-This question was submitted by a user and answered by a volunteer of our choice.

What is Petty Cash Book?

A petty cash book is a specialized accounting ledger used to record small and miscellaneous expenditures that are typically paid for in cash. It helps in maintaining a record of all such expenses in an organized manner.

The petty cash book helps in tracking small expenditures efficiently and provides accountability for cash transactions that might otherwise be difficult to monitor. It also simplifies the process of auditing and ensures that small expenses are properly documented for financial reporting purposes.

Features of Petty Cash Book

Petty Cash Book allows for the systematic recording of minor expenditures, ensuring that even the smallest transactions are documented and accounted for.

The petty cash book helps maintain control over cash disbursements by providing a clear record of who authorized the expenses and for what purpose.

It provides a detailed record of cash expenditures, which is essential for accurate financial reporting and budgeting.

The petty cash fund can serve as a readily available source of cash for unforeseen or emergency expenses, providing liquidity when needed.

The petty cash book is usually maintained by a petty cash custodian or administrator within an organization.

The petty cash book typically follows a simple format, often divided into columns for date, description of expense, amount spent, and columns for various expense categories.

Balance of Petty Cash Book

Balance of the petty cash book is an asset and not income. The logic behind the answer is that petty cash book is one of the types of cash book and petty cash book records expenses and incomes which is similar to cash book. Since a cash account is considered an Asset, a petty cash book which is a part of a cash book is also an asset.

The balance of petty cash book is never closed and their balances are carried forward to the next accounting period which is considered as one of the most significant qualities of an asset whereas Income doesn’t have any opening balance and their balances get closed at the end of every accounting year.

Petty cash book is placed under the head current asset in the balance sheet. The Closing Balance of the petty cash book is computed by deducting Total expenditure from the Total cash receipt (as received from the head cashier).

Example Problem

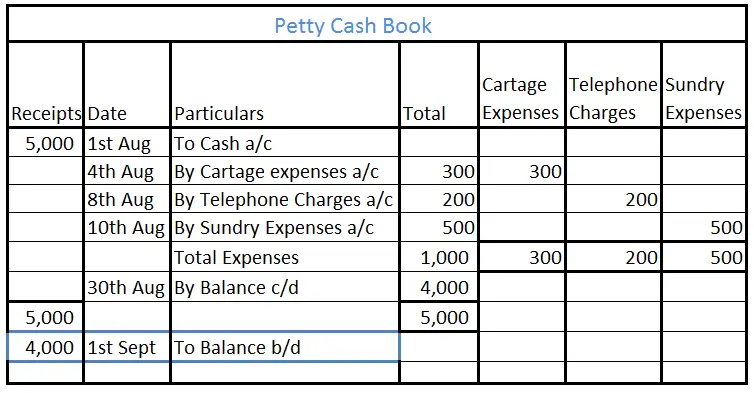

Prepare Petty Cash Book of Alex & Max Co. from the following information as provided below

| Date | Particulars | Amount |

| 1st Aug | Received cash from head cashier | 5,000 |

| 4th Aug | Paid Cartage expenses | 300 |

| 8th Aug | Telephone charges paid | 200 |

| 10th Aug | Paid Sundry expenses | 500 |

Petty Cash Book of Alex & Max Co.

Conclusion

Thus, the balance of the petty cash book is an asset and not income.

the balance of the petty cash book is classified as an asset because it represents the remaining cash available for small expenses within the organization and is essential for maintaining liquidity and facilitating day-to-day operations.

It is not considered income or revenue because it does not result from the organization’s primary revenue-generating activities.