Closing Stock Not Shown in Trial Balance

The reason why closing stock is not shown in trial balance takes into consideration whether or not the closing stock has been adjusted with purchases or not. It is important to understand and endure so that a correct trial balance is prepared and the ledger balances are accurately checked.

It is usually shown as additional information or an adjustment outside the trial balance.

Reason

Closing stock is the leftover balance out of goods which were purchased during an accounting period. Total purchases are already included in the trial balance, Hence closing stock should not be included in the trial balance again. If it is included, the effect will be doubled.

Suppose total purchases during an accounting period inside a Trial Balance are: 10,000

Closing Stock: 2,000 (This is included in purchases already)

If both of these figures are shown in trial balance then there will be a mismatch of 2,000 because the effect has now been doubled in the trial balance.

Also, No separate account is opened for closing stock inside the general ledger. Hence, the closing stock is not to be shown in the trial balance.

Related Topic – Top Accounting Interview Questions

Exception

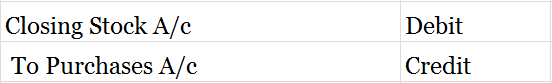

The only instance when closing stock will appear in trial balance is when the closing stock is adjusted against purchases with the below-mentioned journal entry.

This nullifies the double effect as closing stock & purchases are now adjusted and are treated separately.

>Read How to Calculate COGS (Cost of Goods Sold)?