-This question was submitted by a user and answered by a volunteer of our choice.

Yes, investments are assets.

First, let me familiarize you with the meaning of the term investments in order to understand its nature.

Meaning of Investments

Investments are assets or resources owned and controlled by entities. They provide future economic value to entities. They are held with an intention to generate additional income or to benefit from the appreciation in value over time.

Examples of investments

1. Investment in Mutual funds

2. Investment in Government securities

3. Investment in Debentures & Bonds

4. Acquiring Shares of companies

5. Acquisition of Land & Building to earn rentals or for capital appreciation

6. Investment in Subsidiaries, Associates, and Joint Venture

Analyzing the meaning of investments themselves, we can conclude that investments are assets for entities acquiring them.

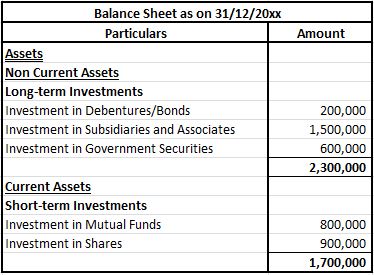

Presentation of Investments in Financial Statements

1. Long-term Investments

Investments that are held for more than a period of 1 year are termed as Long-term Investments.

Examples

a. Investment in Real Estate to earn rentals or for capital appreciation

b. Purchase of Debentures or Corporate/Government Bonds having a maturity period of more than a year

c. Investment in Subsidiaries, Associates or Joint Venture

Treatment in Financial Statements

| Financial Statement | Treatment |

| Balance Sheet | Presented as Long-term Investments in the balance sheet under the head “Non-Current Assets” |

2. Short-term Investments

Investments that are held with an intention to dispose off within a period of 1 year are referred to as Short-term Investments. They are held primarily for the purpose of trading. They are also known as Marketable Securities.

Examples

a. Investment in Mutual Funds

b. Acquisition of Shares of companies

Treatment in Financial Statements

| Financial Statement | Treatment |

| Balance Sheet | Presented as Short-term Investments in the balance sheet under the head “Current Assets” |

An extract of the balance sheet has been attached for a better understanding of the presentation of investment.