-This question was submitted by a user and answered by a volunteer of our choice.

Depreciation as an Operating Expense

Yes, depreciation is an operating expense.

To understand this you might want to check the illustrative case given below;

You have an entity providing financial services to your clients. You had commenced it 4 years ago. At the time of the commencement of the operations you had 25 employees and laptops being the core assets of your business, were purchased by you for your team initially.

After 4 years do you still believe that if you dispose of these laptops or you decide to replace them you will get the same amount you had spent initially for purchasing them or could they have the same features and technology that a newly launched laptop currently has or uses?

The answer to this is Obviously Not. The new laptop available in the market will have better features and might be faster. Also, these used laptops shall not possess the same value at the time of their replacement.

I will have a quick run over the concept of “What is Depreciation?”

Depreciation is nothing but a diminution in the value of an asset, due to natural wear and tear, exhaustion of subject matter, effluxion of time accident, obsolescence or similar causes.

Assuming you have received an answer but you still don’t get the logic for treating it as an operating expense the below-given para may be of some help.

An operating expense is an expense that a business incurs for carrying on its normal operations. Hence, since depreciation is charged on an asset that’s used for day-to-day business operations it is covered under operating expense even though it’s a non-cash expense.

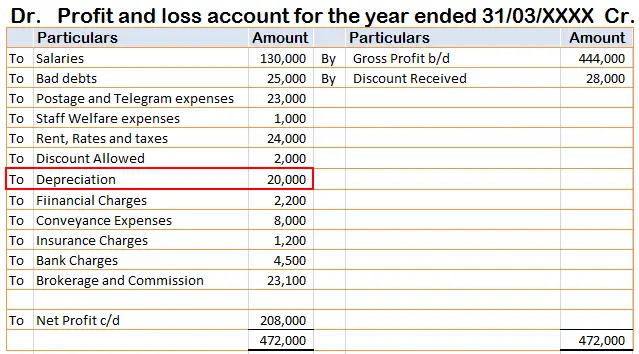

Based on the above para you would agree that all the operating expenses are presented on the debit side of profit and loss or an income statement. And since depreciation is related to an asset used for manufacturing or providing service or aiding business for that matter it is an operating expense and so it shall also be presented on the debit side of an income statement.

You can check the profit and loss statement added below for a better understanding of the treatment of depreciation in the income statement.

The depreciation can be treated as a non-operating expense only in specific circumstances where the assets are not used for the main operations of the business. When such an asset is used for an incidental operation then we treat depreciation as a non-operating expense.

>Related Long Quiz for Practice Quiz 28 – Operating Expense