Definition of Cost Center

A function or department in the organization that does not directly add to the profit, but costs the organization money to operate is known as a cost center. The cost center indirectly adds to the profitability of the business.

The cost center operates on a budget decided by the organization. By showcasing operational excellence, the cost centers manage to keep a check on the costs incurred by them and stick to the budgetary restrictions.

The cost centers do not involve themselves in the investment or revenue decisions of an organization. Their main function is to track expenses. This allows for more accurate budgets and forecasts. The data that they provide is basically for internal reporting. The management can use the data provided by cost centers to improve operational efficiency and maximize profits.

Some cost centers observed in organizations are:

- Accounting Department

- IT Department

- HR Department

- Quality Control Department (in case of manufacturing units)

- Maintenance Staff

Example

Human Resources department, Finance department, etc.

Similarly, for the Research & Development department, it incurs lots of costs in its endeavor to come up with new products for the company, though it is difficult to say how much profit it generates for the company. The sum of Research, Planning, and Implementation of new plans will be the total for this department.

Uses

- A cost center is used to track expenditure for a specific function. Without creating such a cost center, it would take immense effort to measure the cost of supplying this service exactly. It would require breaking up of all expenditures of the business department wise, which is a very tedious task.

- It is also used to allocate resources to the most profitable activities as this requires to track costs for all activities undertaken.

Cost Unit and Cost Center

Cost Unit

It is a representing unit of product, service, or time (can be a combination of these) in respect to which costs may be ascertained, collected, or expressed. For instance, a business may like to determine the cost per tonne of steel, per tonne-kilometre of a transport service, or cost per machine hour.

- A single contract/project can also be a cost unit

- A batch/group of identical items that maintains its identity through one or more stages of production can also be a cost unit

- Cost units are usually units of physical measurement such as area, volume, weight, value, number, or time

Example

A brick-making company ascertains its cost per 1,000 bricks.

An electricity production company measures its cost per kilowatt-hour(kwh).

A hospitality business determines its cost of maintenance per room.

A transport business ascertains its cost incurred per passenger kilometre.

These are the cost units for the above-mentioned businesses and include parameters of physical measurement.

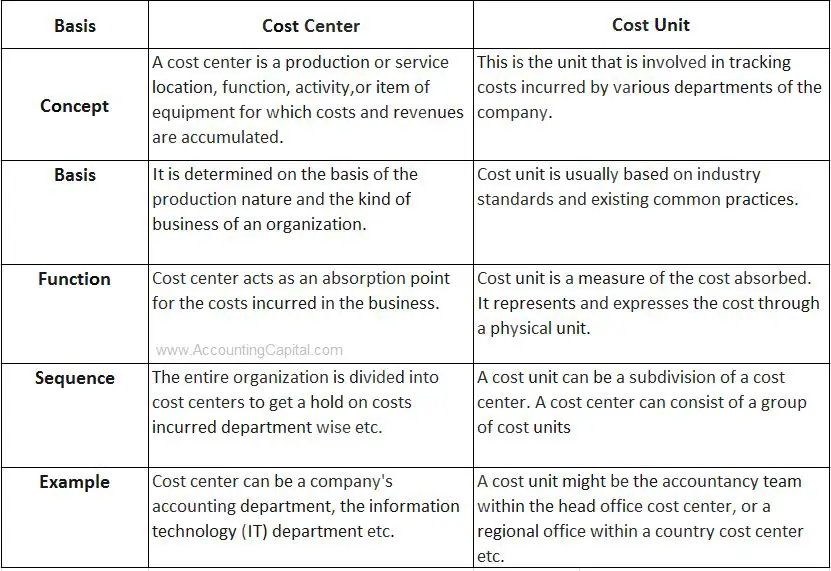

Differences

Sometimes, cost center and cost unit act as one, but they have clear distinguishable characteristics:

Types of Cost Centers

Following is the broad classification of cost centers, observed in an organization:

- Personal CC

A personal cost center refers to a person or a group of people. For example, a sales manager, a workforce manager, etc.

- Impersonal CC

The impersonal cost center refers to a location, equipment, a group of these, or both. For example, the London branch, boiling house, cooling tower, the generator set, etc.

- Production CC

A production cost center is associated with a product or manufacturing work. It is a cost center where the raw material is handled for conversion into finished products. Here both direct and indirect expenses are incurred. For example, machine shops, welding shops, and assembly shops, etc.

- Service CC

A service cost center involves providing services to the production department. It serves as an ancillary unit to a production cost center. For example, payroll processing department, powerhouse, service centers, plant maintenance centers, etc.

Short Quiz for Self-Evaluation

> Read Service Center and Profit Center