-This question was submitted by a user and answered by a volunteer of our choice.

Negative Goodwill

Yes, I believe goodwill can have a negative balance. We call this negative goodwill “Bargain Purchase“.

It’s a difference between the purchase price paid for an asset and its actual fair market value. Although you should know that it’s an extremely rare case scenario.

Negative Goodwill v/s Goodwill

I think if you get an idea of the difference between the two you will be in a better position to understand why it arises and what exactly does it mean.

- Negative goodwill is exactly opposite to goodwill as while goodwill is favourable for the seller the bargain purchase is not favourable for his company

- Negative goodwill arises when the purchase price of an asset is lower than its market value.

- Whereas in the case of goodwill the purchase price is higher than its market value. To simply state it goodwill is a premium paid by the buyer for the assets of such another company.

- While negative goodwill is favourable to the buyer the positive goodwill is favourable to the seller.

In case of a bargain purchase, the Purchase Price of an Asset < its Fair Market Value

the above statement could be interpreted with the help of a below-mentioned example

The company ABC faced financial distress for a few years and hence the board of directors had only 2 alternatives left i.e either to sell the company or file for liquidation. The company was hence sold for an amount lower than its fair market value

It is reflected from below mentioned illustration

| Particulars | Purchase Value | Fair Market Value |

| Inventory | 20,000 | 40,000 |

| Trade Receivables | 40,000 | 46,000 |

| Cash and Bank Balance | 50,000 | 65,000 |

| Property plant and equipment | 1,50,000 | 155,000 |

| Patents and Copyrights | 25,000 | 35,000 |

| Assets | 285,000 | 3,41,000 |

| Long term Debts | 65,000 | 60,000 |

| Trade Payables | 20,000 | 30,000 |

| Liabilities | 85,000 | 90,000 |

| Net Assets | 2,00,000 | 2,51,000 |

You would doubt that even though the goodwill can have a negative balance how shall it be presented in the Financial Statements.

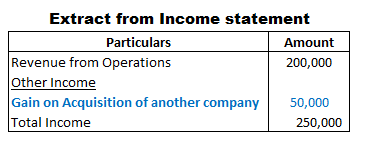

Negative Goodwill in an income statement

It should be recognized as a “gain on acquisition “ in the income statement of an acquirer.

The below image would be of some help-

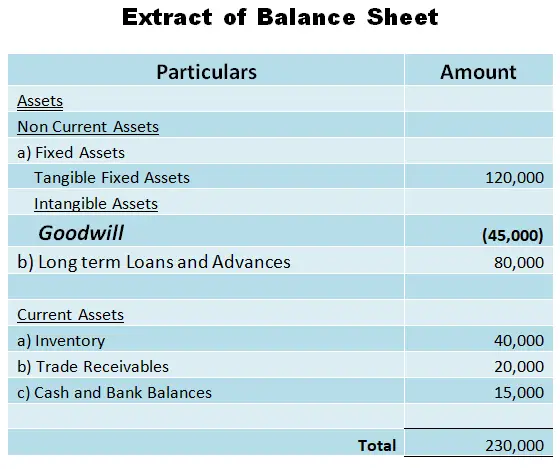

Negative Goodwill in a Balance Sheet

It can be shown as a part of liability or as a negative balance in the books of Seller Company since it is unfavourable for such company whereas goodwill is shown as an intangible asset. Alternatively, such a negative balance can also be shown as a negative balance under the intangible asset.

I generally follow the alternative approach to present negative goodwill under the head of intangible assets but you can follow any method you are comfortable with since both are acceptable in the industry.

If you are still confused about how to present negative goodwill in a balance sheet perhaps the below-stated example may be of some help