-This question was submitted by a user and answered by a volunteer of our choice.

Examples of Bank Reconciliation Statement

Illustration 1,

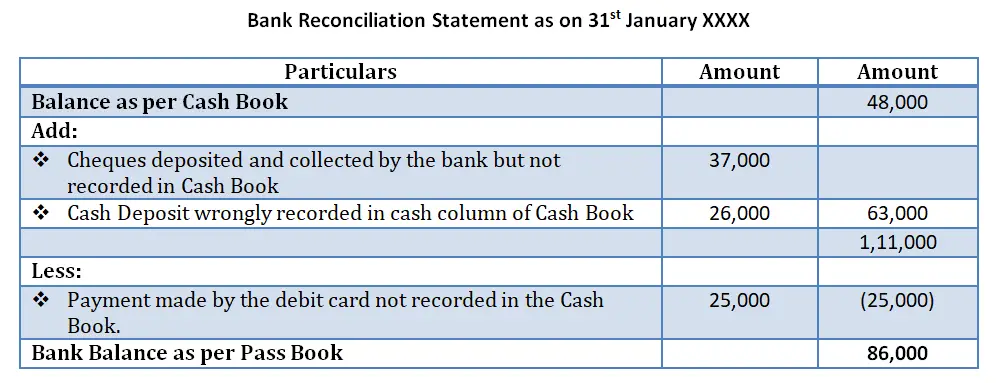

From the following particulars prepare a Bank Reconciliation Statement on 31st January XXXX

- Debit Balance as per Cash Book 48,000.

- A cheque of 37,000 was deposited and collected by the bank but not recorded in Cash Book.

- Purchased Furniture and payment by the debit card 25,000, was not recorded in Cash Book.

- A cash deposit of 26,000 was recorded in the cash column of Cash Book.

Solution:

Illustration 2

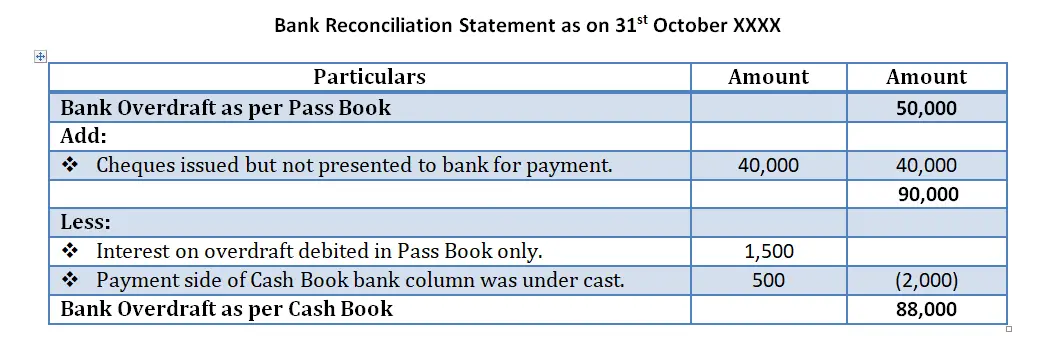

From the following particulars prepare a Bank Reconciliation Statement on 31st October XXXX

- Pass Book of Ms Jane shows an overdraft of 50,000.

- Cheques issued but not presented for payment to bank 40,000.

- Payment side, bank column of Cash Book was undercast by 500.

- Interest on overdraft charged by the bank was 1,500.

Solution:

Examples of Cash Book

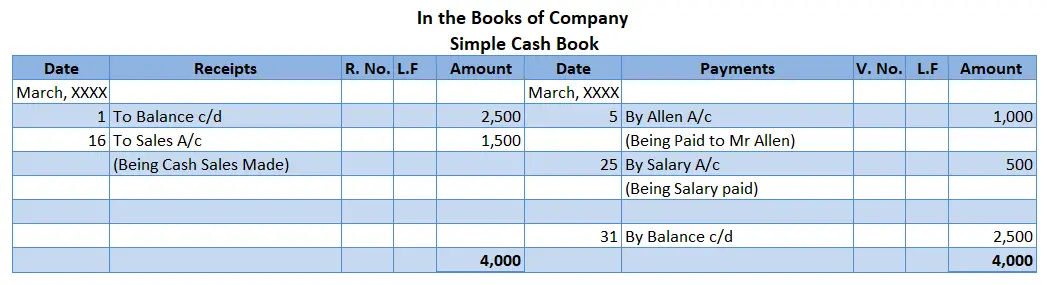

Illustration 1,

| Date | Particulars | Amount |

| 1st March XXXX | Cash in Hand | 2,500 |

| 5th March XXXX | Cash paid to Mr Allen | 1,000 |

| 16th March XXXX | Cash Sales | 1,500 |

| 25th March XXXX | Paid Salary | 500 |

Solution:

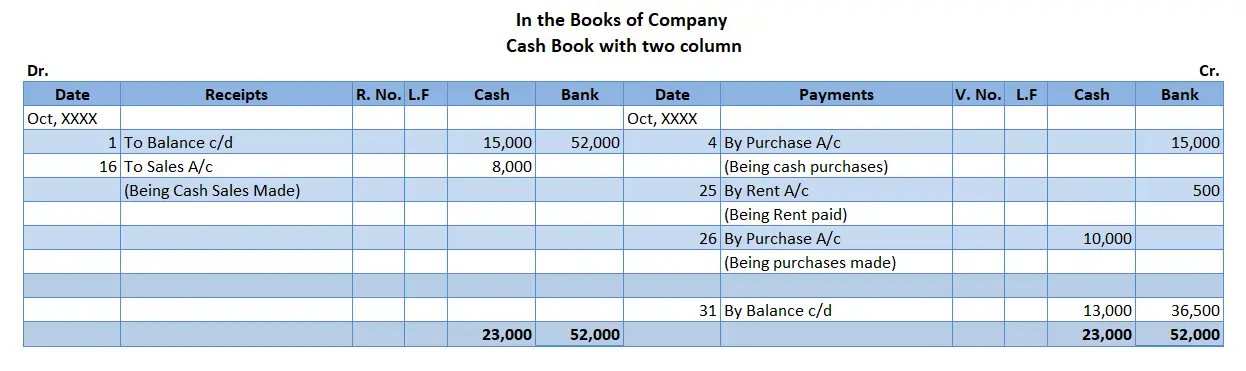

Illustration 2,

Prepare a 2 column cash book

| Date | Particulars | Amount |

| 1st Oct XXXX | Bank Balance | 52,000 |

| 1st Oct XXXX | Cash Balance | 15,000 |

| 4th Oct XXXX | Purchased goods and payment made by cheque | 15,000 |

| 16th Oct XXXX | Sold goods for cash | 8,000 |

| 25th Oct XXXX | Paid rent by cheque | 500 |

| 26th Oct XXXX | Purchased goods for cash | 10,000 |

Solution: