-This question was submitted by a user and answered by a volunteer of our choice.

Before answering this question you should first have a glance over the concept of interest on capital.

Interest on Capital

An organisation or an entity is considered separate from its partners or proprietor or shareholders for that matter.

Since the capital brought in by the partners and proprietor is an obligation for an entity thus the interest payable to the partners or proprietor for that matter is considered as an expense of the firm or an entity. Had not the partners or sole owner brought in the capital the firm or the organisation would have borrowed such amount externally and so, it would have to incur a certain financial charge.

Adjustment of Interest on Capital in the Financial Statement

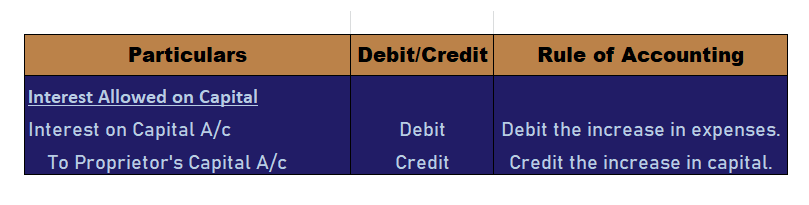

Where the capital is introduced by the sole proprietor the transaction will be journalised as

Interest when due;

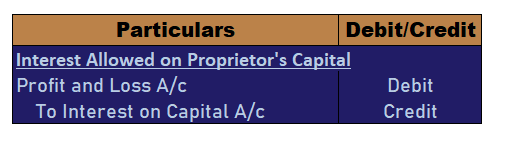

Interest on capital transferred to profit and loss statement

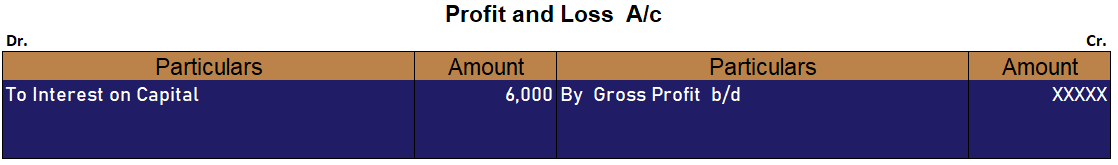

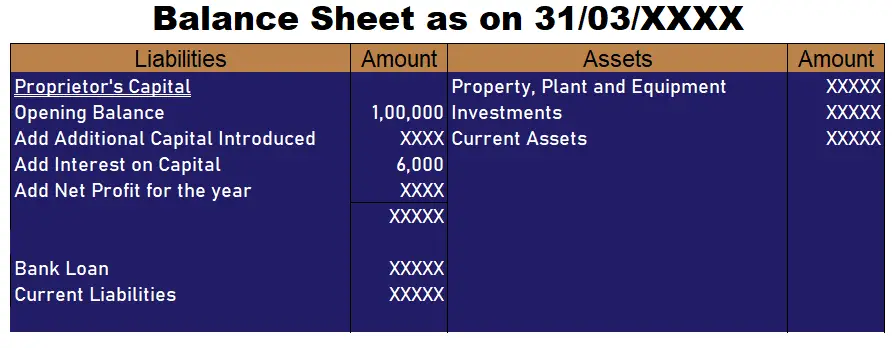

Thus, ultimately the profit of the firm is reduced as such interest is treated as an expense and hence debited in the profit and loss statement and it is shown in the balance sheet by increasing the capital on the liability side of the balance sheet by that amount.

For Example;

Mr John is a dealer in the smartphone has introduced capital worth 1,00,000 and the firm shall pay interest @ 6% p.a. at the end of the year.

It will be displayed in the profit and loss statement as;

It will be displayed in the balance sheet as;

Interest on capital is provided out of profits only. Thus in case of loss, no interest is provided.

In the case of a partnership firm –

If the firm maintains Fluctuating Capital i.e all entries in respect of salary, interest, profit earned and drawings of partners are transacted through the partner’s capital A/c.

