-This question was submitted by a user and answered by a volunteer of our choice.

For a better understanding of the concept, let us first have an insight into the meaning of debit and credit accounts.

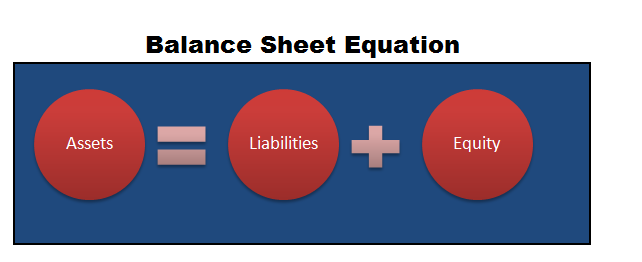

The following image shows the Balance Sheet Equation:

In the above equation, all the accounts covered on the left-hand side of the equation are classified as debit accounts, and on the right-hand side are classified as credit accounts.

In other words, Assets are classified as Debit accounts, which means that all the asset accounts would always have a debit balance.

On the other hand, Liabilities and Equity are classified as Credit accounts, which means that all Liability accounts and Capital account would usually have a credit balance.

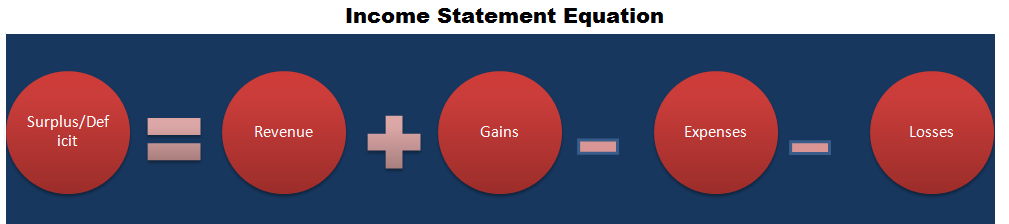

The Income Statement Equation is given below:

In the Income Statement, Surplus, gains, and revenue are credit accounts, and expenses, losses, or deficits are debit accounts.

The Golden Rules of Accounting may also help in getting a better insight into the concept:

| NATURE OF ACCOUNT | RULE |

| Real Account | Debit what comes in, Credit what goes out |

| Nominal Account | Debit all expenses and losses, Credit all incomes and gains. |

| Personal Account | Debit the Receiver, Credit the Giver. |

Debit Balance

In simple terms, while balancing the ledger when the Debit side total > Credit side total the difference = Debit Balance. Most of the time, it maintains a “positive balance”.

This is because when you add a debit to a debit it gives you a debit i.e. when you add a positive number with another positive number you get a higher positive number and when you add a credit to a debit it reduces the debit balance. But in most cases, it remains positive.

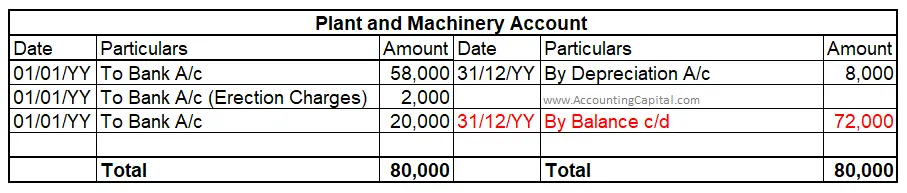

Let us take up the example of a Plant and Machinery account. Even though we credit the depreciation from this account, the balance remains positive.

Credit Balance

In simple terms, while balancing a ledger Credit side total > Debit side total the difference = credit balance. All the credit accounts, most of the time maintain a credit balance i.e. they have a “negative balance”.

This is because when you add a credit to another credit you get a higher balance of credit. Similarly, when you debit the credit account it reduces the credit balance. But most of the time it still gives a credit balance i.e. remains negative. However, we do not put a negative sign while we account for it.

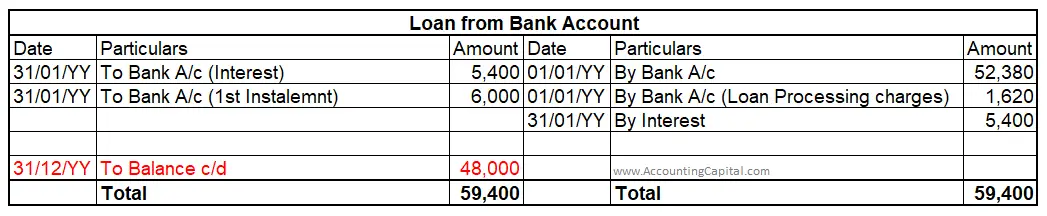

The ledger given below might be of some help to understand this better:

Conclusion

The following are the key takeaways from the article:

- Assets are classified as Debit accounts, which means that all the asset accounts have a debit balance.

- On the other hand, Liabilities and Equity are classified as Credit accounts, which means that all Liability accounts and Capital account would usually have a credit balance.

- While balancing a ledger if the Credit side total > Debit side total the difference then there is a credit balance.

- However, while balancing the ledger when the Debit side total > Credit side total the difference there is a Debit Balance.