Meaning

Creditors are individuals or companies to whom you owe money for goods or services purchased on credit. A group of such individuals or entities is called Sundry Creditors. They may also be referred to as accounts payable or trade payables.

Sundry means “various” or “several”. In the world of business, it refers to many similar items combined under one head.

Typically, sundry creditors arise from core business operations, such as the purchase of goods or services. The business treats them as a liability.

Example: Microsoft purchases 500 laptops from HP on credit. Thus, HP will be shown as a creditor (current liability) in the books of Microsoft. Similarly, a collection of such creditors is viewed as sundry creditors from Microsoft’s point of view.

Related Topic – Journal Entry for Credit Purchase

Example

Suppose “Daniel Constructions” sold building material worth 90,000 to “Axis Housing” on credit and Daniel Constructions (seller) agrees to receive a delayed payment in the future accounting period for the related invoice.

In the above case, Daniel Constructions is a creditor for Axis Housing, and the same is recorded in their books for 90,000 due to the credit purchase. Many such creditors combined together are known as “Sundry Creditors”.

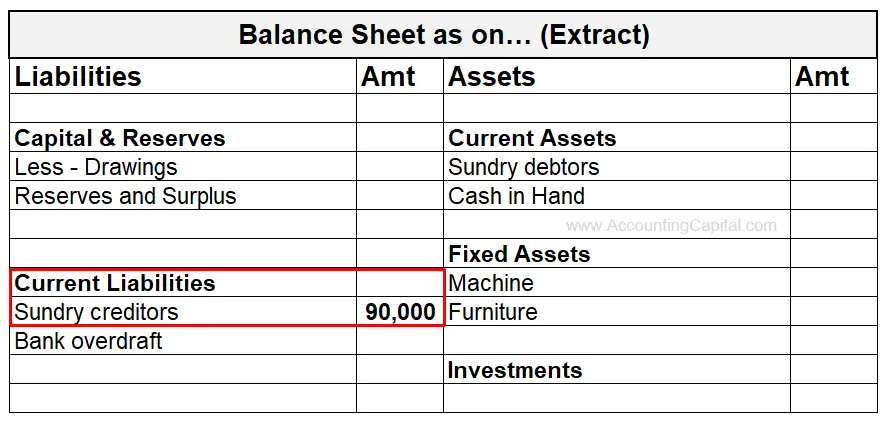

Sundry Creditors in Balance Sheet

In the books of Axis Housing Note: Debtors in the books of Daniel Constructions will also increase by 90,000 on account of credit sales done for 90K construction material.

Note: Debtors in the books of Daniel Constructions will also increase by 90,000 on account of credit sales done for 90K construction material.

Type of Account

In order to apply accurate accounting rules, it is essential to know what type of account are you dealing with.

As per the golden rules of accounting

| Type of Account | Personal Account |

| Rule Applied | Debit the Receiver & Credit the Giver |

Similarly as per the modern rules of accounting

| Type of Account | Liability account |

| Rule Applied | Debit the decrease in liability and Credit the increase |

Journal Entry

Trade Payables arise as a result of credit purchases which is expenditure in nature, however, when the money is due to be paid it becomes a liability for the organization. Following is the journal entry for sundry creditors that should be recorded to show credit purchase of goods/services;

In the Books of the Buyer

| Purchases A/C | Debit |

| To Sundry Creditors A/C | Credit |

(Being goods or services purchased on credit)

Rules – Debit the increase in expense & Credit the increase in liability.

At the time when payment is made by the creditor below entry is recorded.

| Sundry Creditors A/C | Debit |

| To Cash (or) Bank (or) B/P | Credit |

(Payment made in cash (or) by cheque (or) issue of a bill payable to the seller)

Rules – Debit the decrease in liability (Sundry Creditors) & Credit the decrease in assets (Cash/Bank) or Credit the increase in liability (Bills Payables).

