-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of Net Current Assets

To understand net current assets, we need to understand current assets and current liabilities.

Current assets are those assets that are used for operating activities and it is used within a year. It is liquid and easily converted into cash. An example of the current asset will be inventory.

Current liabilities are those liabilities that need to be fulfilled by the company within a year. It is a short-term financial obligation. Usually, current assets are used to cover the current liabilities. An example of current liabilities will be short-term borrowing.

Net Current Assets is the difference between total current assets and current liabilities. It is also called working capital. This shows the company’s liquidity position to cover short-term obligations.

There are different types of working capital: gross working capital, net working capital, positive and negative working capital, cyclical working capital, etc.

The Net Current Assets can have a positive or a negative value, wherein the two are an indicator of the well-being of a business. In case the current assets are greater than the current liabilities, the company possesses sufficient assets to pay off its indebtedness and is operating efficiently.

However, a company is said to be facing financial difficulty and is not in a position to pay off its debts when the value of net current assets is negative.

Calculation of Net Current Assets: Formula

The formula is as follows:

![]()

where;

Total current assets = Cash and Cash Equivalents + Stock + Marketable Securities + Prepaid Expenses + Accounts Receivable + Other Liquid Assets

Total current liabilities = Current Portion of Long-term Debt + Notes Payable + Accounts Payable + Accrued Expenses + Unearned Revenue + Other Short-term Debt

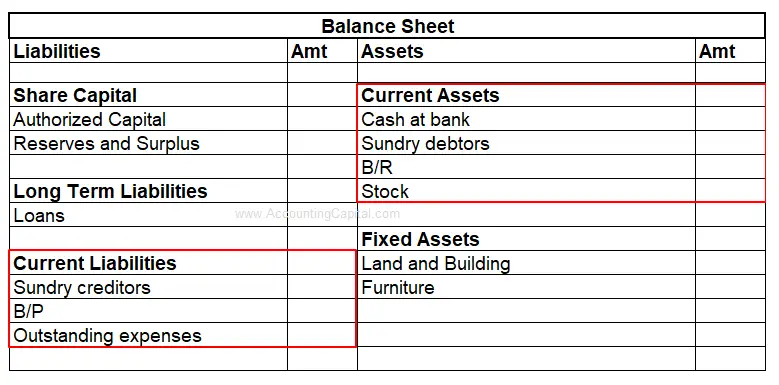

- On the balance sheet, the total current assets are listed under the heading current assets.

- On the other hand, the total current liabilities are shown on the balance sheet under the heading current liabilities.

On the balance sheet, components of net current assets i.e., current assets and current liabilities appear on the asset side and liability side respectively.

Current assets are directly proportional to net current assets whereas current liabilities are inversely proportional to net current assets.

Example

Calculate the Net Current Assets of ABC Ltd.

(Extract of Balance Sheet)

| PARTICULARS | AMOUNT |

| CURRENT ASSETS | |

| Cash and Cash Equivalents | 2,00,000 |

| Accounts Receivables | 40,000 |

| Stock Inventory | 15,000 |

| Marketable Securities | 35,000 |

| Prepaid Expenses | 6,000 |

| TOTAL CURRENT ASSETS | 2,96,000 |

| CURRENT LIABILITIES | |

| Accounts Payable | 15,000 |

| Accrued Expense | 2,000 |

| Unearned Revenue | 20,000 |

| Taxes Payable | 40,000 |

| Short-term Debt | 10,000 |

| Interest Payable | 6,000 |

| TOTAL CURRENT LIABILITIES | 93,000 |

Solution:

Total current assets = 2,96,000

Total current liabilities= 93,000

Net Current Assets = Total Current Assets – Total Current Liabilities

= 2,96,000- 93,000

= 2,03,000

Key Takeaways

- Net Current Assets are also known as Net Working Capital.

- Net Current Assets is the difference between the total current assets and total current liabilities.

Net Current Assets Vs Current Assets

| Basis | Net Current Assets | Current Assets |

| Meaning | It is the difference between total current assets and total current liabilities |

As the name implies, current assets refer to short-term assets that will be used, sold or converted to cash within one year by a company. |

| Formula | Current Assets – Current Liabilities+ | Cash and Cash Equivalents + Stock + Marketable Securities + Prepaid Expenses + Accounts Receivable + Other Liquid Assets |

| Other Name | It is also known as working capital. | It is also known as liquid assets. |

Conclusion

The net current asset or working capital helps with ratio analysis. This helps in showing the creditworthiness of the company, especially the company’s financial trust. This will help in the overall confidence of the shareholders and the creditors.

It also helps in funding growth initiatives, like research and development and starting a new line of products.

Working capital is also very useful for risk management.