bank A/C | 20,000 |

March 31 – Journal entry for transfer of rent expense to the income statement (profit and loss account)

| Income Statement | 20,000 |

| To Rent A/C | 20,000 |

Related Topic – Journal Entry for Advance Received from Customer

Journal Entry for Rent Paid in Advance

Rent paid in advance i.e. Prepaid Rent is the amount of rent paid by a firm in advance but the related benefits equivalent to the amount of advance payment are yet to be received. The benefits are due to be received in the future accounting period.

It is displayed as a current asset in the balance sheet as it is an advance payment.

Journal Entry

| Prepaid Rent A/C | Debit | Debit the increase in asset |

| To Rent A/C | Credit | Credit the decrease in expense |

(Recording rent paid in advance)

Example – On 1st January ABC Co. paid office rent amounting to 10,000 (5,000 x 2) for the month of January & February. Payment is made in cash. Show journal entries to be posted in the books of ABC Ltd.

Accounting on January 1

| Prepaid Rent A/C | 5,000 |

| Rent A/C | 5,000 |

| To Cash A/C | 10,000 |

(5000 rent paid for January, 5000 rent paid in advance for February, all by cash)

Accounting on February 1

| Rent Account | 5,000 |

| To Prepaid Rent Account | 5,000 |

(5000 rent obligation for February charged against the rent paid in advance last month)

Short Quiz for Self-Evaluation

>Read Petty Cash Book