-This question was submitted by a user and answered by a volunteer of our choice.

Cash Withdrawn from Bank for Office Use

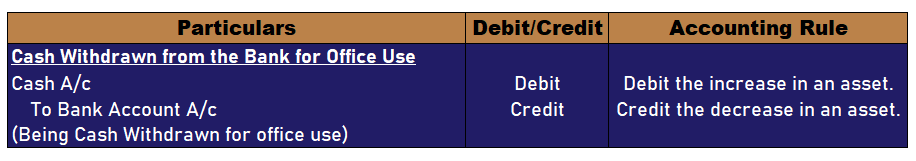

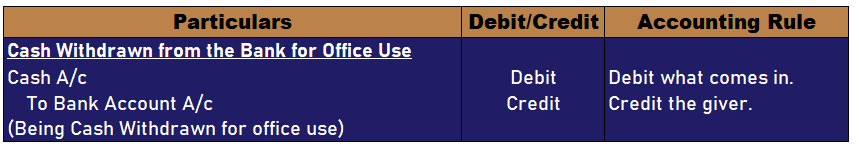

The cash withdrawn from the bank for office use shall be recorded in the books as;

Journal Entry (Using modern rules of accounting)

Why is the cash account debited?

When we withdraw an amount from the bank we receive cash i.e the entity’s cash in hand balance increases. As per the modern rules of accounting, we debit the increase in an asset. And so in the above entry cash account is debited.

Why is the bank account credited?

When an amount is withdrawn from the bank the entity receives cash while the balance in his bank account reduces. Thus as per the modern rules of accounting, we credit the decrease in an asset.

The bank account of an entity is shown under the head of current assets and so it’s credited since the withdrawals lead to a reduction in the balance with the bank. Hence, in the above entry bank account is credited.

Journal Entry (Using golden rules of accounting)

Why is the cash account debited?

As per the golden rule of accounting, a cash account is classified as a real account. As per the rule for a real account, we debit what comes in and credit what goes out. Hence, when the cash is withdrawn for office use we receive cash hence, the cash account is debited.

Why is the bank account credited?

As per the golden rule of accounting, the bank account is classified as a personal account. As per the rule for a personal account, we debit the receiver and credit the giver. Here, the Bank balance reduces i.e bank is the giver hence, it’s credited.