-This question was submitted by a user and answered by a volunteer of our choice.

Meaning of days sales outstanding

Days sales outstanding (DSO) refers to the average number of days the receivables from credit sales remain outstanding in the books of accounts before they are converted to cash.

A high DSO portrays that the time interval between credit sales and cash receivables is very long and might lead to problems in the cash flow of the company while on the other hand, a low DSO shows that the company is able to collect the amount in fewer days.

It is important to note here that the formula for DSO is applicable only in relation to the credit sales of the company.

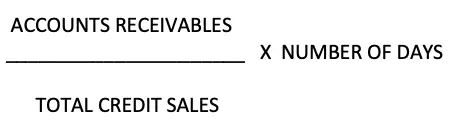

The formula to calculate days sales outstanding is as follows;

DSO can be calculated on a monthly, quarterly, or yearly basis depending on the terms of the company.

Example

XYZ Ltd. made credit sales amounting to 7,00,000 in October, out of which 4,00,000 are yet to be received. As there are 31 days in October, the DSO for XYZ Ltd. shall be calculated as follows:

DSO = Accounts receivables/ Total credit sales x No. of days

= 4,00,000/7,00,000 x 31

= 17.7 days

In my opinion, 17.7 days is a low average turnaround for a company to collect cash from accounts receivables in a month and hence portrays a good DSO however, it varies from company to company what they consider to be a high or low DSO.