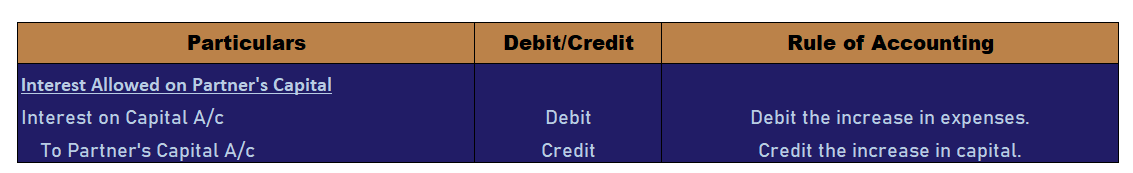

Thus, where an entity maintains only partners capital account the interest on capital shall be journalised as;

Interest on capital due;

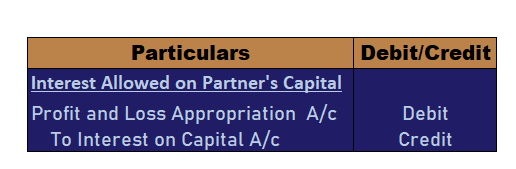

Interest on capital transferred to profit and loss appropriation statement;

Some entities prefer showing the partner’s capital accounts with the same old figures i.e no entries in respect of salary, interest, profit earned and drawings of partners are transacted through the partner’s capital A/c.

A separate account is to be opened for the same called “Partner’s Current Account”. The interest on capital here shall be calculated only on fixed capital.

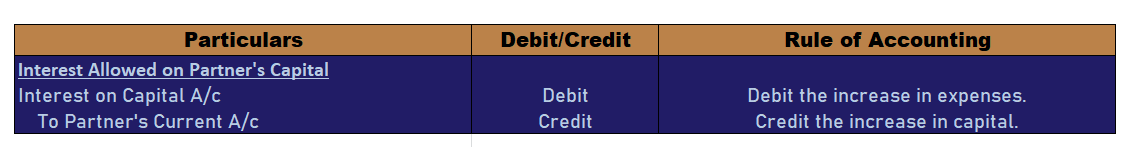

In this case, such a transaction shall be journalised as;

Interest due on capital

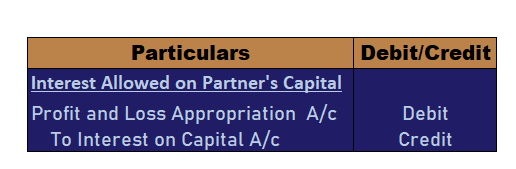

Interest on capital transferred to profit and loss appropriation statement;

Thus, ultimately the profit of the firm is reduced as such interest is treated as an expense and hence debited in the profit and loss appropriation statement and it is shown in the balance sheet by increasing the partner’s capital/ current a/c on the liability side of the balance sheet by that amount.

The example given below will be of some help to interpret the above paragraph.

An entity has 2 partners – Alex and Anna at the beginning of the year both have introduced a capital of 100,000 each and it was agreed in the partnership deed that the partners will charge interest @ 12% p.a. every year at the end of the year.

Hence, the interest of 24,000 (100,000 x 12% p.a x 2 partners) shall be transacted in the balance sheet and Profit and loss statement as;

