Cash Memo

In accounting, all transactions are properly documented as evidence of the financial trail. Cash Memo is a source document used in case of a cash transaction between the seller and a buyer.

In case of a cash sale, the seller prepares the cash memo and hands it over to the purchaser. It acts as a proof for ‘cash sales’ made by a business. On the other hand, it acts as proof for cash purchase made by a person or business.

It can be seen as an equivalent to the invoice but for cash sales. Most often a cash memo is prepared in a pair so that a duplicate copy is present with the seller as well. This helps the seller to compile all its cash sales along with reconciliation, tax payments, analysis, inventory planning, cash management, etc.

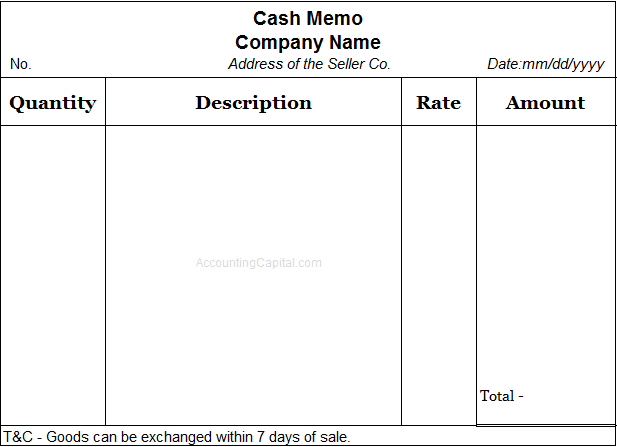

It contains the following details;

- Date of transaction

- Details of goods

- Quantity

- Rate per item

- Gross total

- Taxes

- Net total

- Terms & conditions

Template of Cash Memo

To authenticate the document it is signed or stamped with a seal by an authorized person. It is a legal document and the stamp/signature helps with the validity of the event in case of a dispute.

Short Quiz for Self-Evaluation

>Read What is a Debit Note?