Meaning and Formula

Goodwill refers to the prestige or reputation attached to a brand name. Additionally, the goodwill of a firm is the result of a firm’s past efforts, which puts it in a profitable position to gain higher revenue without investing any extra amount of capital & effort. It is because goodwill adds value to a firm’s brand name & acts as an attractive force for the potential buyers of the firm’s products or services.

In addition, (purchased) goodwill is recorded in the books and is viewed as a long-term intangible asset for the company. The valuation of goodwill is subjective & depends upon the method of valuation that the valuer assumes.

Formula to compute the value of goodwill;

| (Purchased) Goodwill = Purchase price of the acquired company – (Fair market value of the total assets acquired – Fair market value of the total liabilities taken over) |

When to Value Goodwill

- In the case of mergers and acquisitions of entities,

- In case of reconstitution of partnership firms, i.e., in case of admission, retirement, death of a partner, or change in profit sharing ratio among existing partners.

Related Topic – Is goodwill a fictitious asset?

Methods of Valuation of Goodwill

Following are the various methods for valuation of goodwill;

1) Average Profit Method – This method involves the multiplication of the average profit of the firm by the number of years of purchase (number of years in which the entity is expected to continue earning the average profits) to get the value of the goodwill.

| Goodwill = Average Profit x Number of Years Purchase |

Additionally, either simple average profit or weighted average profit can be used for this computation based on the requirements of the business.

a) Simple Average Profit Method – Here, profits of the business for a certain number of years are simply averaged to calculate the average profit. Then this simple average profit is multiplied by the number of years of purchase.

b) Weighted Average Profit Method – Here, firstly a certain weight is assigned to the normal profits of each year according to their relevant importance & then the weighted average profit is computed. Lastly, this weighted average profit is multiplied by the number of years purchased to arrive at the value of goodwill.

| Weighted average profit = Sum of profits multiplied by weights/Sum of weights (agree) |

| Goodwill = Weighted Average Profit x Number of Years Purchase |

Note – Major benefit of using the weighted average profit method over the simple average profit method is that under this method the trend of profitability is also considered as recent years are given more weight than the earlier years, unlike simple average profit.

Example

Suppose profits of Mitsubishi Motors Corporation for the last five years are;

| Year (Ended) | I Year | II Year | III Year | IV Year | V Year |

| Profits | 60,000 | 28,000 | 50,000 | 40,000 | 56,000 |

Provided the number of years purchase is 3.

Simple Average Profit Method i.e. when equal weight is assigned to the five years.

Simple Average Profit = Total Profit / Total Number of Years

= (60,000 + 28,000 + 50,000 + 40,000 + 56,000) / 5

= 234,000 / 5 = 46,800

| Goodwill = Simple Average Profit x Number of Years Purchase

= 46,800 x 3 = 140,400 |

Weighted Average Profit Method i.e when 1, 2, 3, 4, & 5 weights are assigned to the five years, respectively.

Weighted Average Profit = Total Weighted Profit / Total of Weights

= [(60,000 x 1) + (28,000 x 2) + (50,000 x 3) + (40,000 x 4) + (56,000 x 5)] / 15

= [60,000 + 56,000 + 150,000 + 160,000 + 280,000] / 15 = 706,000 / 15

= 47,066.67 = 47,067 approx.

| Goodwill = Weighted Average Profit x Number of Years Purchase

= 47,067 x 3 = 141,201 (approx.) |

Related Topic – Which accounts are not closed at the end of accounting period?

2) Super Profit Method – In this method, the value of goodwill is calculated by multiplying the super profit by the number of years of purchase. Super profit refers to the amount of profit earned by the business over and above the normal profits usually earned on the given amount of capital.

| Goodwill = Super Profit x Number of Years purchase |

where Super profit = Actual or Average profit – Normal profit

Normal Profit = Capital Employed or Average Capital Employed x Normal Rate of Return/ 100, and

Average Capital Employed (for the given year) = (Opening Capital Employed + Closing Capital Employed) / 2

Further, two approaches are there to compute the amount of capital employed from the balance sheet of a partnership firm.

a) Liabilities side approach

Capital Employed = Partners’ Capital Accounts+ Partners’ Current Accounts + Reserves + Longterm loans – Existing Goodwill – Fictitious Assets – Non Trade Investments – Deferred Revenue Expenditure – Debit Balance of Profit & Loss Account

b) Assets side approach

Capital Employed = All Assets (except goodwill, non-trade investments & fictitious assets) – Current Liabilities

Note – Both the approaches will give the same figure of capital employed by the business.

Example

Let’s assume the net profits of PepsiCo over the last three years as given below;

| Year | I | II | III |

| Profits | 16,000 | 20,000 | 24,000 |

The amount of capital investment is 60,000 & the normal rate of return is 20%. The number of years purchase is 4 years.

Average Profit = Total Profit / Total Number of Years

= (16,000 + 20,000 + 24,000) / 3 = 60,000 / 3 = 20,000

Normal Profit = Capital Employed x Normal Rate of Return

= 60,000 x 20/100 = 12,000

Therefore, Super Profit = Average Profit – Normal Profit = 20,000 – 12,000 = 8,000

| Goodwill = Super Profit x Number of Years purchase

= 8,000 x 4 = 32,000 |

Related Topic – Difference between receipt, payment, income and expenditure

3) Capitalization Method – Under this method, the value of goodwill is calculated either by subtracting the total net assets of the entity from its total capitalized value or by simply capitalizing the super profit of the entity.

