-This question was submitted by a user and answered by a volunteer of our choice.

Debenture Suspense Account

It’s basically a temporary account prepared by an entity to record the transaction of debenture when such an entity issues or agrees to issue a certain amount worth debentures as collateral security. As soon as the entity repays the loan taken it shall nullify the earlier agreement in simple terms pass the reversal entry.

When a company issues debentures, it may receive applications from investors. These applications might come in various forms, such as checks or electronic transfers.

It takes time for the company to process these applications, verify the funds, and issue the debentures to the investors. During this period, the company may create a debenture suspense account to temporarily hold the funds received and record the pending issuance of debentures.

The debenture suspense account is a temporary account on the company’s balance sheet. It reflects the amount received from investors for debentures that have not yet been fully processed. This account helps in maintaining accurate financial records until the debentures are issued and properly accounted for.

Once the debentures are fully processed and issued to the investors, the amounts from the debenture suspense account are transferred out and recorded appropriately in the company’s books. This might involve transferring the funds to a different account and updating the company’s records to reflect the issuance of the debentures.

Issue of Debenture as Collateral Security

When an entity has to borrow funds from a bank or a financial institute such bank or financial institute shall not grant such loan amount until the entity provides some collateral security in order to safeguard its interest. Bank shall always prefer to have as collateral the physical assets than any alternative means.

But if such physical asset does not cover the amount of loan as collateral then the entity will issue the debentures as secondary security.

When an entity default in making payment of interest or principal amount of loan then the bank will first realize such amount outstanding by discharging the primary asset and if it does not cover the entire amount then the bank will have no choice but to claim its rights over the debentures so issued by the entity.

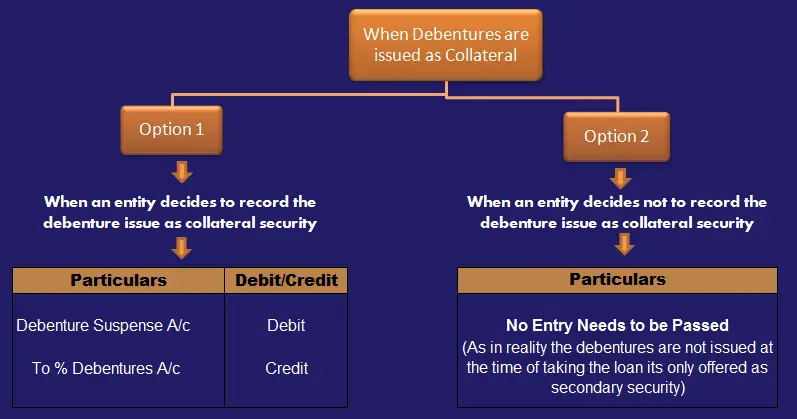

When the debentures are issued as collateral the entity has two options –

At the end of the accounting period the Debenture Suspense Account will be subtracted from Debentures Account on Equities and Liabilities side of the Balance Sheet.

At the time of repayment of the loan the entries passed above will be reversed.

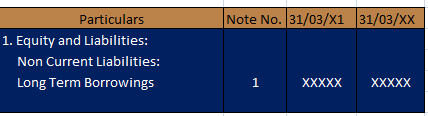

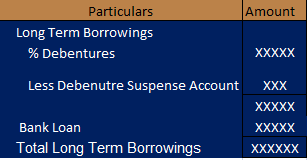

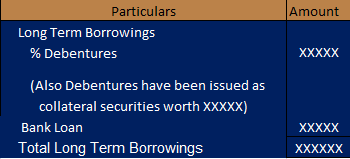

The Debentures issued as collateral security shall be shown in the balance sheet if the company follows Option 1 as:

Extract of Balance Sheet as on 31/03/XXXX

Notes to Accounts:

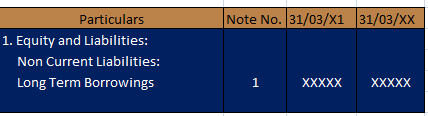

The Debentures issued as collateral security shall be shown in the balance sheet if the company follows Option 2 as:

Extract of Balance Sheet as on 31/03/XXXX

Notes to the Accounts

It is preferable to use option 1 as the entity has some evidence and records of such transaction. Even though in actuality no amount was received by the entity at the time of transacting it.

I hope it was informative.

Aastha.