Definition of Trial Balance in Accounting

As per the accounting cycle, preparing a trial balance is the next step after posting and balancing ledger accounts. It is a statement of debit and credit balances that are extracted on a specific date.

It is made as an attempt to prove that the total of ledger accounts with a debit balance is equal to the total of ledger accounts with a credit balance. As the name suggests, it is an actual “trial” of the debit and credit balances, they should be equal.

A journal and a ledger are maintained according to the double-entry concept of accounting. In a trial balance, the sum of debits and credits must match.

Related Topic – What is a Debit Balance & Credit Balance?

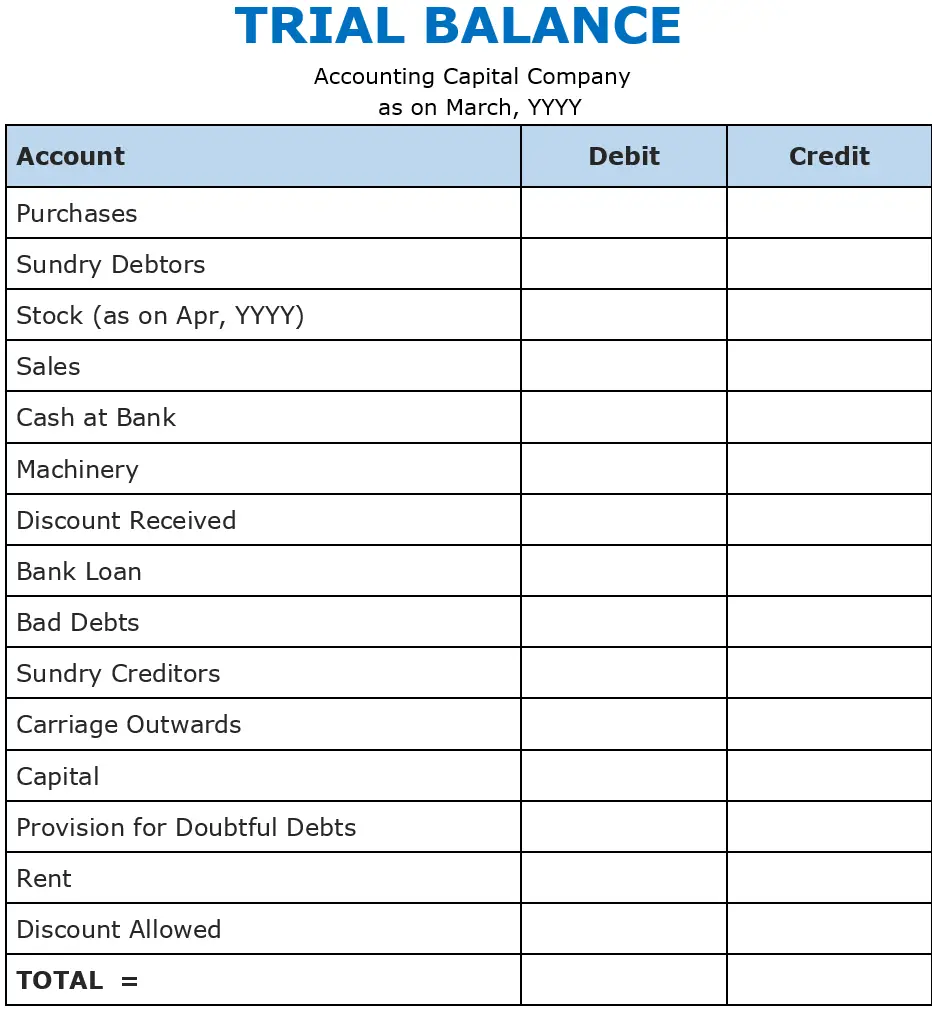

Sample Format of Trial Balance with PDF Download

The format of trial balance mainly consists of 3 columns

The suffix “Account” or “A/c” may or may not be written after the account names.

Related Topic – What is an Adjusted Trial Balance?

Use of a Trial Balance

- It acts as a base to create the final accounts of a business such as an Income statement, a Trading A/C, and a Balance Sheet.

- To prepare a trial balance it is important to ensure the arithmetic conceptual accuracy. Due to the dual aspect of accounting, the sum of total credits should be equal to the sum of total debits.

- Due to its accuracy, tallied Trial Balances offer significant peace of mind regarding the accuracy of ledger balances.

- It acts as a summarized form of all ledger balances, in case the debit and credit balances do not match then it is concluded that there is some error and the difference is temporarily transferred to a “Suspense A/C” and corrected afterwards.

- Auditors may decide to use it and transfer the account balances onto their auditing software. They can then perform various different kinds of inspections.

Debit and Credit Accounts

In order to provide a summary statement view of the balances of various accounts, the trial balance is prepared. This also indicates the correct nature of the balances of different accounts. A general rule to follow here is;

- Assets & Expenses shall have a Debit Balance.

- Liabilities & Incomes shall have a Credit Balance.

The reason or logic behind the above rule is to keep the accounting equation in balance and this is the convention commonly followed. The accounting equation is A = L + E, or assets equal liabilities plus equity. The concept is based on the understanding that all assets of a business are either the financial right of the creditors (liabilities) or the owner (equity) in different proportions.

To balance the equation, a double-entry system with debits and credits is used. A debit increases the asset balance while a credit increases the liability or equity. This is required because they are on different sides of the accounting equation. This results in the majority of asset accounts having debit balances, and the majority of liability and equity accounts having credit balances.

Also, expenses cause the owner’s equity to decrease. Since the owner’s equity’s normal balance is a credit balance, an expense must be recorded as a debit. Similarly, incomes cause the owner’s equity to increase, and hence an income is recorded as a credit.

The following are a few examples of different accounts and their natural balance. Items that appear on the debit side of the trial balance:

- Land and Buildings

- Plant and Machinery

- Furniture and Fixtures

- Office Tools and Equipment

- Cash at Bank

- Cash in Hand

- Motor Van

- Loss from the sale of fixed assets

- Travelling charges

- Printing and postage expenses

Items that appear on the credit side of the trial balance:

- Capital Account

- Sundry Creditors

- Bank Overdraft/Loan

- Bills Payables

- Sales (Revenue)

- Purchase Returns

- Common stock

- Un-earned revenues

- Retained earnings

- Interest Received

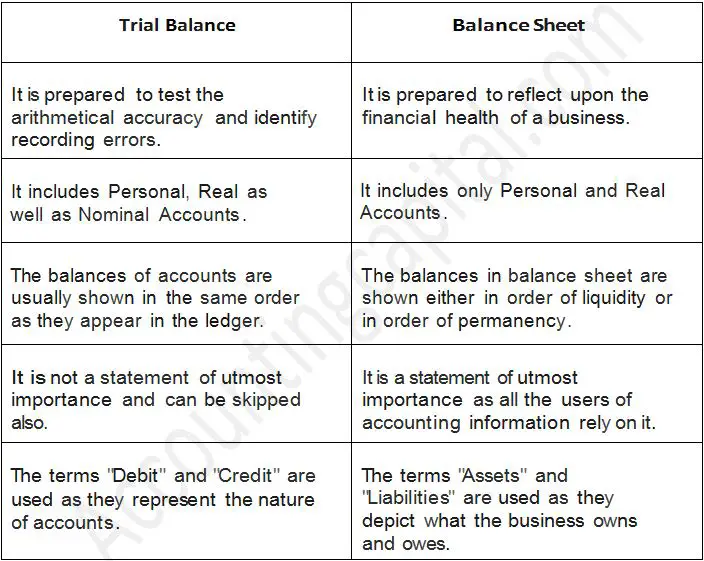

Trial Balance and Balance Sheet

A Trial balance is a summary of balances of all accounts recorded in the ledger. It is prepared at the end of a particular period to indicate the correct nature of the balances of various accounts. A balanced trial balance ascertains the arithmetical accuracy of financial records.

A balance sheet is a statement that represents the financial position of a business on a particular date. All assets and liabilities are presented in the balance sheet in a classified form. Thus, it is a summary of the complete accountancy record. A balance sheet helps the user quickly get a handle on the financial strength and capabilities of the business along with its weaknesses.

Both the trial balance and the balance sheet are very crucial to the financial statements as a whole as they serve different purposes. A Trial balance is used-

- To check the arithmetical accuracy of the ledger accounts

- To locate errors in recording

- To provide a basis for preparing the financial statements

A Balance sheet is used-

- To know the actual financial standing of a business on a given day

- To ascertain and identify the trends in a business

- To project and make provisions for future probable setbacks

A trial balance and a balance sheet may seem similar as they both are the description of accounts and not the accounts themselves. Both are statements and are prepared at a particular point in time. But, they are actually very different as explained in the following table:

Short Quiz for Self-Evaluation

>Read How to prepare a trial balance from ledger balances?