-This question was submitted by a user and answered by a volunteer of our choice.

Closing Stock refers to the unsold goods held at the end of the financial year. To ascertain the true financial position of a company it is necessary to adjust the closing stock at the end of an accounting year.

Closing stock is crucial for accurate financial reporting because it impacts the calculation of the cost of goods sold (COGS) and the determination of a company’s gross profit. It is typically valued at either its cost price or its net realizable value, whichever is lower, in accordance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

Closing stock is reported on the balance sheet under the current assets section, as it represents inventory that a company expects to sell in the near future. Properly managing and valuing closing stock is essential for correct financial reporting and assessment of a company’s financial health.

The valuation and management of closing stock directly impact a company’s profitability. Proper management ensures that inventory is neither overvalued nor undervalued, which can affect the calculation of profits and taxes.

Tracking closing stock helps businesses manage their inventory levels effectively. It provides insights into which products are selling well and which may be slow-moving, allowing businesses to adjust their purchasing and sales strategies accordingly.

In many cases, closing stock requires a physical count of inventory items to accurately determine their quantity and condition at the end of the accounting period.

The formula to calculate closing stock is:

Closing Stock = Opening Stock + Purchases – Cost of Goods Sold

Where:

- Opening Stock is the value of inventory at the beginning of the accounting period.

- Purchases represent the total value of inventory purchased during the accounting period.

- Cost of Goods Sold (COGS) is the total cost of inventory sold during the accounting period.

Adjustment entry of closing stock

The closing stock generally does not appear in the trial balance and is seen as an adjustment entry. We need to pass an adjusting entry before the preparation of final accounts. It is important to note that an adjustment entry is always recorded twice in the books of accounts therefore, the two ways of recording the same for closing stock are as follows:

1. Credit side of the trading account.

2. The asset side of the balance sheet.

Example

The closing stock of ABC Ltd. amounts to 40,000. The journal entries in the books of the company are as follows;

| PARTICULARS | AMOUNT | |

| Closing stock a/c | Debit | 40,000 |

| To Trading a/c | Credit | 40,000 |

(being closing stock adjusted)

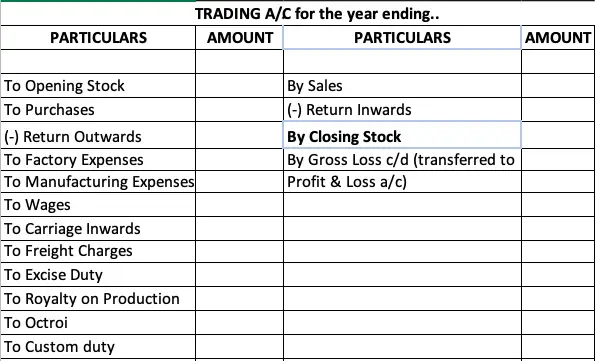

Placement of closing stock in the trading a/c

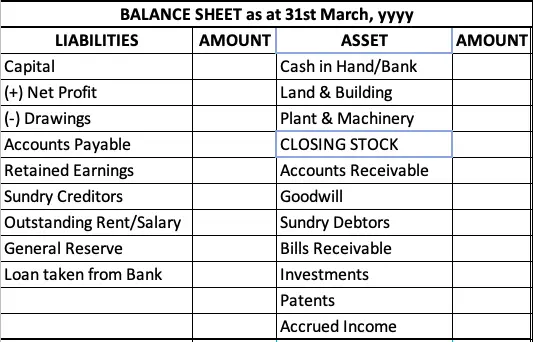

Placement of closing stock in the balance sheet

Note: Sometimes, adjusted purchases are given in the trial balance which indicates that the opening as well the closing stock have been adjusted through purchases. It is important to note here that the closing stock will only be recorded on the asset side of the balance sheet and will not appear in the trading a/c.

Hope this helps.