Overview of Purchase Ledger Control Account

Purchase Ledger Control Account (PLCA) is a summarized ledger of all the trade creditors of the entity. This Control Account typically looks like a “T-account” or a replica of an Individual Trade Payable (Creditor) account. But instead of containing transactions of invoices, returns, and payments related to one creditor, it contains summarized transactions of invoices, returns, and payments related to all the creditors in the business.

Purchase Ledger Control Account is also referred to as a “Trade Creditors Control Account”. It indicates the total amount a business entity owes to its suppliers at a particular point in time. Therefore, it is a “short-term liability” for the business entity and forms part of the balance sheet.

Thus, Purchase Ledger Control Account is credited if its balance increases & debited if its balance decreases. The balance of the PLCA should equal the sum of the balances of the individual supplier accounts. If discrepancies arise, then they should be investigated.

As per the Modern Rules of Accounting

| Account | Increase | Decrease |

|---|---|---|

| Liability | Credit (Cr.) | Debit (Dr.) |

Purchase Ledger Control Account (liability) is Credited (Cr.) when increased & Debited (Dr.) when decreased.

Why is it like this?

Since it indicates the total trade payables, it shows a credit balance and the modern rule of accounting cannot be broken under any circumstances.

How is it done?

Suppose the following were the transactions during the year with the Creditors ABC Inc. & XYZ Inc. along with the outstanding balance as of 31/12/20×2.

| Particulars | ABC Inc. | XYZ Inc. |

| Opening balance | 90,000 | – |

| Credit Purchases | 140,000 | 330,000 |

| Discount received | 20,000 | 30,000 |

| Purchase returns | 15,000 | 10,000 |

| Payment made | 45,000 | 60,000 |

| Interest expense on the overdue amount | – | 20,000 |

| Outstanding balance as of 31/12/20×2 | 150,000 | 250,000 |

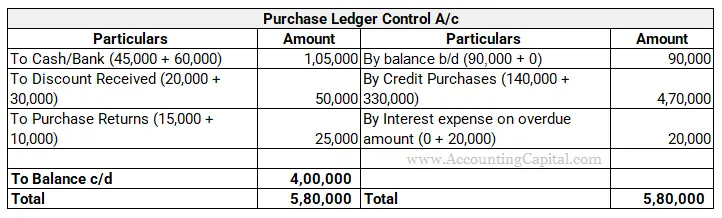

Purchase Ledger Control Account for the year 01/01/20×2 to 31/12/20×2 will be presented as follows:

The balance of PLCA i.e. 400,000 is equal to the sum of the balance of individual outstanding creditors i.e. 150,000 + 250,000 = 400,000.

You can see that the transactions which increase the balance of PLCA are credited & decrease the balance are debited. Also, it is depicting a credit balance.

As per the Golden Rules of Accounting

| Account | Rule for Debit | Rule for Credit |

|---|---|---|

| Personal | Debit the Receiver | Credit the Giver |

Purchase Ledger Control Account (liability) is credited as per the Golden Rules.

The individuals and other organizations that have direct transactions with the business are called personal accounts. PLCA indicates total trade payables at a given point in time, and since trade payables are personal accounts, PLCA also operates according to the golden rule for personal accounts.

As per the golden rules of accounting (for personal accounts), liabilities are credited. In other words, the giver of the benefit is a liability to the one who receives it.

Example

The following were the transactions during the year with the Creditors ABC Inc. & XYZ Inc. along with the outstanding balance as of 31/12/20×2.

| Particulars | ABC Inc. | XYZ Inc. |

| Opening balance | 80,000 | 10,000 |

| Credit Purchases | 200,000 | 320,000 |

| Discount received | 20,000 | 30,000 |

| Purchase returns | 10,000 | 10,000 |

| Payment made | 50,000 | 60,000 |

| Interest expense on the overdue amount | – | 20,000 |

| Outstanding balance as of 31/12/20×1 | 200,000 | 250,000 |

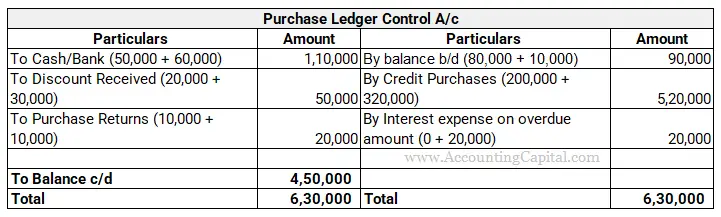

Purchase Ledger Control Account for the year 01/01/20×2 to 31/12/20×2 will be presented as follows:

The balance of PLCA i.e. 450,000 is equal to the sum of the balance of individual outstanding creditors i.e. 200,000 + 250,000 = 450,000.

You can see that PLCA is depicting a credit balance.

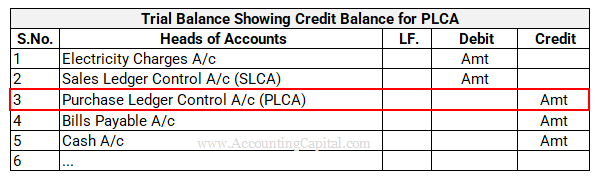

Purchase Ledger Control Account in Trial Balance

PLCA shows a credit balance in the trial balance. A trial balance example showing a credit balance for PLCA is provided below.

Read