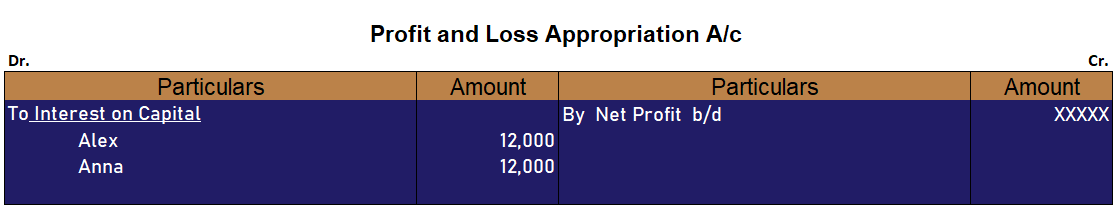

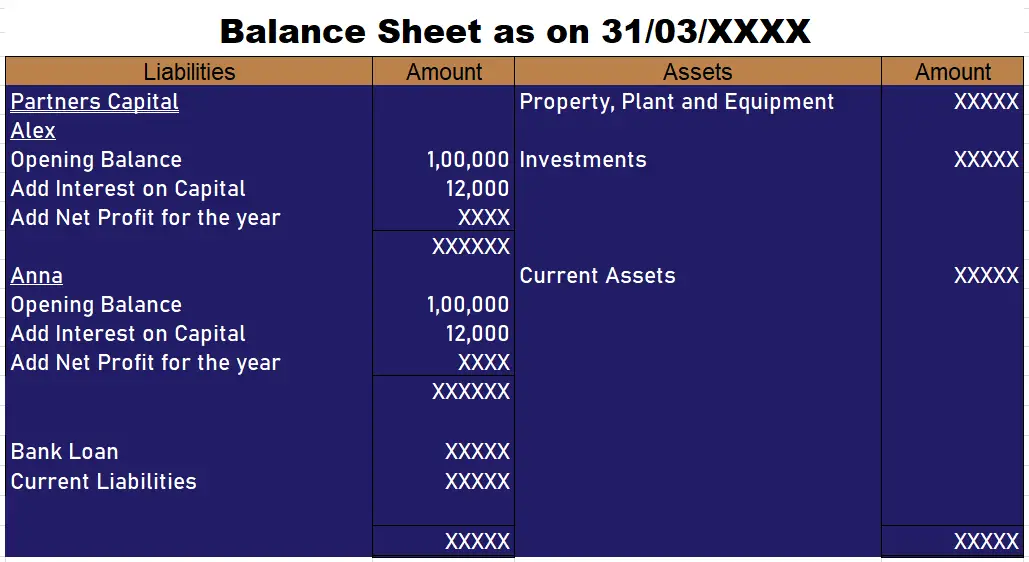

If the firm maintains partners capital account only;

Adjustment in profit and loss appropriation statement

Extract of Profit and Loss Appropriation Account;

Adjustment in a balance sheet

A snippet of the balance sheet is given below

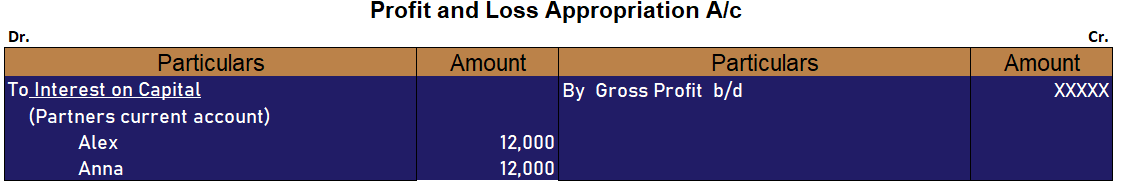

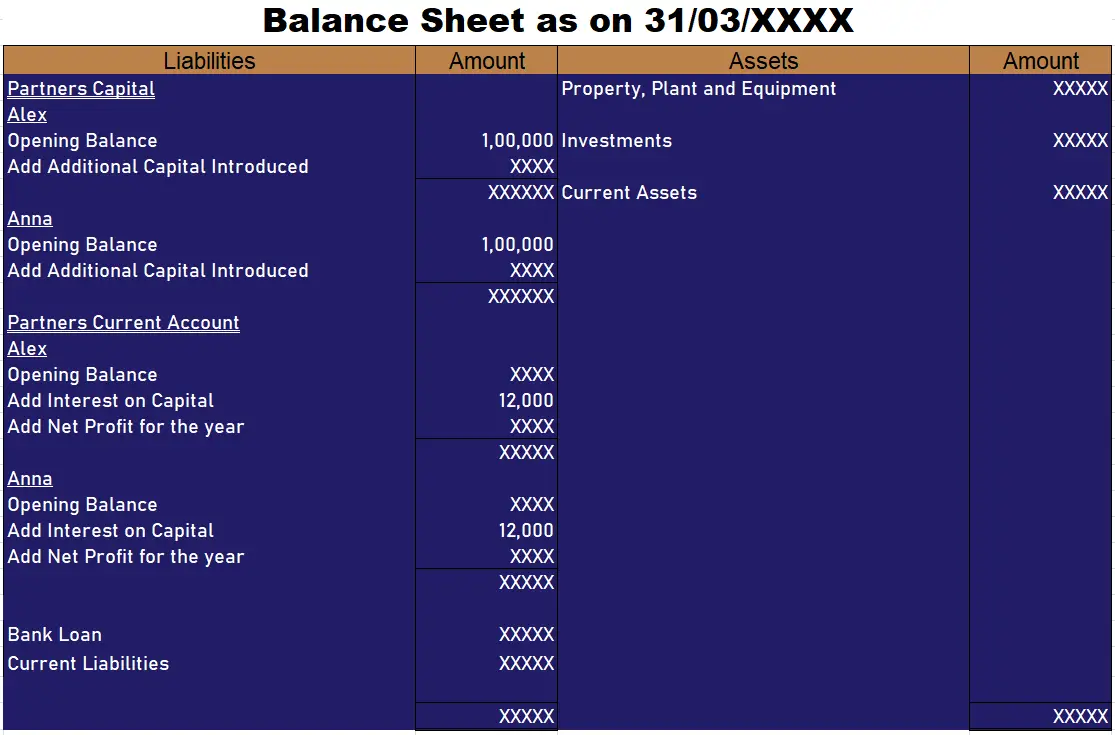

If the firm maintains partners capital account and partners current account

Adjustment in profit and loss statement

Extract of Profit and Loss Appropriation Account;

Adjustment in a balance sheet

A snippet of the balance sheet is given below

I have tried simplifying it as much as I could. I hope this helps.