Thus, two alternatives are there to compute the amount of goodwill under this method that is as follows;

a) Capitalization of Average Profit Method – Here, the total capitalized value of the firm is calculated first by capitalizing the average profit based on the normal rate of return. Then, the amount of net assets is deducted from the total capitalized value to get the value of goodwill.

| Goodwill = Total Capitalized Value of the Firm – Net Assets |

Where, Total Capitalized Value of the Business = Average Profit x 100 / Normal Rate of Return, and

Net Assets of the Business = All Assets (except goodwill, non-trade investments & fictitious assets) – Outside Liabilities

=[(Total Fixed Assets + Total Current Assets) – (Total Current Liabilities + Total Long Term Liabilities)]

b) Capitalization of Super Profit Method – Here, the amount of goodwill is computed by simply capitalizing on the super profit.

| Goodwill = (Super Profit x 100) / Normal Rate of Return |

Note – Both the above two methods will always give the same amount of goodwill of the business at a given point in time.

Example

Assume Harry & Hermione are partners having capital worth 400,000 & 300,000, respectively. Also, at the end of the given financial year, the firm earned a profit of 90,000. The normal rate of return is 10%.

Normal Rate of Return = 10%

Capital Employed = Capital of Harry + Capital of Hermione

= 400,000 + 300,000 = 700,000

Capitalization of Average Profit

Average Profit = 90,000 (assumed as per the given data)

| Total Capitalized Value = (Average Profit x 100) / Normal Rate of Return

= (90,000 x 100) / 10 = 900,000 Goodwill = Total Capitalized Value – Net Assets = 900,000 – (400,000 + 300,000) = 2,000,000 – 700,000 = 200,000 |

Capitalization of Super Profit

Super Profit = Average Profit – Normal Profit

= 90,000 – [(700,000 x 10) / 100] = 20,000

| Goodwill = (Super Profit x 100) / Normal Rate of Return

= (20,000*100) / 10 = 200,000 |

Related Topic – 5 principles of accounting with examples

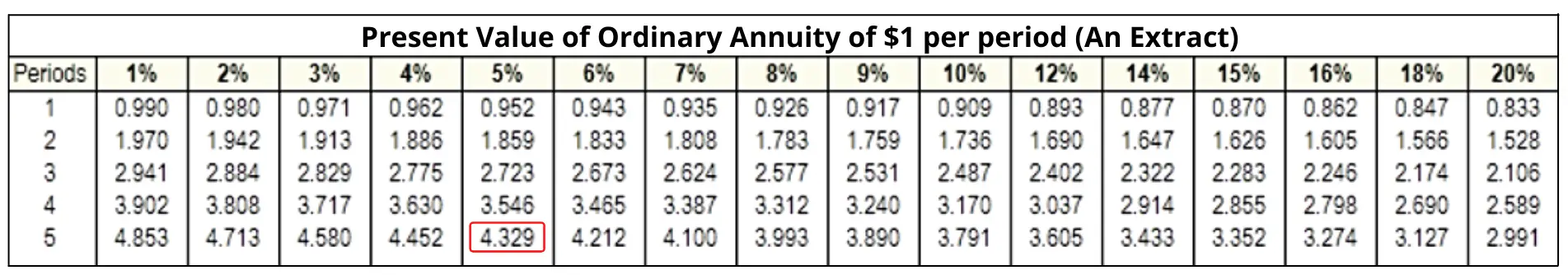

4) Annuity Method – In this method, goodwill is computed by calculating average super profit as the value of an annuity over a set number of years. Discounting at the provided normal rate of return gives the present value of this annuity.

The value of goodwill is the discounted present value of the annuity. Annuity tables may be used to determine the value of a $1 annuity.

Formula to calculate the present value of a $1 annuity

where,

- A = Present value of $1 annuity for n years

- r = Discount or Interest Rate / Normal Rate of Return (in%)

- n = number of years

Formula to compute goodwill

| Goodwill = Super Profit x Present Value of $1 Annuity |

Example

Suppose net profits after tax of KPMG International Limited for the last five years are;

| Year (Ended) | I Year | II Year | III Year | IV Year | V Year |

| Profits | 20,000 | 25,000 | 35,000 | 30,000 | 40,000 |

The amount of capital employed is 200,000 & the normal rate of return is 5%. It is also expected that the company will be able to maintain its super-profits for the next five years.

Average Profit = Total Profit / Total Number of Years

= (20,000 + 25,000 + 35,000 + 30,000 + 40,000) / 5

= 150,000 / 5 = 30,000

Normal Profit = Capital Employed x Normal Rate of Return

= 200,000 x 5 / 100 = 10,000

Super Profit = Average Profit – Normal Profit

= 30,000 – 20,000 = 10,000

Now, refer to the annuity table to look for the present value of $1 after 5 years, a @5% normal rate of return.

| Goodwill = Super Profit x Present Value of $1 Annuity

= 10,000 x 4.329 = 43,290 |

Although there is no best method for the valuation of goodwill because the method to be used depends on the situation of an individual business & its trade practices. Thus, different methods for goodwill valuation might prove to be appropriate for different kinds of businesses.

>Read Can goodwill be negative?