Ledger Account

Creditors being a liability have a credit balance in Accounts. All credit purchases made during the year should be credited to the Creditors Account, showing an increase in the creditors’ balance. On the other hand, all transactions such as payment to a creditor, purchase returns, etc. that reduces the creditors’ balance should be debited.

| PARTICULARS | AMT | PARTICULARS | AMT |

| Cash/ Bank | – | Bal b/d | – |

| Bill Payable | – | Credit Purchases | – |

| Purchase Return | – | ||

| Discount Received | – | ||

| Bal c/d | – | – | |

| TOTAL | – | TOTAL | – |

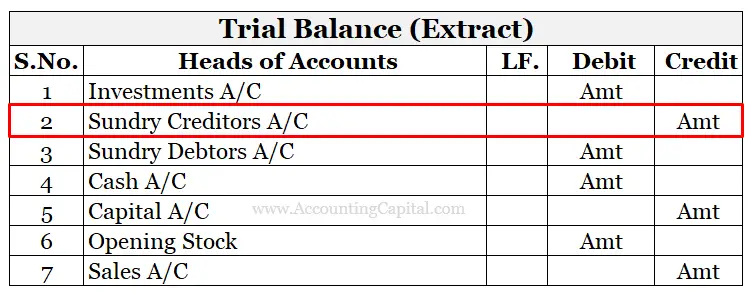

Sundry Creditors in Trial Balance

Treatment of Sundry Creditors in the Trial Balance

Case 1: In case of no provision for discount on creditors exist. It is simply shown as it is with a credit balance.

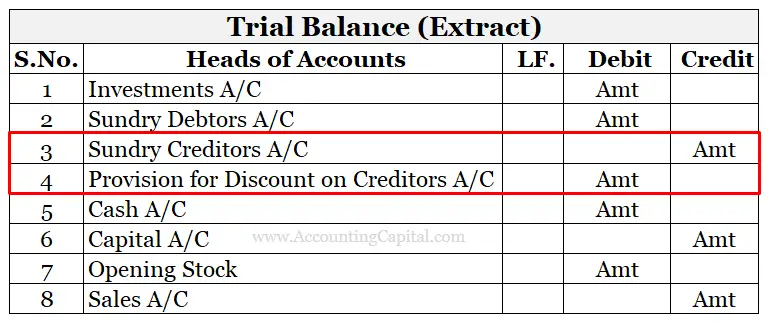

Case 2: When Sundry Creditors are recorded at the gross value in the trial balance, that is before making adjustments for provision for discount on creditors.

Case 3: When Sundry Creditors are recorded at the net value in the trial balance, that is after making adjustments for provision for discount on creditors.

Net Sundry Creditors = Gross Sundry Creditors – Provision for Discount on Creditors

The Trial Balance will appear similar to as in case 1.

Note: Either the gross or net value of such creditors can be recorded in the Trial Balance.

Provision for Discount on Creditor is included for theoretical/conceptual purposes. However, it is not maintained in real-world practices generally. It is because it violates the principles of Prudence which says, do not anticipate profits but provide for all possible losses.

Related Topic – Difference Between Debtors and Creditors

Sundry Creditors & Sundry Debtors

Example demonstrating the relationship between the two terms

Suppose a furniture-making company, Wood Ltd. sells furniture worth 30,000 to QRT Ltd. on credit. Therefore, Wood Ltd. will become a creditor for QRT Ltd. Whereas, QRT Ltd. will become a debtor for Wood Ltd.

As a result, such transactions usually lead to the addition of a debtor & a creditor in the books of the seller and the buyer respectively. Hence, the two terms are complementary to each other.

Difference Between Sundry Creditors & Sundry Debtors

- It refers to a group of people to whom the enterprise or individual owes an amount, but Sundry Debtors are those who owe an amount of money to the enterprise.

- Unlike, Creditors who belong to the liabilities, Debtors are a part of assets.

- As per the modern rules, an increase in Creditors (liability) is to be credited, whereas an increase in Debtors (asset) is to be debited.

- Similarly, debit a decrease in Creditors and credit a decrease in debtors.

Short Quiz for Self-Evaluation

>Read Sundry Debtors